AI in Real Estate: Optimizing Property Valuations for Smarter Investment Decisions

Artificial Intelligence (AI) is rapidly transforming various industries, and real estate appraisal is no exception. These cutting-edge valuation tools combine computational power with market intelligence to deliver results that challenge traditional methods. The integration of machine learning models allows for dynamic pricing adjustments based on real-time market fluctuations, giving buyers and sellers unprecedented insights into property values.

Modern valuation platforms aggregate information from diverse sources including historical transactions, neighborhood development patterns, and even local zoning changes. Advanced analytics can detect subtle correlations between seemingly unrelated factors, such as school district improvements and commercial development timelines.

Data-Driven Insights for Enhanced Accuracy

Traditional appraisal methods often struggle with the subjective nature of property valuation. AI systems eliminate much of this guesswork by applying consistent analytical frameworks across all evaluations. By processing millions of data points - from square footage measurements to recent renovation permits - these systems establish valuation benchmarks with remarkable precision.

The technology goes beyond static comparisons, incorporating predictive modeling to anticipate how emerging trends might influence future values. For instance, an algorithm might detect that properties near new transit hubs appreciate 12% faster than comparable listings just half a mile away.

Automation and Efficiency: Streamlining the Appraisal Process

What traditionally took appraisers weeks to complete can now be accomplished in hours through automated valuation models. This acceleration doesn't sacrifice quality - in many cases, it enhances it through comprehensive data analysis. The systems automatically flag inconsistencies in property records or unusual valuation outliers that might warrant closer inspection.

Automated workflows also standardize reporting formats, ensuring all stakeholders receive clear, consistent valuation documentation. This uniformity reduces misunderstandings and speeds up transaction timelines.

Improved Accessibility and Affordability

The democratization of valuation technology means even modest properties can benefit from sophisticated analysis. Where traditional appraisals might be cost-prohibitive for small landlords or first-time buyers, AI solutions offer professional-grade assessments at fractional costs. This accessibility is transforming how real estate professionals approach portfolio management and investment strategies.

Overcoming Challenges and Ensuring Transparency

As with any disruptive technology, implementation hurdles exist. The most significant barrier isn't technical capability, but rather establishing trust in algorithmic decision-making. Leading platforms now incorporate explainable AI features that detail the weighting of various valuation factors, allowing users to understand how specific data points influenced the final assessment.

The Future of Real Estate Appraisal: Embracing Innovation

We're witnessing just the beginning of AI's impact on property valuation. Next-generation systems will likely incorporate environmental sensors, virtual property walkthroughs, and predictive maintenance analytics into their valuation models. As these technologies mature, they'll fundamentally reshape how we conceptualize and quantify real estate value.

Regulatory Considerations and Ethical Implications

The rapid adoption of valuation technologies necessitates thoughtful governance. Regulators must balance innovation with consumer protections, ensuring algorithms don't inadvertently reinforce historical biases or create new forms of discrimination. Transparent auditing processes and ongoing bias testing will be essential as these tools become industry standards.

Leveraging Data for Enhanced Accuracy

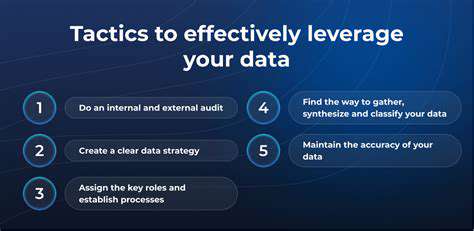

Data Collection Strategies

Modern data collection extends far beyond basic property characteristics. Progressive firms now incorporate satellite imagery, foot traffic analytics, and even social media sentiment into their valuation models. This multidimensional approach captures aspects of property value that traditional methods often miss, like neighborhood desirability or emerging commercial viability.

Data Preprocessing Techniques

Raw property data requires sophisticated normalization before analysis. Advanced cleaning algorithms can detect and correct inconsistencies across different data sources, such as reconciling conflicting square footage reports or identifying outdated tax records. This preprocessing ensures the foundation for all subsequent analysis remains solid.

Statistical Modeling for Insights

Today's valuation models employ ensemble methods that combine multiple statistical approaches. This hybrid methodology compensates for the limitations of any single technique, producing more robust and reliable results. The models continuously self-evaluate, adjusting their weighting algorithms as market conditions evolve.

Data Visualization for Communication

Interactive dashboards have replaced static reports, allowing stakeholders to explore valuation components dynamically. These visual tools highlight key value drivers through heat maps, trend lines, and comparative benchmarks, making complex analyses accessible to non-technical users.

Interpretation and Validation of Results

Validation processes now incorporate both quantitative checks and qualitative reviews. Automated systems flag valuations that deviate significantly from expected ranges, while human experts assess whether these deviations reflect genuine market anomalies or potential data errors.

Application in Specific Domains

The principles of data-driven valuation apply across property types, though with important specializations. Commercial valuations might emphasize tenant mix analytics, while residential models could focus on school quality metrics. Understanding these domain-specific factors ensures appropriate model calibration.

Ethical Considerations in Data Usage

Responsible data practices are non-negotiable in modern valuation. Leading firms implement strict protocols for data anonymization, ensuring individual privacy while maintaining analytical rigor. Regular audits verify that algorithms don't develop unintended biases over time.

Streamlining the Valuation Process

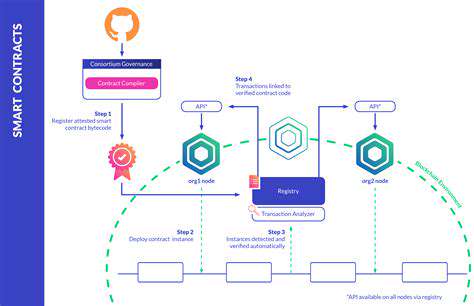

Integrating Artificial Intelligence for Accurate Data Analysis

AI doesn't replace human judgment - it enhances it. By handling routine analyses, these systems free appraisers to focus on complex cases requiring nuanced evaluation. The technology serves as a force multiplier, allowing smaller teams to manage larger portfolios without sacrificing quality.

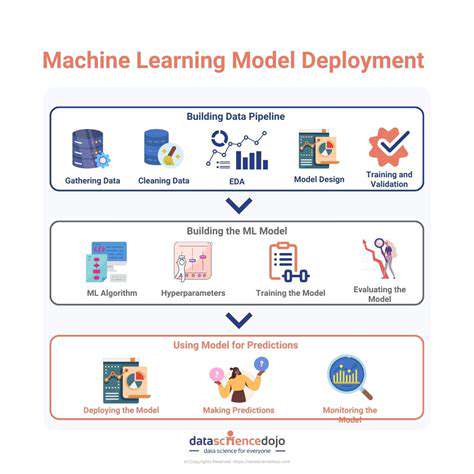

Automating Valuation Models to Enhance Efficiency

Modern AVMs incorporate feedback loops that improve with each valuation. When human appraisers override automated suggestions, the system learns from these corrections, gradually refining its algorithms. This collaborative approach combines the speed of automation with the wisdom of experience.

Enhancing Data Collection Through Digital Platforms

Cloud-based platforms enable real-time data sharing across stakeholders. Property owners can upload renovation documentation directly into valuation systems, ensuring assessments reflect the most current information. This collaborative ecosystem reduces information gaps and delays.

Implementing Machine Learning for Predictive Valuations

Predictive models now incorporate external economic indicators. Interest rate forecasts, employment trends, and even climate risk projections inform forward-looking valuations, helping investors make more informed long-term decisions.

Overcoming Challenges in the Adoption of AI Technologies

Successful implementation requires cultural change as much as technical upgrades. Progressive firms invest in continuous training, helping teams understand both the capabilities and limitations of their AI tools. This knowledge empowers staff to use the technology effectively while maintaining appropriate oversight.

Improving Investment Decisions and Risk Management

Understanding the Fundamentals of Investment Analysis

Modern investors benefit from AI-powered analytics that contextualize property fundamentals. Automated systems can instantly compare a building's financials against thousands of similar properties, highlighting strengths and weaknesses that might take days to identify manually.

The Role of Risk Management in Investment Strategies

Advanced simulations now model hundreds of potential market scenarios. These stress tests reveal how different economic conditions might impact property cash flows, allowing investors to structure more resilient portfolios.

Leveraging Technology and Data for Better Investment Outcomes

Investment platforms increasingly incorporate alternative data streams. Mobile location data can reveal changing neighborhood patterns, while satellite imagery tracks development progress - all contributing to more informed investment theses.

The Importance of Diversification in Building Resilient Portfolios

AI-powered portfolio optimizers suggest diversification strategies beyond simple asset class mixes. These systems analyze correlations across geographies, property types, and tenant industries to construct truly balanced real estate holdings.

Developing a Personalized Investment Plan

Digital advisors can now tailor recommendations to individual investor profiles. By analyzing risk tolerance, liquidity needs, and tax situations, these tools create customized acquisition strategies that align with personal financial goals.