Climate Risk and Real Estate Development: Building for Climate Resilience

Material Selection and Construction Techniques

Building durability hinges on selecting appropriate materials and assembly methods. Climate-adaptive construction prioritizes flood-resistant composites, thermally stable substances, and regionally available resources that combine environmental responsibility with structural robustness. Material choices should account for complete lifecycle performance under projected climate conditions.

Contemporary engineering methods - including fortified concrete frameworks, raised structural supports, and advanced moisture barriers - provide enhanced protection against climatic stresses. These techniques must be customized based on location-specific vulnerability assessments.

Community Engagement and Planning

Effective resilience strategies require collaborative development with local stakeholders. Incorporating indigenous knowledge through participatory workshops often reveals site-specific vulnerabilities overlooked by conventional assessments. This grassroots intelligence enhances the relevance and effectiveness of adaptation measures.

Comprehensive planning must evaluate climate impacts across all community systems - from utility networks to public recreation areas. Multi-sector coordination between municipal authorities, residents, and developers ensures cohesive adaptation strategies that benefit entire communities.

Monitoring and Evaluation for Continuous Improvement

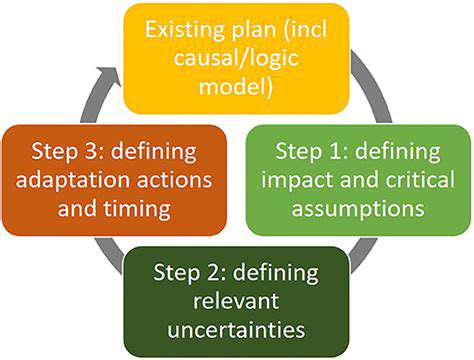

Climate resilience demands ongoing performance tracking and refinement. Systematic documentation of structural behavior during extreme weather provides invaluable data for improving future designs. This cyclical process of implementation, observation, and enhancement keeps adaptation strategies aligned with evolving climate realities.

Analytical review of climate response metrics allows for targeted adjustments to construction standards and materials specifications. Such evidence-based adaptation ensures the built environment remains responsive to accelerating climatic changes.

Financial Considerations and Climate-Related Risks

Assessing Financial Vulnerability

Comprehensive climate risk assessment represents a critical component of responsible real estate development. Project feasibility analyses must now incorporate variables like sea level projections, storm frequency models, and precipitation pattern shifts that could influence asset valuation, insurance requirements, and construction scheduling.

Sophisticated financial modeling should simulate multiple climate scenarios, enabling developers to quantify risks and establish appropriate mitigation budgets. This forward-looking approach identifies vulnerable projects early and facilitates the development of robust contingency strategies.

Insurance and Risk Transfer Mechanisms

The insurance sector's response to climate volatility has created new challenges for property development. As traditional coverage becomes more restrictive and expensive, developers must explore alternative risk management tools like weather derivatives and catastrophe-linked securities to maintain financial protection.

Climate Change Adaptation Costs

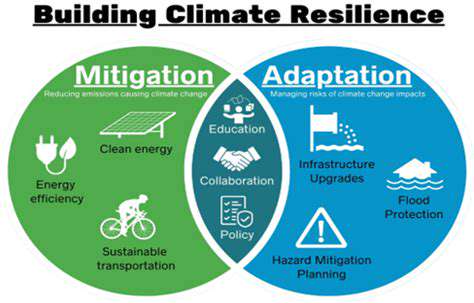

Initial investments in climate resilience, while substantial, represent strategic expenditures that preserve long-term asset value. Budget planning must account for elevation requirements, flood mitigation systems, and enhanced drainage infrastructure, recognizing these as value-preserving measures rather than optional additions.

The dynamic nature of climate legislation requires developers to maintain awareness of evolving compliance standards that may affect project economics. Proactive adaptation to regulatory changes prevents costly delays and redesigns.

Financing Climate-Resilient Projects

The capital requirements for climate-adaptive construction necessitate innovative funding solutions. Sustainability-linked financial instruments and resilience-focused investment vehicles can attract capital by demonstrating reduced climate risk exposure and enhanced long-term viability.

Investment Strategies for Climate Mitigation

Beyond protective measures, proactive climate investments in renewable energy integration, high-efficiency building systems, and sustainable water technologies can generate operational savings and market differentiation. These forward-thinking approaches position developments favorably in an increasingly eco-conscious marketplace while contributing to broader environmental objectives.

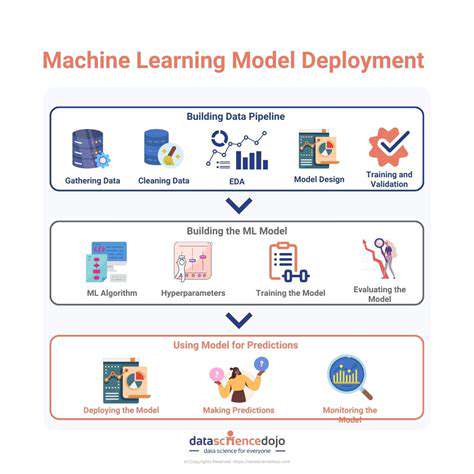

Contemporary organizations navigate an unprecedented deluge of data streams from digital platforms, IoT devices, and transactional systems. The inability to effectively harness this information torrent results in strategic blind spots and competitive disadvantages. Advanced analytical frameworks have become essential tools for transforming raw data into actionable intelligence across all sectors.