AI Driven Portfolio Management for Real Estate

Data-Driven Insights for Informed Decisions

Understanding the Foundation of Data-Driven Insights

Data-driven insights are crucial for making informed decisions across various fields, from business strategy to scientific research. At the core of this approach lies the ability to collect, analyze, and interpret data to uncover meaningful patterns and trends. This process requires a systematic methodology that goes beyond simply collecting figures; it involves a critical evaluation of the data's validity and relevance to the specific questions being asked.

Data analysis goes beyond simple calculations; it involves a deep understanding of the context and potential biases within the data. By employing rigorous analytical techniques, we can uncover hidden relationships and correlations that would otherwise remain undetected, providing a more complete and accurate picture of the situation.

Identifying Key Performance Indicators (KPIs)

Identifying the right KPIs is paramount for tracking progress and measuring success. These are quantifiable metrics that provide a clear indication of how well a process, strategy, or project is performing. Choosing relevant KPIs requires careful consideration of the specific goals and objectives of the initiative.

Selecting the wrong KPIs can lead to misguided conclusions and misdirected efforts. A well-defined set of KPIs ensures that the data collected and analyzed are directly aligned with the desired outcomes, maximizing the value of the insights derived.

Utilizing Data Visualization Techniques

Data visualization plays a critical role in transforming complex datasets into easily digestible and understandable information. Effective visualizations can quickly communicate key trends, patterns, and insights, enabling stakeholders to grasp the essence of the data without needing extensive technical expertise.

Visual representations of data, such as charts and graphs, can effectively convey the story behind the numbers. By employing appropriate visualization techniques, we can uncover hidden relationships and trends that might not be apparent in raw data, facilitating more informed decision-making.

Leveraging Statistical Modeling for Prediction

Statistical modeling allows us to predict future outcomes based on historical data. By identifying patterns and correlations in past performance, we can develop models that offer insights into potential future trends and behaviors. This predictive capability is invaluable for anticipating challenges, optimizing resource allocation, and achieving strategic goals.

Predictive modeling offers a powerful tool for anticipating future outcomes and making proactive decisions. However, the accuracy of these predictions depends heavily on the quality and comprehensiveness of the data used to build the model.

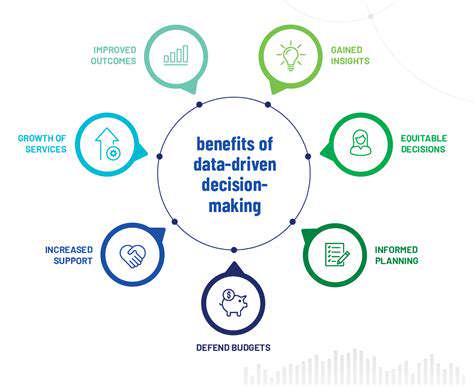

Implementing Data-Driven Decision-Making Processes

Implementing a robust data-driven decision-making process requires a structured approach that incorporates data analysis into every stage of the decision-making cycle. This includes defining clear objectives, collecting relevant data, analyzing the data effectively, and presenting the findings in a clear and concise manner to stakeholders.

This process emphasizes the importance of clear communication and collaboration between data analysts and decision-makers. By integrating data analysis into the decision-making process, organizations can make more informed choices, increase efficiency, and achieve better outcomes.

The Role of Data Security and Privacy

In today's data-driven world, ensuring the security and privacy of collected data is paramount. Data breaches can have significant repercussions for individuals and organizations, potentially compromising sensitive information and leading to reputational damage and financial losses.

Robust data security measures are essential for protecting sensitive information and ensuring the privacy of individuals. Implementing appropriate security protocols and adhering to data privacy regulations are crucial components of any successful data-driven strategy.

Automated Portfolio Rebalancing and Risk Management

Understanding Automated Portfolio Rebalancing

Automated portfolio rebalancing is a crucial component of modern investment strategies, leveraging technology to maintain a desired asset allocation. This process automatically adjusts the portfolio holdings to stay within pre-defined parameters, mitigating the impact of market fluctuations and ensuring the portfolio aligns with the investor's risk tolerance and financial goals. By automating this critical task, investors can free up time and mental energy, focusing on larger financial objectives.

This automated process monitors market conditions and makes adjustments as needed, ensuring the portfolio remains balanced and aligned with the investor's risk profile. This proactive approach helps to prevent emotional decision-making and maintain a consistent investment strategy.

The Role of AI in Risk Management

Artificial intelligence (AI) plays a pivotal role in enhancing risk management within automated portfolio rebalancing. AI algorithms can analyze vast amounts of market data, identifying potential risks and opportunities in real-time. This capability allows for more informed and responsive adjustments to the portfolio, potentially minimizing losses and maximizing returns.

By continuously learning from market trends and historical data, AI-powered systems can adapt to evolving market conditions. This adaptive nature provides a significant advantage over traditional, rule-based rebalancing methods, ensuring a more robust and dynamic approach to portfolio management.

Defining Optimal Asset Allocation

Optimal asset allocation is a fundamental aspect of portfolio construction, determining the ideal proportion of various asset classes within the investment portfolio. AI algorithms can analyze historical performance, market trends, and investor risk profiles to create an asset allocation strategy that aligns with the investor's financial goals and risk tolerance.

The goal of automated asset allocation is to achieve a balance between risk and return. AI-powered systems can continuously refine the allocation based on ongoing market conditions and performance, ensuring the portfolio remains optimized over time.

Real-Time Market Data Analysis

AI-driven portfolio management systems leverage real-time market data to identify and respond to changes in market conditions. This capability allows for immediate adjustments to the portfolio, potentially preventing significant losses during periods of market volatility.

The constant monitoring of market data is crucial for maintaining the desired asset allocation and mitigating risks. By reacting to changing market conditions in real-time, AI ensures the portfolio remains aligned with the investor's objectives.

Predictive Modeling for Future Performance

AI algorithms can incorporate predictive modeling techniques to forecast future market performance. This allows for proactive adjustments to the portfolio, potentially anticipating market trends and capitalizing on opportunities before they materialize. By incorporating predictive models, AI-powered systems can provide investors with a significant advantage in navigating the complexities of the financial markets.

Benefits of Automated Rebalancing

Automated rebalancing offers numerous benefits for investors, including increased efficiency, reduced emotional bias, and improved portfolio performance. This approach streamlines the investment process, freeing up investors to focus on other financial priorities. By eliminating the need for manual intervention, automated rebalancing minimizes the potential for impulsive decisions driven by market fluctuations.

Furthermore, automated rebalancing enhances consistency in the investment strategy, ensuring the portfolio remains aligned with the investor's long-term goals. This consistency can lead to improved long-term returns and a greater sense of financial security.

Overcoming Challenges and Considerations

While automated portfolio rebalancing offers significant advantages, there are challenges and considerations to address. These include the potential for algorithmic bias, the need for ongoing monitoring and maintenance, and the importance of clear risk management strategies. Understanding these factors is crucial for successful implementation of automated portfolio solutions.

Additionally, the selection of appropriate AI algorithms and the quality of the data used for analysis are critical factors in ensuring the effectiveness and accuracy of the rebalancing process. Careful consideration of these aspects is essential for maximizing the benefits of AI-driven portfolio management.

Read more about AI Driven Portfolio Management for Real Estate

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing