AI Driven Insights for Real Estate Investment Decisions

Predictive Analytics for Market Trends

Predictive Modeling Techniques

Predictive analytics leverages various statistical and machine learning techniques to forecast future market trends. These techniques range from simple regression analysis to complex algorithms like neural networks and support vector machines. Choosing the appropriate technique depends heavily on the specific data available and the nature of the desired prediction. For instance, linear regression is suitable for identifying linear relationships between variables, while more sophisticated methods are needed to capture non-linear patterns.

Different models have varying strengths and weaknesses. Understanding these nuances is crucial for selecting the right model for a particular task. Some models excel at identifying subtle trends, while others are better at handling large datasets. Therefore, evaluating model performance metrics is essential to gauge the accuracy and reliability of the predictions.

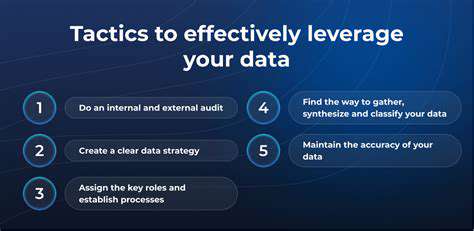

Data Collection and Preparation

The accuracy of predictive analytics hinges on the quality and quantity of the data used. Careful data collection from various sources, including market research reports, sales data, and social media sentiment analysis, is paramount. Data preparation involves cleaning, transforming, and structuring the collected data to ensure its suitability for the chosen predictive models. This process often includes handling missing values, outlier detection, and feature engineering.

Ensuring data integrity is critical. Inaccurate or incomplete data can lead to flawed predictions and incorrect business decisions. Therefore, meticulous data cleaning and validation steps are necessary to ensure the reliability of the insights derived from the analysis.

Market Trend Identification

Predictive analytics allows businesses to identify emerging market trends before they become mainstream. By analyzing historical data, current market conditions, and external factors, predictive models can pinpoint potential shifts in consumer preferences, technological advancements, and economic fluctuations. This early identification of trends enables companies to adapt their strategies and capitalize on opportunities.

Understanding the drivers behind these trends is crucial to developing effective strategies. By analyzing the relationships between different variables, predictive models can provide insights into the underlying causes of observed market movements. This understanding informs informed strategic decision-making.

Customer Segmentation and Targeting

Predictive analytics can segment customers based on various factors, such as demographics, purchasing behavior, and preferences. This segmentation allows companies to tailor their marketing strategies to specific customer groups. Personalized marketing campaigns are more effective and enhance customer engagement and loyalty.

Targeted marketing campaigns based on customer segmentation boost conversion rates and increase revenue by providing a more relevant and appealing experience to each customer group. This targeted approach is crucial in today's competitive market.

Risk Assessment and Mitigation

Predictive analytics assists in identifying potential risks and vulnerabilities in the market. By analyzing historical data and external factors, models can forecast potential economic downturns, regulatory changes, or shifts in consumer preferences. This proactive approach enables companies to mitigate potential risks and develop contingency plans.

Forecasting Sales and Revenue

Predictive models can accurately forecast future sales and revenue based on various factors, such as historical sales data, marketing campaigns, and economic indicators. This forecasting capability enables companies to anticipate future demand and plan production, inventory, and staffing needs accordingly. Accurate forecasting is critical for effective resource allocation and profitability maximization.

Optimization of Business Strategies

Predictive analytics provides insights into optimizing business strategies. By analyzing the impact of different strategies on key performance indicators, predictive models can identify the most effective approaches. These data-driven insights enable companies to make informed decisions and enhance operational efficiency.

Predictive analytics helps businesses to make data-driven decisions across all facets of their operations. This results in improved resource allocation, enhanced customer experiences, and a stronger competitive edge in the market.

Property Valuation with Enhanced Accuracy

Understanding the Foundation of Property Valuation

Property valuation is a crucial process that determines the fair market value of a property. This involves considering a multitude of factors, ranging from the property's physical characteristics to the prevailing market conditions. A robust understanding of these fundamental elements is essential for accurate assessments. Accurate valuations are critical for various purposes, including property transactions, insurance claims, and estate planning.

Appraisers meticulously analyze comparable sales data in the surrounding area to establish a baseline for valuation. They also consider the property's location, size, condition, and features, such as the presence of modern amenities or any existing renovations. This comprehensive evaluation process is crucial to establishing a fair and realistic market value.

Factors Influencing Property Value

Numerous factors influence a property's market value, and these factors are often intertwined. Location is frequently cited as a primary determinant, as properties situated in desirable neighborhoods or close to amenities tend to command higher prices. The presence of schools, parks, and public transportation can significantly impact a property's appeal and, consequently, its value.

Property size and design also play a significant role, affecting the perceived value of a property. Larger properties with well-designed layouts generally attract more buyers and command higher prices. The condition of the property, including its structural integrity, landscaping, and overall upkeep, also impacts its value perception.

Advanced Valuation Techniques

Beyond the fundamental factors, appraisers employ sophisticated techniques to refine property valuations. One such technique involves analyzing recent sales data of comparable properties. This data provides a clear indication of the market's current trends and helps to establish a more accurate valuation.

Advanced valuation models, often incorporating statistical analysis, can provide a more precise estimate of market value. These models consider various variables to predict future market trends and refine the valuation process. These models contribute significantly to the objectivity and accuracy of the valuation.

The Role of Market Conditions in Valuation

Market conditions significantly impact property values. Economic downturns or recessions often lead to decreased property values, while periods of economic growth can boost property values. Interest rates and availability of financing also play a substantial role. When interest rates are low, more people can afford mortgages, which can drive up property values.

Fluctuations in the overall market, including shifts in demand and supply, directly affect a property's valuation. A decrease in demand can lead to a decrease in property value, while an increase in demand can raise the price.

Valuation for Different Purposes

Property valuation serves various purposes beyond simple sales transactions. In insurance claims, accurate valuations are essential for determining the amount of compensation due to the property owner. In estate planning, valuations are critical for fair distribution of assets. Understanding the specific purpose for the valuation will inform the type of data and analysis that is required for each case.

Different types of properties, such as residential, commercial, or industrial, may necessitate specific valuation methodologies. Appraisers tailor their approaches to the unique characteristics of each type of property and the goals of the valuation.

Read more about AI Driven Insights for Real Estate Investment Decisions

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing