Real Estate Climate Risk: Understanding Vulnerability and Resilience

Developing Climate-Resilient Real Estate Strategies

Assessing Existing Risks

Understanding the current vulnerabilities of existing real estate portfolios to climate change impacts is crucial for developing effective mitigation and adaptation strategies. This involves a thorough analysis of factors like floodplains, wildfire zones, sea-level rise projections, and the potential for extreme weather events such as hurricanes, droughts, and heavy precipitation. Detailed historical data, including records of property damage and insurance claims, can be invaluable in identifying areas with a heightened risk profile. This assessment should also consider the potential for cascading effects, where one climate event can exacerbate vulnerabilities in other systems and impact property values.

A crucial aspect of this assessment is understanding the specific climate risks relevant to each property or portfolio. This means considering location-specific factors like topography, vegetation, and proximity to critical infrastructure. The identification of high-risk areas should inform decisions regarding property maintenance, insurance, and potential relocation or redevelopment.

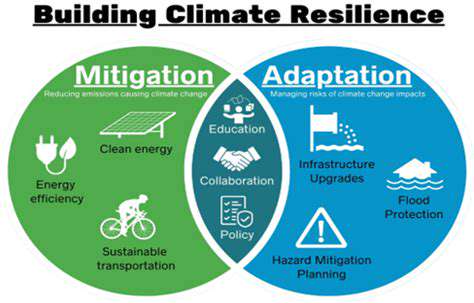

Implementing Adaptation Strategies

Adaptation strategies are key to reducing the impact of climate change on real estate assets. These strategies may include elevating buildings in coastal areas, installing flood defenses, incorporating drought-resistant landscaping, and strengthening building materials to withstand extreme weather events. Investing in green infrastructure, such as permeable pavements and rainwater harvesting systems, can help mitigate the effects of flooding and drought. The selection of appropriate adaptation strategies should be based on a comprehensive risk assessment and tailored to the specific characteristics of the property or portfolio.

Developing Climate-Resilient Design

Incorporating climate resilience into the design process can significantly enhance the long-term value and sustainability of real estate projects. This involves using climate-resistant materials, optimizing building orientation for solar gain and wind protection, and designing for water management systems. Careful consideration of potential future climate scenarios can help developers create buildings that are more resistant to extreme weather and capable of withstanding longer-term effects, such as rising sea levels or shifting precipitation patterns.

Sustainable design principles, such as passive solar design, natural ventilation, and water conservation strategies, should be integrated into the building's design to reduce its environmental footprint and enhance its resilience to climate change impacts.

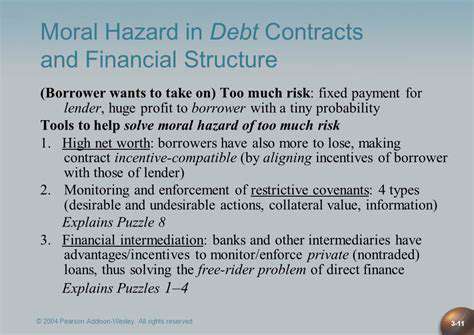

Integrating Climate Risk into Financial Models

Accurate financial modeling that takes climate risk into account is essential for making informed investment decisions. This requires incorporating climate-related variables into traditional financial projections, such as the valuation of property, projected rental income, and insurance costs. Predicting potential losses from climate events, such as flooding or wildfire, and incorporating them into the financial model is critical for assessing the long-term viability of a property or portfolio. This also includes considering the potential for changes in property values due to climate-related events and incorporating those into risk assessments.

Engaging with Stakeholders

Effective communication and collaboration with stakeholders, including tenants, residents, local communities, and regulatory bodies, are vital for successful climate-resilient real estate development. Open dialogue about climate risks and adaptation strategies can foster trust and encourage shared responsibility. Transparency about climate-related vulnerabilities and the implemented mitigation and adaptation strategies can enhance stakeholder confidence and support for the development. Engaging with local authorities on climate-related regulations and incentives can help to ensure compliance and encourage sustainable development practices.

Policy Advocacy and Incentives

Advocating for policies that support climate-resilient real estate development can create a favorable environment for sustainable practices. This involves working with policymakers to implement regulations and incentives that encourage the adoption of climate-resilient building practices and promote the development of green infrastructure. Supporting research and development of climate-resilient technologies and materials can also help drive innovation in the real estate sector. Encouraging investment in climate-resilient infrastructure, like flood control measures and renewable energy sources, can create a more resilient and sustainable real estate market for the future.

Read more about Real Estate Climate Risk: Understanding Vulnerability and Resilience

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing