ESG Factors: Integrating Sustainability into Real Estate

Reducing Emissions Through Sustainable Practices

When we talk about environmental impact reduction, the conversation naturally turns to practical sustainability measures. Forward-thinking organizations are now powering their operations with renewable energy, implementing smart energy management systems, and developing comprehensive waste reduction programs. The most innovative companies are deploying cutting-edge emission control technologies throughout their production and logistics networks. These measures don't just shrink environmental footprints - they create tangible business value through enhanced brand reputation and increased appeal to eco-conscious investors.

Sustainable Supply Chain Management

The environmental performance of supply chains deserves meticulous attention. Progressive businesses conduct thorough supplier assessments, enforce sustainable procurement policies, and actively support their partners' transition to greener technologies. By embedding sustainability deep within supply networks, companies can ensure their products maintain environmental integrity from raw materials to final delivery.

Comprehensive supply chain audits frequently reveal unexpected emission hotspots, allowing businesses to strategically target their sustainability investments where they'll have maximum impact. This methodical approach cultivates genuinely sustainable business models that stand up to scrutiny.

Sustainable Product Design and Manufacturing

Modern product development prioritizes environmental considerations at every stage. Designers now specify recycled materials, engineer products for extended service life, and incorporate end-of-life recyclability into their blueprints. The most progressive designs go beyond the product itself, reimagining packaging solutions to minimize waste throughout the entire product journey.

Promoting Energy Efficiency

Energy optimization has become a hallmark of responsible operations. Businesses are retrofitting facilities with high-efficiency equipment, upgrading building envelopes, and implementing intelligent lighting controls. These measures deliver dual benefits: significant energy savings and reduced operational expenses. The most ambitious organizations complement these efforts with on-site renewable energy installations, further diminishing their dependence on conventional power sources.

Waste Management and Recycling

Comprehensive waste management systems represent a fundamental component of environmental stewardship. Leading companies implement sophisticated material sorting and recycling protocols, dramatically reducing landfill contributions. This commitment extends beyond their immediate operations, influencing waste reduction throughout their entire supply network. Such initiatives actively contribute to the development of a circular economic model.

Carbon Offset Initiatives

For emissions that prove unavoidable through direct reduction, carbon offset programs offer a valuable solution. Businesses are increasingly supporting verified emission reduction projects, including reforestation efforts and renewable energy development. These programs must be carefully vetted to ensure they deliver genuine, measurable environmental benefits that complement a company's direct emission reduction efforts.

Environmental Monitoring and Reporting

Rigorous environmental performance tracking forms the backbone of effective sustainability programs. Organizations monitor key indicators including energy usage, waste volumes, and emission levels, using this data to refine their environmental strategies. Transparent sustainability reporting builds stakeholder confidence while providing actionable insights for continuous improvement.

Social Responsibility: Creating Inclusive and Equitable Communities

Corporate Social Responsibility Initiatives

Contemporary businesses recognize that their social impact extends far beyond financial performance. Forward-looking CSR programs now encompass everything from ethical procurement and equitable employment practices to environmental conservation and community partnership initiatives. These comprehensive programs reflect an understanding that long-term business success is inextricably linked to societal wellbeing. Organizations with robust CSR frameworks frequently discover that these investments yield returns through enhanced brand equity, improved talent retention, and increased shareholder value.

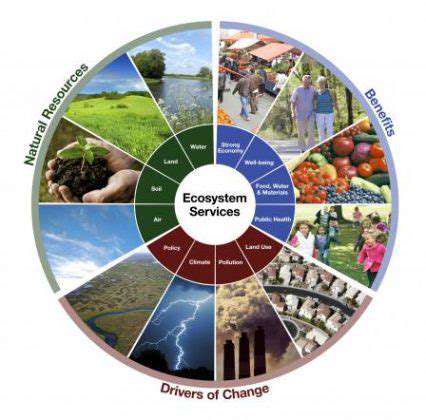

Environmental stewardship features prominently in modern CSR strategies. Companies are implementing energy optimization programs, transitioning to sustainable packaging solutions, and supporting biodiversity conservation efforts. These environmental initiatives often reveal unexpected operational efficiencies and cost reduction opportunities, while simultaneously strengthening customer relationships with environmentally conscious consumer segments.

Building Trust and Transparency

Credible social responsibility programs are built on foundations of transparency and accountability. Businesses committed to ethical operations openly share information about their environmental performance, labor standards, and supply chain practices. This openness allows stakeholders to make informed assessments of a company's sustainability commitments. In today's market, transparency isn't just virtuous - it's a competitive differentiator that resonates powerfully with consumers.

Effective stakeholder communication requires multiple channels of engagement, including social media platforms, community forums, and detailed CSR reporting. These open dialogues create opportunities for valuable feedback and deeper understanding of corporate impacts.

Proactive issue management represents another critical transparency component. The most responsible organizations systematically identify potential risks and implement preventive measures. When challenges do arise, timely communication coupled with concrete remediation plans demonstrates authentic commitment to social responsibility.

Ethical supply chain management remains non-negotiable for responsible businesses. This means ensuring fair compensation, safe working conditions, and responsible sourcing throughout global supplier networks. Ethical procurement practices contribute to more equitable economic systems while protecting companies from reputational risks associated with supply chain controversies.

Governance: Ensuring Transparency and Accountability

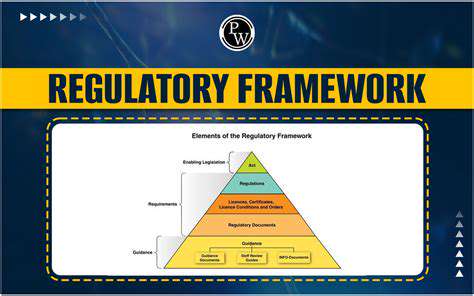

Transparency in Decision-Making

Robust governance systems demand clarity in ESG-related decision processes. This means establishing clear protocols for addressing environmental, social and governance considerations, complete with defined metrics for assessing performance. Such transparency builds confidence among investors, employees and communities by providing clear visibility into organizational commitments. Comprehensive disclosure should include not just outcomes, but the methodologies behind them and lessons learned along the way.

Effective transparency requires multiple communication channels. Detailed ESG reporting - combining quantitative data with qualitative context - should be readily available to all stakeholders. This level of openness demonstrates authentic commitment to sustainable operations and accountable business practices.

Accountability Mechanisms for ESG Performance

Converting ESG commitments into concrete results requires well-defined accountability structures. Leading organizations assign specific ESG responsibilities to individuals and teams, ensuring they possess both the authority and resources to drive meaningful change. This includes implementing robust monitoring systems to track progress against targets and trigger corrective actions when necessary.

Regular internal audits and third-party evaluations help organizations assess ESG program effectiveness and identify improvement opportunities. Maintaining accountability requires clear expectations, consistent follow-through, and a culture that values sustainable business practices at all levels.

Board Oversight and Stakeholder Engagement

Effective ESG integration demands active board-level involvement. Progressive boards participate directly in ESG strategy development, ensuring alignment with broader business objectives. This includes establishing clear performance expectations, allocating appropriate resources, and holding management accountable for results. Regular ESG progress reports enable informed board-level decision making.

Meaningful stakeholder engagement provides critical perspective on ESG priorities. Organizations benefit from actively soliciting input from employees, customers, investors and communities about their sustainability concerns. This stakeholder intelligence helps shape more relevant and impactful ESG initiatives while building trust in the organization's commitments.

The Future of Real Estate: Embracing Sustainability for Long-Term Value

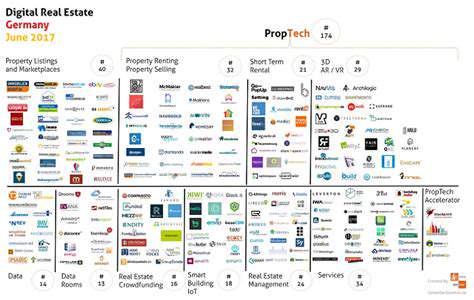

The Rise of Technology in Real Estate

Digital transformation is reshaping real estate at every level, from property marketing to investment analysis. Industry professionals now utilize sophisticated digital tools to enhance every stage of the property transaction process. Advanced analytics enable hyper-personalized property searches and more accurate market predictions, while immersive technologies like 3D modeling and virtual reality are redefining property viewing experiences.

Sustainable Practices Gaining Momentum

The real estate sector is undergoing a green revolution, driven by growing environmental awareness. Eco-conscious developments featuring renewable energy systems and energy-efficient designs are becoming market differentiators. Today's property buyers increasingly prioritize sustainability features, creating strong demand for green-certified buildings that align with their environmental values.

The Impact of Remote Work on Real Estate

The remote work revolution is fundamentally reshaping housing preferences and market dynamics. Homebuyers now prioritize lifestyle amenities and living space over proximity to traditional employment centers. This paradigm shift requires real estate professionals to develop new expertise in evaluating emerging desirable locations, particularly those offering superior connectivity, recreational opportunities, and quality-of-life advantages. Suburban and rural markets are experiencing renewed interest as workers seek more spacious living environments.

The Importance of Data-Driven Decision Making

Modern real estate practice has become intensely data-driven. Professionals now leverage advanced analytics to identify market trends, forecast pricing movements, and assess investment potential. Comprehensive data analysis has become indispensable for evaluating opportunities in today's complex property markets. The most successful practitioners combine this quantitative approach with local market knowledge to develop nuanced investment strategies.

The Evolution of Financing Options

Real estate financing continues to evolve with the emergence of innovative solutions. Fintech platforms are democratizing access to property financing through streamlined digital applications and alternative lending models. This financial innovation is expanding homeownership opportunities while introducing new considerations for borrowers and lenders alike.

Globalization and International Real Estate

Borderless investment activity continues to grow, creating both opportunities and complexities in global property markets. Success in international real estate now requires specialized knowledge of cross-border regulations, currency considerations, and local market conditions. This globalized environment offers expanded investment options but demands more sophisticated due diligence processes.

The Role of Artificial Intelligence

AI applications are beginning to transform multiple aspects of real estate operations. From automated property valuation models to predictive analytics for investment decisions, AI tools are enhancing efficiency and accuracy across the sector. As these technologies mature, they promise to revolutionize traditional real estate practices while creating new opportunities for data-driven insights.

Read more about ESG Factors: Integrating Sustainability into Real Estate

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing