AI Driven Valuation: Debunking Myths and Highlighting Benefits

Addressing the Challenges: Ensuring Ethical and Reliable AI Valuation

Defining AI Valuation: A Multifaceted Approach

AI valuation, a rapidly evolving field, transcends traditional methods by leveraging algorithms and machine learning to assess the worth of assets, projects, and even entire companies. This approach considers a wide range of factors, from the complexity of the underlying technology to the potential market impact, going beyond simplistic metrics. It seeks to capture the unique value proposition of AI-driven businesses in a dynamic and often unpredictable market.

Data Integrity and Bias Mitigation: Crucial for Accuracy

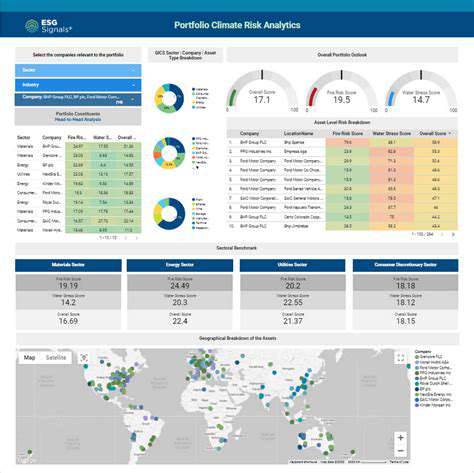

The quality of data used in AI valuation models is paramount. Inaccurate or biased data can lead to skewed valuations, potentially harming investors and hindering the fair assessment of AI projects. Robust data collection methods, rigorous quality control, and the proactive identification and mitigation of biases are essential to ensure reliable and ethical AI valuations.

Moreover, the continuous monitoring and updating of datasets are critical to account for evolving market trends and technological advancements. This dynamic approach ensures that the valuation models remain relevant and accurate in the face of rapid change.

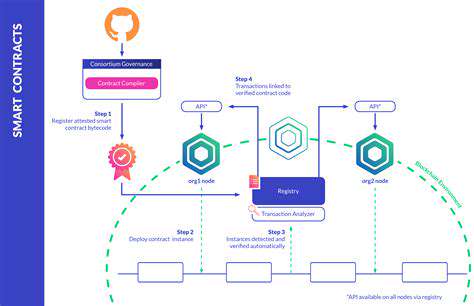

Transparency and Explainability in AI Valuation Models

Understanding how AI valuation models arrive at their conclusions is critical for trust and accountability. Opaque algorithms can breed distrust and undermine the credibility of AI-driven valuation processes. Efforts to enhance transparency and explainability through clear documentation, readily available insights, and interpretable models are crucial to build confidence in AI valuation results.

Assessing Intellectual Property and Technology Risk

AI valuation models should account for the unique characteristics of AI-driven innovations. This includes a rigorous assessment of intellectual property rights, potential technological obsolescence, and the competitive landscape. Understanding the specific risks associated with the technology and the potential for rapid advancements is essential to provide a complete and informed valuation.

Considering Market Volatility and Future Potential

The dynamic nature of the AI market demands valuation models that can adapt to unpredictable market fluctuations. AI valuations must consider the potential for disruption, the rapid pace of innovation, and the influence of unforeseen events. Models should incorporate scenario planning and sensitivity analyses to account for various market possibilities and future potential.

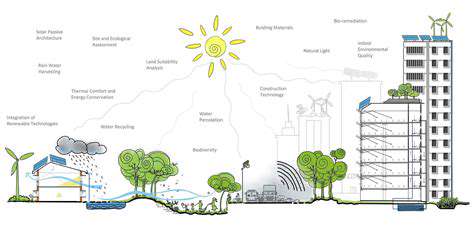

Ethical Considerations in AI Valuation

AI valuation must consider the ethical implications of its application. Fairness, accountability, and transparency in the valuation process are paramount. Addressing potential biases, ensuring equitable access to AI valuation services, and minimizing the potential for discrimination are key ethical considerations that should be integrated into the framework.

Regulatory Landscape and Standards for AI Valuation

The emerging regulatory landscape surrounding AI presents both challenges and opportunities for the development of standardized AI valuation methods. Clear regulatory guidelines and industry standards are needed to ensure consistency, reliability, and ethical practices. This will foster trust in the AI valuation process and encourage responsible development and deployment of AI technologies.

Read more about AI Driven Valuation: Debunking Myths and Highlighting Benefits

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing