AI Driven Valuation: A Competitive Edge in Real Estate

Beyond Traditional Valuation: The Rise of Data-Driven Insights

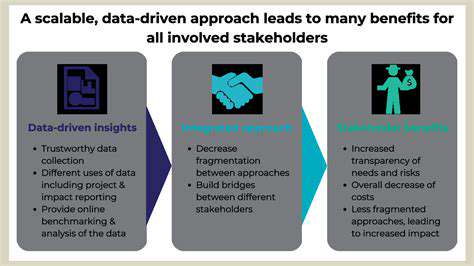

Traditional appraisal methods, often reliant on subjective judgments and historical data, are increasingly being challenged by the power of AI-driven valuation. This shift towards data-rich insights promises to revolutionize the way we understand and assess property values, providing a more nuanced and accurate picture of market realities. The integration of vast datasets encompassing everything from economic indicators to social trends allows for a more comprehensive evaluation, moving beyond the limitations of traditional methodologies.

This approach allows for a more dynamic and adaptable evaluation, responding to rapidly changing market conditions and emerging trends. By incorporating real-time data, AI systems can adjust valuations more swiftly, reflecting the immediacy of market fluctuations. This responsiveness is a significant advantage over traditional methods, which often struggle to keep pace with these transformations.

Machine Learning Models: Powering Predictive Accuracy

Sophisticated machine learning models are at the forefront of this revolution. These models can analyze massive datasets to identify patterns and correlations that might be missed by human appraisers. By learning from historical transactions and market data, these models can predict future values with a degree of accuracy previously unattainable. The ability to process and understand complex relationships within data empowers these models to deliver insights that can be extremely valuable for all stakeholders.

Machine learning algorithms are also adept at adapting to new information and evolving market conditions. This dynamic learning capability allows for ongoing improvement in predictive accuracy, ensuring the valuations remain relevant in a constantly changing real estate landscape. This continuous refinement is crucial for maintaining the reliability and accuracy of the valuation process.

Real-Time Data Integration: A Dynamic Valuation Approach

AI-driven valuation systems excel at integrating real-time data streams. This continuous flow of information, encompassing everything from social media sentiment to news articles, provides a more comprehensive understanding of market dynamics. This detailed and current perspective allows for a more immediate and responsive valuation process, crucial for tracking and reacting to short-term fluctuations in the market.

By incorporating real-time data, AI-driven valuation tools can provide up-to-the-minute insights, enabling stakeholders to make informed decisions with greater confidence. This level of instantaneous data processing was simply not possible with traditional methods, which often relied on delayed or incomplete information.

Improving Efficiency and Cost-Effectiveness

The integration of AI in the valuation process leads to substantial improvements in efficiency. Automation of data collection, analysis, and reporting dramatically reduces the time and resources needed for appraisals. This enhanced efficiency translates directly into cost savings for all parties involved, from real estate agents to lenders.

By streamlining the appraisal process, AI-powered solutions can significantly reduce the time required to obtain valuations. This speed is especially critical in today's fast-paced real estate market, enabling quicker transactions and more timely decision-making. The efficiency gains also translate to cost savings, benefiting both buyers and sellers.

Addressing Bias and Subjectivity in Traditional Methods

One of the key advantages of AI-driven valuation is its ability to mitigate the inherent biases and subjectivity often present in traditional appraisal methods. By relying on objective data analysis, AI systems can provide a more unbiased and consistent valuation process. This objectivity is crucial for fairness and transparency in the real estate market.

Historical biases in traditional appraisal methods can lead to significant inaccuracies. AI-driven valuation systems can eliminate these biases, providing a more equitable and transparent evaluation of property values. This level of objectivity fosters trust and confidence in the valuation process.

The Future of Valuation: A Seamless Integration

The future of real estate valuation lies in a seamless integration of AI with existing processes. This integration will not replace human expertise but will augment it, providing appraisers with powerful tools to enhance their insights and decision-making. Expert knowledge and judgment will remain vital components of the process.

As AI technology continues to evolve, we can anticipate even more sophisticated and accurate valuation tools. This evolution will continue to improve the efficiency, accuracy, and fairness of the appraisal process, leading to a more robust and reliable real estate market.

Predictive Analytics for Enhanced Market Forecasting

Predictive Modeling Techniques

Predictive analytics leverages various statistical and machine learning techniques to forecast future outcomes. These techniques encompass a wide spectrum, from simple regression models to complex algorithms like neural networks. Choosing the appropriate technique hinges on the nature of the data and the desired forecast accuracy. For example, linear regression is suitable for predicting continuous variables with a clear linear relationship, while decision trees are effective in handling categorical and numerical data with non-linear relationships. Different models provide different levels of insights, and careful consideration of the specific problem is crucial.

Data Preparation and Feature Engineering

A critical aspect of predictive modeling is the meticulous preparation of the data. This involves handling missing values, transforming variables, and identifying relevant features that significantly contribute to the prediction. Data quality directly impacts the accuracy of the predictive model. Proper data cleaning and transformation are essential steps to ensure the model's reliability. Feature engineering, which involves creating new variables or transforming existing ones, can also enhance the model's performance by capturing complex relationships within the data.

Model Evaluation and Validation

Evaluating the performance of a predictive model is paramount. Different metrics, such as accuracy, precision, recall, and F1-score, are used to assess how well the model predicts outcomes. The selection of appropriate metrics depends entirely on the specific context of the problem. Furthermore, model validation techniques, such as cross-validation, are employed to ensure that the model generalizes well to unseen data and isn't overfitting to the training data. Overfitting can lead to poor performance on new, unseen data.

Deployment and Monitoring

Once a predictive model is developed and validated, it needs to be deployed into a production environment. This often involves integrating the model into existing systems and automating the prediction process. A critical step in ensuring ongoing effectiveness is continuous monitoring of the model's performance. This includes tracking key metrics and re-training the model with updated data to maintain its accuracy and relevance as new information becomes available. Regular monitoring is crucial to avoid inaccurate predictions.

Real-World Applications

Predictive analytics finds extensive applications across various industries. From predicting customer churn in the telecommunications sector to forecasting demand in the retail industry, these techniques are proving valuable for informed decision-making. By analyzing historical data and identifying patterns, businesses can anticipate future trends and proactively address potential challenges. These techniques are useful for a wide range of business strategies, from risk management to optimizing inventory levels. The applications are vast and innovative.

Beyond simply navigating, modern vehicles are increasingly incorporating advanced safety features designed to proactively mitigate risks and protect occupants. These features go beyond basic collision avoidance systems, encompassing a range of technologies that monitor the driver and surrounding environment, providing real-time alerts and interventions to prevent accidents. This proactive approach to safety is a significant advancement in automotive technology.

Read more about AI Driven Valuation: A Competitive Edge in Real Estate

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing