AI in Real Estate Lending: Risk Assessment Models

Data-Driven Decision Making

Modern lending algorithms digest hundreds of variables - from payment histories to behavioral patterns - creating multidimensional borrower profiles. This granular analysis surpasses traditional credit scoring by incorporating non-traditional indicators of reliability. The resulting assessments provide lenders with unparalleled visibility into repayment probabilities.

Such comprehensive risk modeling doesn't just prevent defaults; it enables more nuanced pricing strategies that benefit both institutions and qualified borrowers.

Operational Transformation

The automation of underwriting processes delivers tangible business impacts. Approval timelines shrink from weeks to hours, creating competitive advantages in customer acquisition. This acceleration stems from parallel processing capabilities that human underwriters simply can't match.

The efficiency gains extend beyond speed - automated systems maintain consistency in evaluation criteria while eliminating human fatigue factors that can compromise decision quality.

Financial Inclusion Advancements

By decoupling credit decisions from subjective human judgments, algorithmic systems open doors for borrowers with unconventional financial histories. Geographic barriers dissolve as digital platforms extend services to underserved rural markets. This technological leap forward promises to narrow historical gaps in capital access.

Implementation Challenges

Algorithmic transparency remains a critical hurdle. Financial institutions must balance proprietary model protections with regulatory demands for explainable AI. The solution lies in developing audit trails that satisfy compliance requirements without compromising competitive advantages.

Another consideration involves data freshness - models require continuous retraining to account for economic shifts and evolving consumer behaviors.

Regulatory Evolution

Forward-thinking policymakers are crafting frameworks that encourage innovation while safeguarding consumers. Emerging standards address model validation, bias testing, and dispute resolution mechanisms. This regulatory maturation will likely accelerate mainstream adoption across global markets.

Future Directions

The next wave of innovation integrates predictive analytics with alternative data streams. We're witnessing the emergence of self-learning systems that adapt to market dynamics in real-time, fundamentally reshaping risk management paradigms. These advancements position algorithmic lending as the cornerstone of 21st-century financial infrastructure.

Leveraging Data for Enhanced Accuracy

Strategic Data Acquisition

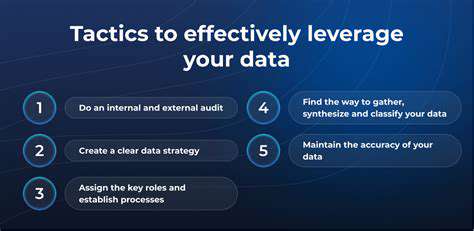

High-quality decision-making begins with intentional data sourcing. Leading institutions deploy hybrid collection methods that combine traditional financial data with behavioral indicators. The most effective strategies maintain laser focus on data relevance - collecting less but extracting more value from each data point.

Modern integration platforms now enable real-time data streaming from diverse sources, creating living profiles that reflect current financial circumstances rather than historical snapshots.

Advanced Analytical Processing

Data transformation represents the critical bridge between raw information and actionable intelligence. Sophisticated preprocessing pipelines now handle data normalization, anomaly detection, and feature engineering automatically. This automation ensures analytical consistency while freeing data scientists for higher-value tasks.

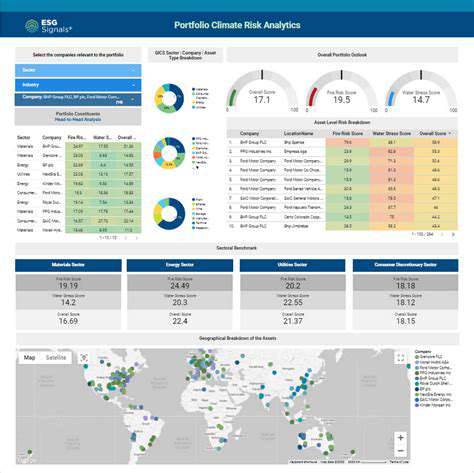

Visual analytics have evolved beyond static dashboards to interactive exploration tools. Contemporary visualization platforms allow drill-down capabilities that reveal hidden patterns and exception cases requiring human review.

Insight Activation

The true test of any data initiative lies in operational impact. Leading organizations embed analytical outputs directly into workflow systems, triggering automated actions when specific thresholds are met. This closed-loop approach ensures insights translate into concrete business outcomes.

Change management remains crucial - the most sophisticated models fail without proper staff training and process adaptation. Successful implementations balance technological sophistication with organizational readiness.

Security and Compliance

Data governance frameworks now incorporate privacy-by-design principles, with robust encryption applied throughout the data lifecycle. The convergence of regulatory requirements and consumer expectations demands nothing less than enterprise-wide commitment to data integrity.

Emerging privacy-enhancing technologies like homomorphic encryption allow meaningful analysis of sensitive data without exposing raw information - a breakthrough for risk assessment applications.

Improving Efficiency and Reducing Costs

Process Optimization

Modern lending platforms achieve remarkable throughput by reengineering traditional workflows. Intelligent document processing extracts and validates borrower information with 98%+ accuracy, while robotic process automation handles routine verifications. This orchestration of digital workers creates seamless borrower experiences.

Dynamic Risk Modeling

Contemporary risk engines incorporate macroeconomic indicators and local market conditions into their calculations. This contextual awareness allows more responsive pricing and underwriting than static models. The resulting portfolios demonstrate greater resilience during economic downturns.

Automated Valuation Precision

Next-generation valuation models synthesize satellite imagery, neighborhood trends, and property characteristics into hyperlocal estimates. The elimination of appraisal bottlenecks accelerates closing timelines while reducing valuation disputes through transparent methodologies.

Fraud Mitigation

Machine learning systems now detect sophisticated fraud patterns by analyzing application metadata and behavioral biometrics. These systems flag high-risk submissions for enhanced due diligence, creating effective barriers against organized fraud rings.

Personalized Financial Products

Adaptive pricing algorithms create win-win scenarios by tailoring terms to individual circumstances. Borrowers gain access to optimized financing solutions, while lenders achieve better portfolio performance through precise risk-based pricing.

Regulatory Technology

Compliance automation tools maintain real-time awareness of changing regulations across jurisdictions. This capability proves particularly valuable for lenders operating in multiple markets, ensuring consistent adherence to diverse legal requirements.

Predictive Portfolio Management

Advanced simulation tools model portfolio performance under various economic scenarios. This foresight enables proactive adjustments to underwriting standards and reserve allocations, optimizing long-term profitability.