AI in Real Estate Lending: Loan Portfolio Analysis

Leveraging AI for Enhanced Credit Risk Assessment

Improving Credit Risk Assessment

AI-powered systems can analyze vast datasets of financial information, including credit history, income, and spending patterns, to identify patterns and predict the likelihood of borrowers defaulting on their loans. This allows lenders to make more informed decisions, reducing the risk of loan defaults and improving the overall efficiency of the credit process. By leveraging this predictive capability, institutions can potentially approve more responsible borrowers and avoid high-risk ones, thereby mitigating financial loss.

This advanced data analysis allows for a more nuanced understanding of creditworthiness, going beyond traditional credit scoring models. The result is a more accurate assessment of risk, potentially leading to reduced lending costs and increased profitability for financial institutions.

Automating Loan Processing

AI can automate many aspects of the loan application and approval process, significantly reducing processing time and improving the customer experience. From initial application intake to verification of documentation, AI can streamline the entire process, freeing up human resources to focus on more complex tasks and building stronger relationships with clients.

Automated systems can handle large volumes of applications efficiently, allowing for faster turnaround times and increased loan approvals. This efficiency also allows for a wider reach, potentially including underserved populations and communities previously excluded from traditional lending practices.

Personalized Loan Recommendations

By analyzing individual borrower profiles, AI can tailor loan products and interest rates, offering personalized financial solutions. This ability to provide customized financial advice can significantly improve the customer experience and lead to greater customer satisfaction.

This personalized approach can lead to better loan terms for borrowers, improving their financial outcomes and fostering a positive relationship with the lending institution. AI can consider factors beyond basic credit scores, like employment history and career trajectory, offering a more holistic view of the borrower's financial situation.

Enhanced Fraud Detection

AI algorithms can identify fraudulent activities in credit applications and transactions with remarkable accuracy. This proactive approach to fraud prevention can significantly reduce financial losses for lending institutions and protect consumers from malicious activities. By anticipating and detecting fraudulent patterns, AI can safeguard both the lender and the borrower.

The ability to quickly identify and flag suspicious activities is critical in today's increasingly complex financial landscape. This level of sophistication in fraud detection is essential for maintaining the integrity of the credit system and fostering trust between lenders and borrowers.

Improving Customer Service

AI-powered chatbots and virtual assistants can handle routine customer inquiries, providing instant support and resolving issues quickly. This 24/7 availability improves the overall customer experience and reduces the workload on human customer service representatives.

By automating many basic support functions, AI frees up human staff to focus on more complex customer needs, increasing customer satisfaction and loyalty. This improved customer service is a key factor in building long-term relationships with clients.

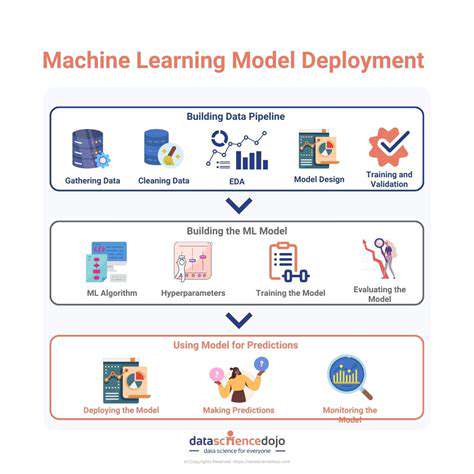

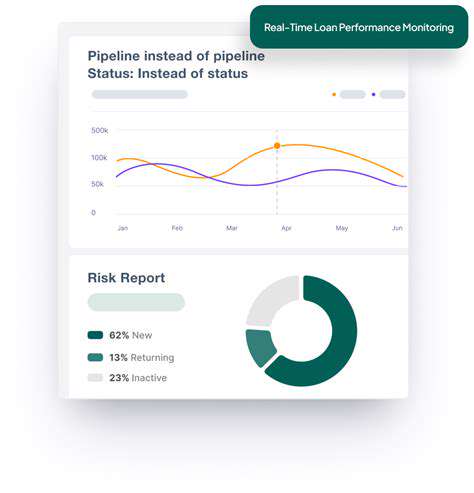

Optimizing Lending Strategies

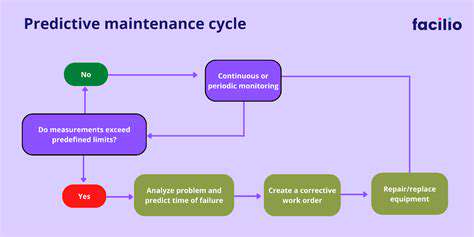

AI can analyze market trends, economic indicators, and other relevant data to optimize lending strategies. This predictive capability allows institutions to adapt to changing market conditions and maintain profitability. This adaptive approach allows institutions to stay ahead of market shifts and make strategic decisions based on real-time data. Predictive modeling can forecast loan performance and identify potential risks in advance, allowing for proactive adjustments to lending policies and practices.

By identifying patterns and trends, AI can help institutions make well-informed decisions about loan portfolios, loan terms, and risk management strategies. This proactive approach to strategic decision-making is crucial for long-term success in the financial services industry.

Read more about AI in Real Estate Lending: Loan Portfolio Analysis

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

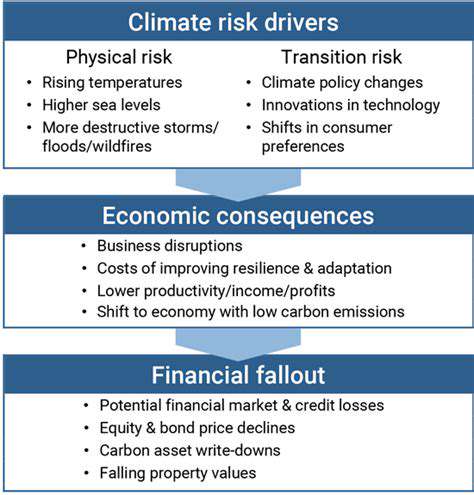

- Understanding Climate Risk in Real Estate Financing