ESG Reporting for Real Estate Portfolio Managers

Key ESG Factors for Real Estate Portfolios

Environmental Factors

Environmental factors are crucial in evaluating the sustainability of real estate investments. Assessing a property's energy efficiency, water usage, and waste management practices is essential. This includes evaluating the building's energy performance certificate (EPC) scores, examining water conservation measures in place, and understanding the property's waste management strategy. Understanding how a property contributes to or mitigates environmental impact is vital for long-term value and investor confidence.

Furthermore, factors like the presence of green spaces, proximity to public transportation, and the building's carbon footprint are important considerations. A building with a high carbon footprint might require significant upgrades to meet sustainability standards, which can affect the overall investment return and potential for future rent increases.

Social Factors

Social factors in real estate encompass community engagement, neighborhood dynamics, and the overall well-being of residents. Evaluating community demographics and potential social impacts is crucial. This includes analyzing factors such as access to amenities, local employment opportunities, and the presence of community support systems. Understanding the social fabric of a neighborhood helps assess the potential for future growth and profitability, as well as the property's social responsibility.

Analyzing the potential impact on the local community, like displacement or gentrification, is paramount. Furthermore, considering tenant diversity and safety measures within the building or complex is crucial for long-term sustainability and social responsibility. These factors can affect the property's appeal to tenants and its overall value.

Governance Factors

Governance factors in real estate investments focus on the ethical and transparent practices of the owners, developers, and management teams. Strong governance structures are essential for maintaining long-term value and investor trust. This includes reviewing the company's policies on ethical conduct, labor practices, and transparency in financial reporting. Understanding the company's history and track record in handling conflicts and disputes is crucial.

Assessing the company's commitment to fair labor practices and worker well-being is essential for responsible investment. This includes evaluating the compensation and working conditions of construction and maintenance personnel, and the company's policies regarding diversity and inclusion within its workforce.

Supply Chain Management

Evaluating the supply chain's sustainability plays a vital role in assessing the overall ESG profile of a real estate investment. Transparency and accountability throughout the entire supply chain are crucial. This includes scrutinizing the sourcing of materials, the environmental impact of construction processes, and the labor practices of subcontractors. Understanding the potential environmental and social risks associated with the supply chain is essential for making informed investment decisions.

Financial Sustainability

Financial sustainability is a key aspect of ESG considerations for real estate. Analyzing the financial health of the property owner, developer, or management company is essential. This includes evaluating their financial stability, debt levels, and capacity to maintain operations. Assessing a property's financial sustainability ensures long-term viability.

Market Trends

Understanding current and projected market trends is crucial for evaluating the long-term viability of a real estate investment. Analyzing factors such as population growth, economic conditions, and technological advancements can help predict future demand and rental rates. Analyzing the local market trends is essential to assess the long-term viability of a property.

Community Impact

Analyzing the potential impact on the local community is paramount in ESG considerations. This includes evaluating the potential for displacement, gentrification, and the creation of affordable housing options. Understanding the social implications of a real estate project is crucial for investors aiming for a responsible investment approach. This includes assessing potential community benefits like improved infrastructure, employment opportunities, and increased social cohesion.

Developing a Robust ESG Reporting Framework

Understanding the Importance of ESG in Real Estate

ESG factors, encompassing environmental, social, and governance considerations, are increasingly crucial for real estate investment decisions. Investors, lenders, and tenants are demanding transparency and accountability regarding a property's environmental impact, social responsibility, and governance practices. This heightened scrutiny necessitates a robust ESG reporting framework to demonstrate a property's commitment to sustainability and responsible operations, ultimately enhancing its value and attracting responsible stakeholders.

Defining ESG Metrics for Real Estate

Developing a comprehensive ESG reporting framework requires clearly defined metrics tailored to the specific characteristics of a real estate portfolio. These metrics should encompass factors like energy efficiency, waste management, water conservation, community engagement, diversity and inclusion initiatives, and the ethical treatment of tenants and employees. Specific data collection methodologies will need to be established to ensure accurate and reliable reporting.

Establishing Data Collection and Reporting Procedures

A robust ESG reporting framework necessitates well-defined procedures for data collection and reporting. This includes establishing clear protocols for gathering information on energy consumption, water usage, waste generation, and other relevant environmental indicators. Social metrics, such as community engagement activities and diversity statistics, also need structured data collection. Comprehensive documentation of these processes is essential for transparency and auditability.

Integrating ESG into Property Management Practices

Effective ESG reporting isn't just about data collection; it's about integrating ESG principles into daily property management practices. This involves implementing energy-efficient building technologies, promoting sustainable building materials, fostering community engagement programs, and ensuring fair and equitable treatment of all stakeholders. These efforts demonstrate a genuine commitment to ESG principles beyond just reporting.

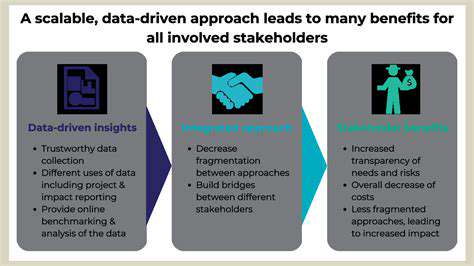

Assessing and Benchmarking ESG Performance

Regular assessment and benchmarking of ESG performance are critical to identifying areas for improvement. Comparing a property's ESG performance against industry benchmarks or peer properties can highlight strengths and weaknesses. This ongoing evaluation allows for proactive adjustments to strategies and operational procedures to enhance ESG performance over time. Continuous improvement is vital for maintaining a robust ESG profile.

Ensuring Transparency and Stakeholder Engagement

Transparency in ESG reporting is paramount. Clear and accessible communication of ESG performance to stakeholders, including tenants, investors, and the wider community, is essential. This transparency fosters trust and demonstrates a commitment to responsible practices. Active engagement with stakeholders throughout the reporting process can provide valuable insights and feedback, further enhancing the effectiveness of the ESG framework.

Addressing Challenges and Future Trends

Implementing a robust ESG reporting framework presents certain challenges, such as the complexities of data collection, the need for skilled personnel, and the evolving nature of ESG standards. However, future trends indicate that ESG reporting will become increasingly sophisticated and integrated, potentially leading to mandatory reporting requirements and increased investor scrutiny. Staying ahead of these trends is crucial for long-term success in the real estate sector.

Read more about ESG Reporting for Real Estate Portfolio Managers

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing