Green Mortgages: Expanding Access and Awareness

The Rise of Eco-Friendly Financing Options

Sustainable Lending Practices

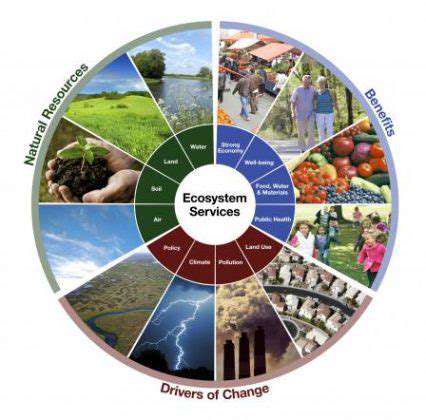

As environmental concerns take center stage, the financial world is witnessing a seismic shift toward eco-friendly financing. Both corporations and private citizens are now aligning their monetary choices with ecological preservation, recognizing how deeply intertwined these spheres truly are. At the heart of this transformation lie innovative lending approaches that prioritize planetary health alongside financial returns.

Forward-thinking lenders now meticulously examine how projects might affect ecosystems before committing funds. Their comprehensive analyses weigh multiple environmental factors - from greenhouse gas outputs to water usage patterns and material lifecycle impacts. This rigorous vetting process ensures capital flows toward ventures that actively improve rather than degrade our natural world.

Government Initiatives and Regulations

National and regional authorities worldwide are rolling out ambitious programs to stimulate green investment. Policy frameworks now actively channel resources into clean energy solutions, regenerative farming practices, and other sustainability-focused sectors. Strategic incentives like tax advantages and expedited permitting processes make sustainable ventures increasingly attractive to entrepreneurs and established businesses alike.

The policy toolkit includes various mechanisms - from rebates for solar panel installations to low-interest loans for energy-efficient retrofits. Such governmental support proves instrumental in de-risking early-stage environmental innovations while accelerating the global transition toward circular economic models.

Investor Demand and Market Trends

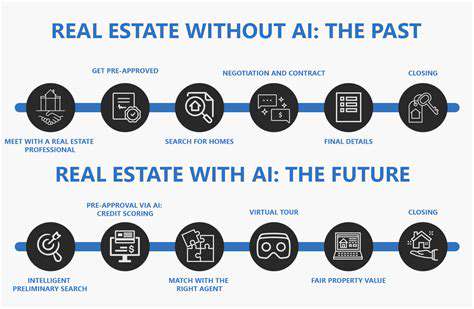

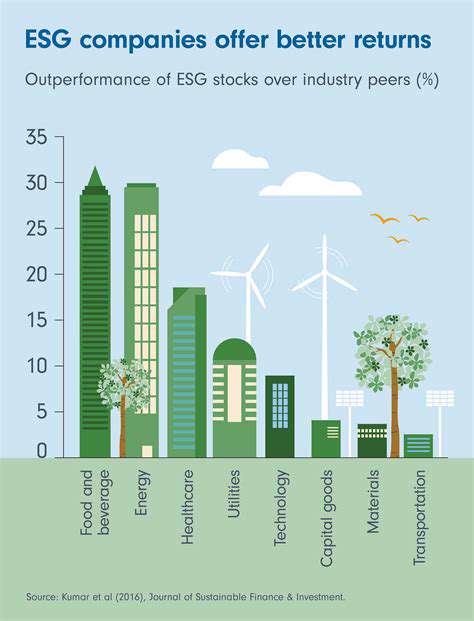

A profound change in investor priorities is reshaping capital markets, with sustainability-focused portfolios outperforming traditional investments in many sectors. This isn't merely ethical posturing - astute financial analysts recognize that environmentally conscious businesses often demonstrate superior long-term resilience and growth potential.

The investment community's evolving preferences have spawned an array of novel financial instruments tailored specifically for green initiatives. From sustainability-linked bonds to green REITs, the financial ecosystem is rapidly developing sophisticated tools to match capital with environmentally beneficial projects.

Impact on the Financial Sector

The financial industry's transformation goes far beyond superficial greenwashing. Major institutions are fundamentally restructuring their assessment criteria, embedding environmental, social, and governance (ESG) considerations into their core decision-making algorithms.

This paradigm shift represents more than compliance with stakeholder expectations - it's a strategic recalibration for long-term viability. Financial leaders increasingly view robust ESG integration not as optional corporate responsibility but as essential risk management in an era of climate uncertainty. The smartest firms are leveraging this transition to gain competitive advantage while future-proofing their operations.

Expanding Awareness and Education

Raising Public Awareness

Effective public engagement strategies require more than information dissemination - they demand compelling storytelling that connects environmental finance concepts to people's daily lives. The most successful campaigns employ emotional resonance alongside factual accuracy, using relatable narratives to make complex financial-ecological relationships tangible. Thoughtfully curated multimedia content can dramatically increase message retention and behavioral change.

Targeted Outreach Programs

One-size-fits-all approaches consistently underperform in awareness building. Savvy organizations now develop hyper-localized initiatives that account for regional economic conditions, cultural values, and existing environmental knowledge gaps. By tailoring content delivery to specific community contexts, educators achieve dramatically higher engagement and comprehension rates. This precision targeting proves particularly effective in overcoming skepticism about sustainable finance's practical benefits.

Collaboration and Partnerships

The most impactful environmental finance education emerges from cross-sector alliances. When financial institutions partner with academic researchers, community organizers, and policy experts, they create knowledge-sharing ecosystems far more potent than any single organization could achieve alone. These synergistic relationships allow for resource optimization while ensuring messaging consistency across different stakeholder groups.

Utilizing Technology for Accessibility

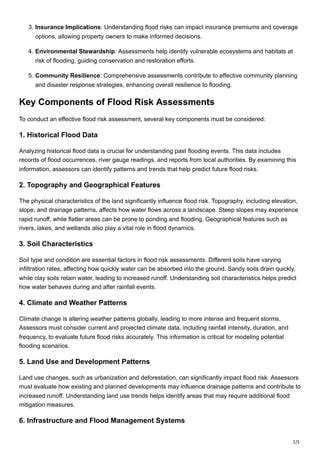

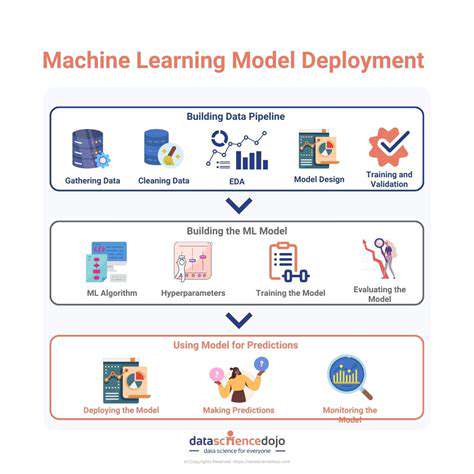

Digital platforms have democratized access to environmental finance education, but true accessibility requires thoughtful design. The most effective digital tools incorporate adaptive interfaces that accommodate users across the technological literacy spectrum, from finance professionals to curious beginners. Interactive simulations and personalized learning pathways can transform abstract concepts into hands-on experiences with lasting impact.

Developing Educational Materials

Pedagogical excellence in this field demands materials that engage multiple learning modalities. Visual learners benefit from infographics illustrating financial flows in sustainability projects, while kinesthetic learners thrive with interactive budgeting exercises for green home improvements. This multimodal approach ensures no learner gets left behind due to incompatible teaching methods, while simultaneously reinforcing concepts through varied presentation formats.

Measuring Impact and Outcomes

Sophisticated metrics now move beyond simple participation tallies to assess genuine behavioral and cognitive shifts. Advanced evaluation frameworks track how awareness translates into concrete actions - whether opening green savings accounts or attending community solar co-op meetings. This data-driven approach allows for real-time program refinement, ensuring educational resources evolve to meet emerging needs and knowledge gaps.

Community Engagement and Empowerment

The most sustainable education initiatives treat community members as co-creators rather than passive recipients. Participatory design processes that incorporate local knowledge yield programs with greater cultural relevance and staying power. When residents see their input shaping program development, they develop deeper ownership that sustains engagement long after initial campaigns conclude. This empowerment model often sparks grassroots environmental finance innovations that professionals might never envision.

Read more about Green Mortgages: Expanding Access and Awareness

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing