Climate Risk Disclosure for Real Estate Portfolios

Identifying Key Climate Risks for Real Estate

Understanding the Scope of Climate Risks

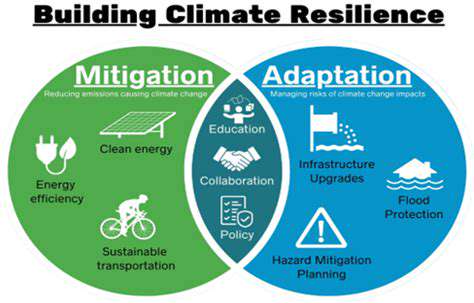

Climate change is no longer a distant threat; its impacts are being felt globally, from extreme weather events to rising sea levels. Identifying and assessing these risks is crucial for effective planning and mitigation strategies. Understanding the full scope of these risks, including their interconnectedness, is paramount to developing robust responses. This involves a comprehensive analysis of potential vulnerabilities and the likelihood of various climate-related hazards.

The increasing frequency and intensity of extreme weather events, such as hurricanes, floods, and droughts, pose significant risks to infrastructure, agriculture, and human health. These events often trigger cascading effects that further amplify the overall impact.

Physical Climate Risks

Physical climate risks encompass the direct impacts of changing climate conditions. These risks are often geographically specific, with certain regions facing greater vulnerabilities based on their unique environmental and socioeconomic characteristics. For example, coastal communities are particularly susceptible to sea-level rise and storm surges, while inland regions may face greater risks from droughts or floods. These physical risks are often difficult to predict with precision, necessitating robust modelling and scenario planning.

The severity of these physical risks can be exacerbated by pre-existing vulnerabilities, such as poverty or lack of access to resources. These existing inequalities can make communities more susceptible to the impacts of climate change.

Transition Risks

Transition risks relate to the shift towards a low-carbon economy. This shift involves significant changes in energy production, transportation, and other sectors, which can create economic and social disruptions. For instance, the transition away from fossil fuels may lead to job losses in related industries, requiring proactive strategies for retraining and workforce development.

The transition to renewable energy sources also presents opportunities for innovation and economic growth. However, the associated costs and challenges must be carefully considered to ensure a smooth and equitable transition.

Economic Climate Risks

Economic climate risks encompass the potential impacts of climate change on various sectors of the economy. These impacts can range from reduced agricultural yields due to changing weather patterns to damage to infrastructure from extreme weather events. The financial implications of these risks are significant and can lead to economic instability and recession in vulnerable regions.

Assessing these economic risks requires a comprehensive understanding of the interdependencies within the economy and the potential for cascading effects. Analyzing these risks is crucial for developing effective economic mitigation strategies.

Social Climate Risks

Social climate risks involve the impacts of climate change on human well-being, including displacement, health issues, and social unrest. Climate change can exacerbate existing social inequalities and lead to increased migration and displacement. The impacts on mental health, due to the stress and trauma associated with climate-related disasters, should not be overlooked.

Addressing these social risks requires a comprehensive approach that considers the needs of vulnerable populations and promotes social resilience.

Political Climate Risks

Political climate risks involve the potential for conflicts and instability arising from climate-related stresses. Competition over scarce resources, such as water, can lead to tensions between different communities and nations. The potential for political upheaval and conflict due to climate change is a significant concern. International cooperation and diplomacy are essential for mitigating these risks.

Understanding and addressing these political risks requires a nuanced understanding of the complex interplay between environmental, social, and political factors.

Governance and Policy Responses

Effective governance and policy responses are crucial for identifying and managing climate risks. Robust regulatory frameworks are needed to incentivize sustainable practices and mitigate the impacts of climate change. International cooperation is essential to address transboundary climate risks, as these risks often transcend national borders.

Investing in research and development is vital to enhance our understanding of climate risks and develop innovative solutions for adaptation and mitigation. Sustainable development strategies that integrate climate considerations are critical to ensure a resilient future.

The Future of Real Estate Investment in a Changing Climate

The Rise of Technology in Real Estate Investment

Technological advancements are rapidly transforming the real estate investment landscape. From sophisticated data analytics platforms that predict market trends to AI-powered property valuations, investors are leveraging technology to gain a competitive edge and streamline their investment processes. This technology-driven approach allows for more informed decisions and potentially higher returns. The ability to access and analyze vast amounts of real-time data is changing the way investors approach due diligence and risk assessment.

Furthermore, online platforms are connecting investors with a wider range of properties and opportunities. These platforms often offer comprehensive property information, virtual tours, and secure transaction management tools, making the entire investment process more efficient and accessible to a broader range of individuals and institutions.

Sustainable and Ethical Practices in Real Estate

Growing awareness of environmental concerns and social responsibility is influencing real estate investment decisions. Investors are increasingly seeking properties and projects that align with sustainable practices, such as energy efficiency, green building materials, and reduced environmental impact. This shift reflects a broader societal trend toward environmentally conscious consumption and investment.

Ethical considerations are also playing a significant role. Investors are scrutinizing the social and economic impact of their investments, looking for projects that contribute positively to communities and promote fair labor practices. Transparency and accountability are becoming paramount in the real estate sector.

The Impact of Global Economic Trends on Real Estate

Global economic fluctuations, geopolitical events, and changing interest rates significantly impact real estate markets. Investors need to carefully analyze these trends to anticipate potential market shifts and adjust their investment strategies accordingly. A thorough understanding of these broader economic forces is essential for navigating market volatility and maximizing returns.

The interplay between global economic trends and local market conditions is complex. Factors such as inflation, recessionary pressures, and currency exchange rates can all influence property values and investment returns. Investors need sophisticated tools and expertise to evaluate these multifaceted factors and make well-informed decisions.

The Role of Data Analytics in Real Estate Investment

Data analytics is becoming increasingly crucial for successful real estate investment. Sophisticated data models can analyze historical market trends, predict future price movements, and assess the potential risk and return of various investment opportunities. This allows investors to make data-driven decisions and maximize their returns.

Data analytics tools provide insights into property performance, neighborhood demographics, and market dynamics. By leveraging these insights, investors can identify high-potential investment opportunities and mitigate risks associated with their investments. This ability to analyze data is essential for making informed decisions in the ever-changing real estate landscape.

Investing in the Future of Urban Living

Urban living continues to evolve, and real estate investment strategies need to adapt to these changes. Investors are increasingly focusing on mixed-use developments, sustainable urban planning, and innovative approaches to urban design. The future of urban living is characterized by a blend of residential, commercial, and recreational spaces, creating vibrant and interconnected communities.

This evolution presents unique investment opportunities. Investors who understand the changing needs and preferences of urban dwellers are well-positioned to capitalize on these opportunities. Understanding the future of urban living is crucial to making successful real estate investments.

Read more about Climate Risk Disclosure for Real Estate Portfolios

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing