Climate Risk Analysis for Real Estate Developers

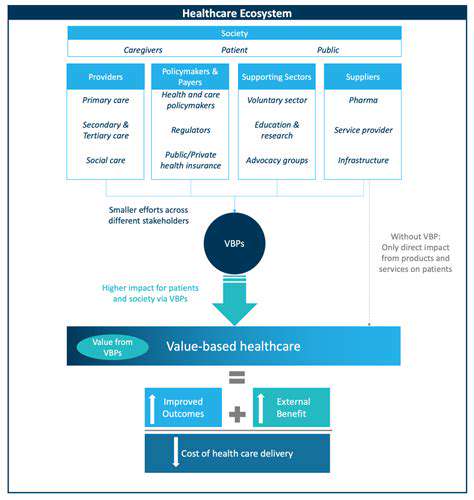

Understanding the Scope of Physical Climate Risks

Assessing physical climate risks is a crucial first step in developing robust climate resilience strategies. It involves identifying and analyzing potential impacts of climate change on physical assets, infrastructure, and operations. This initial evaluation should encompass a wide range of potential hazards, from extreme weather events like hurricanes and floods to more gradual changes like rising sea levels and desertification. The scope of this assessment must consider the specific location and characteristics of the assets being evaluated, including their geographical location, exposure to different types of hazards, and their inherent vulnerabilities.

Identifying Vulnerable Assets and Infrastructure

A critical component of assessing physical climate risks is the identification of vulnerable assets and infrastructure. This process requires meticulous research and data analysis to pinpoint specific locations and systems most susceptible to climate-related hazards. Detailed inventory of buildings, transportation networks, utilities, and other critical infrastructure is essential. Factors such as historical data on extreme weather events, projected climate change scenarios, and the inherent resilience of structures must be carefully considered in this phase.

Evaluating Climate Change Projections and Scenarios

Accurate climate change projections and scenarios are foundational to a comprehensive physical climate risk assessment. Reliable data and models are essential to anticipate future climate conditions, including changes in temperature, precipitation patterns, sea levels, and extreme weather events. These projections should be tailored to the specific region of interest, incorporating regional variations and local factors. It's imperative to consider multiple climate change scenarios, ranging from low to high-impact projections, to account for uncertainties and potential variations in future climate conditions.

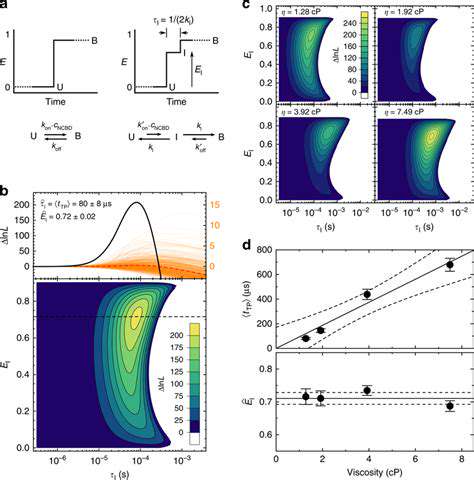

Developing a Risk Matrix and Prioritization Framework

A risk matrix is a valuable tool for organizing and prioritizing identified risks. This matrix should categorize risks based on their likelihood and potential impact, allowing for a structured approach to risk management. By assigning numerical values or ratings to different levels of likelihood and impact, a clear prioritization framework emerges. This aids in focusing resources on mitigating the most significant risks first, ensuring a strategic allocation of resources for the most impactful interventions.

Implementing Mitigation and Adaptation Strategies

Once risks have been identified and prioritized, the next step is to develop and implement appropriate mitigation and adaptation strategies. This involves exploring various options to reduce the vulnerability of assets and infrastructure to climate hazards. Adaptation strategies may include strengthening building codes, implementing flood control measures, or relocating vulnerable infrastructure. Mitigation strategies aim to reduce greenhouse gas emissions and lessen the severity of future climate change impacts. A comprehensive approach to both mitigation and adaptation is essential for effective climate risk management.

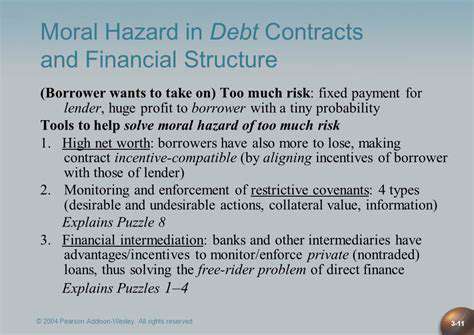

Analyzing Financial and Economic Impacts of Climate Change

Analyzing Financial Trends

Understanding financial trends is crucial for making informed decisions, whether you're an investor, a business owner, or simply trying to manage your personal finances. Examining historical data, identifying patterns, and projecting future outcomes are essential steps. This involves scrutinizing key financial indicators like revenue growth, profit margins, and debt levels. Analyzing these elements provides valuable insight into the health and stability of a company or market.

A deep dive into financial trends often reveals underlying economic forces at play. This analysis can uncover potential opportunities and risks, enabling proactive strategies for success. A thorough understanding of financial trends can empower individuals and organizations to make well-informed choices that align with their objectives, whether that's maximizing returns or mitigating potential losses.

Evaluating Economic Indicators

Economic indicators provide valuable insights into the health and trajectory of an economy. These indicators, such as GDP growth, unemployment rates, and inflation, offer a snapshot of current economic conditions and help to predict future trends. Monitoring these indicators is essential for businesses, governments, and individuals alike, allowing them to adapt their strategies and make informed decisions.

Assessing Market Volatility

Market volatility is a crucial aspect of any investment strategy. Understanding how market fluctuations impact different asset classes is paramount for risk management and portfolio optimization. Market volatility can present significant opportunities, but also substantial risks. A comprehensive understanding of market dynamics is essential to navigate these fluctuations effectively.

This involves considering various factors, such as interest rates, geopolitical events, and consumer sentiment, all of which can influence market movements. Analyzing historical data on market volatility can provide valuable insights into potential future trends.

Impact of Government Policies

Government policies can significantly influence financial and economic conditions. Fiscal and monetary policies can impact inflation, interest rates, and overall economic growth. Understanding these policies and their potential effects is crucial for individuals and businesses to adapt their strategies and make informed decisions.

Forecasting Future Trends

Forecasting future financial and economic trends is a complex but crucial aspect of strategic planning. Sophisticated methods are employed, including econometric models, to project potential outcomes based on historical data and current trends. Predicting these trends is a critical step in making informed decisions. These projections can help businesses and individuals allocate resources effectively and navigate potential challenges.

Analyzing Global Economic Interconnections

Globalization has led to increasingly interconnected economies. Understanding these global interconnections is vital for analyzing financial and economic trends. Events in one region can have ripple effects across the globe, influencing investment decisions and economic growth in other areas. Recognizing these interconnectedness is crucial for comprehensive analysis. This involves considering factors like international trade, currency exchange rates, and global supply chains.

Read more about Climate Risk Analysis for Real Estate Developers

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing