Real Estate Sector and Global Climate Agreements

Understanding Embodied Carbon in Real Estate

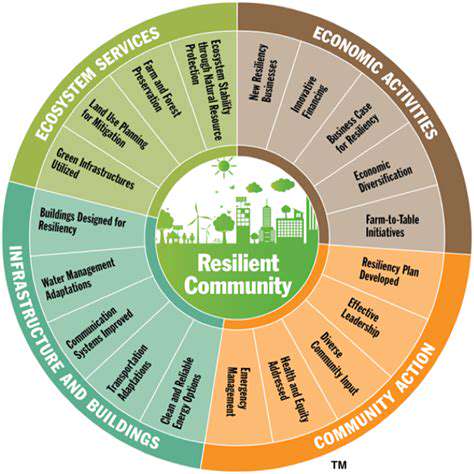

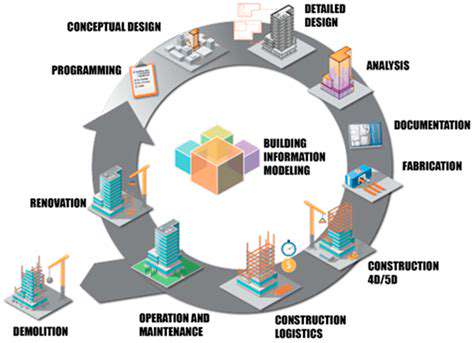

Embodied carbon refers to the greenhouse gas emissions produced during the entire lifecycle of a building material or structure, from its extraction and manufacturing to its transportation, installation, and eventual demolition. This includes emissions from the production of concrete, steel, wood, and other building materials. Understanding and quantifying embodied carbon is crucial for assessing the environmental impact of real estate projects and developing strategies for more sustainable practices throughout the construction and development process.

Recognizing the significant role of embodied carbon in the overall carbon footprint of buildings is paramount to creating a truly sustainable real estate sector. This encompasses not only the initial construction but also subsequent renovations and replacements of building components, highlighting the long-term implications of our choices.

The Impact of Embodied Carbon on the Environment

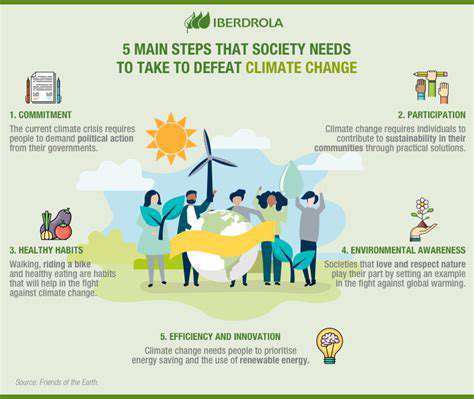

The environmental impact of embodied carbon is substantial. High levels of emissions associated with building materials contribute significantly to global warming and climate change. Reducing embodied carbon is essential to mitigating these effects and transitioning towards a more sustainable future for the real estate industry. This includes promoting the use of low-carbon materials, optimizing construction processes, and prioritizing the reuse and recycling of building materials.

Strategies for Reducing Embodied Carbon in Real Estate

Several strategies can be implemented to reduce embodied carbon in real estate projects. These strategies range from the selection of materials with lower carbon footprints to the optimization of construction processes. Utilizing recycled or renewable materials, employing lightweight construction techniques, and adopting design strategies that minimize material use are all key components of minimizing embodied carbon emissions.

Furthermore, encouraging the development and adoption of more sustainable building codes and standards is essential. These standards should incentivize the use of low-carbon materials and encourage responsible material sourcing and waste management throughout the entire lifecycle of a building.

Embodied Carbon and Real Estate Investment Decisions

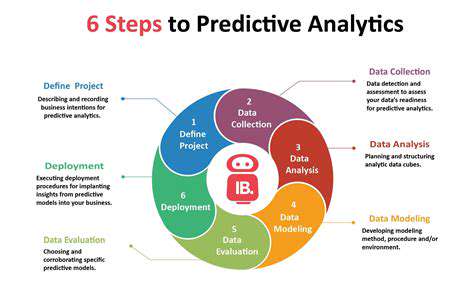

Embodied carbon is increasingly becoming a factor in real estate investment decisions. Investors are beginning to consider the long-term environmental implications of their investments, recognizing the financial and reputational risks associated with high-carbon buildings. This shift in perspective is driving the need for more transparent and reliable methods for calculating and reporting embodied carbon emissions within the real estate sector.

As awareness of the issue grows, real estate developers and investors are likely to face increasing pressure to incorporate embodied carbon considerations into their projects and investment portfolios. This trend will ultimately drive innovation in sustainable building practices and materials, shaping the future of the real estate industry.

Beyond the well-trodden paths of popular tourist destinations lie countless hidden gems waiting to be discovered. AI-powered travel platforms can analyze your preferences, from specific architectural styles to unique culinary experiences, to identify off-the-beaten-path attractions that resonate with your interests. This personalized approach allows you to delve deeper into a destination, experiencing its local culture and authentic charm, far beyond the typical tourist trap.

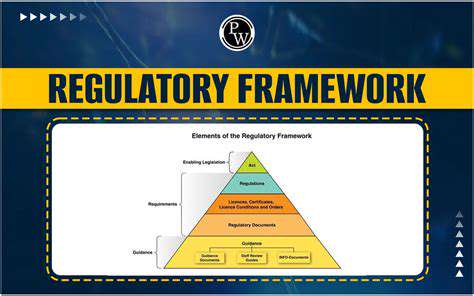

The Role of Policy and Regulation in Shaping Sustainable Real Estate Practices

Read more about Real Estate Sector and Global Climate Agreements

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing