Climate Finance for Resilient Real Estate Projects

Exploring Private Sector Funding Options

Corporate social responsibility programs and family foundations increasingly direct capital toward sustainability initiatives. Unlike rigid government programs, private funders often provide flexible financing structures that adapt to project needs. The most successful fundraisers cultivate genuine relationships with potential donors through consistent engagement rather than transactional interactions.

Philanthropic decision-makers respond strongly to narratives demonstrating measurable impact. A wastewater treatment proposal might emphasize not just pollution reduction metrics but also job creation potential in disadvantaged communities. This dual-benefit approach frequently sways private funders seeking comprehensive returns on their investments.

Leveraging Crowdfunding Platforms

Digital fundraising channels democratize access to capital by connecting projects with global micro-donors. Effective campaigns employ visually compelling storytelling that translates complex climate solutions into relatable narratives. The most successful initiatives maintain transparent communication, frequently updating backers about milestones and challenges.

Utilizing Angel Investors and Venture Capital

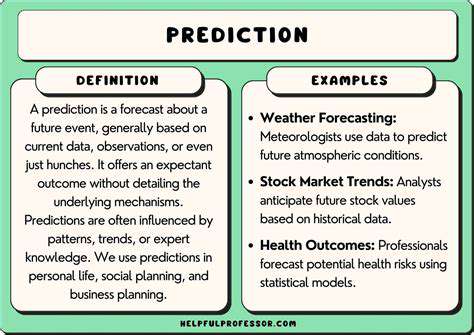

Early-stage climate tech ventures increasingly attract mission-aligned investors seeking both financial returns and environmental impact. These financiers typically require robust business models demonstrating clear pathways to profitability within defined timeframes. Presenting verifiable pilot data often proves more persuasive than theoretical projections.

Considering Impact Investing Strategies

The burgeoning impact investing market offers hybrid financial instruments that balance risk and social benefit. Projects incorporating quantifiable emissions reductions or community co-benefits can access specialized funds with below-market rates. Successful applicants typically embed reporting mechanisms that satisfy investor requirements for impact verification.

Examining Alternative Funding Mechanisms

Creative financing solutions like green bonds or payment-for-ecosystem-services schemes are gaining traction. These models often require innovative legal structures to align financial flows with environmental outcomes. Partnering with financial institutions experienced in sustainable development can help navigate these complex arrangements.

Microbial carbon conversion technologies represent a paradigm shift in emissions reduction, harnessing nature's biochemical pathways for industrial applications. Recent advances in synthetic biology demonstrate how engineered organisms can transform CO₂ into high-value chemicals while reducing manufacturing emissions.

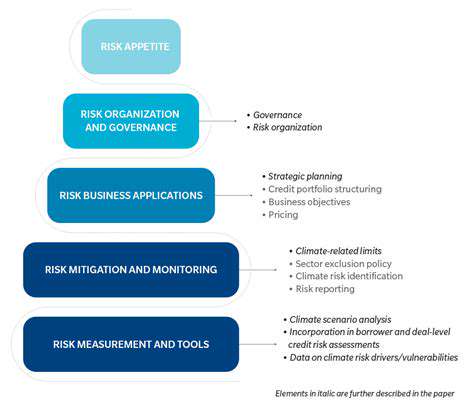

Assessing and Mitigating Climate Risks in Project Financing

Understanding Climate Risks in Project Financing

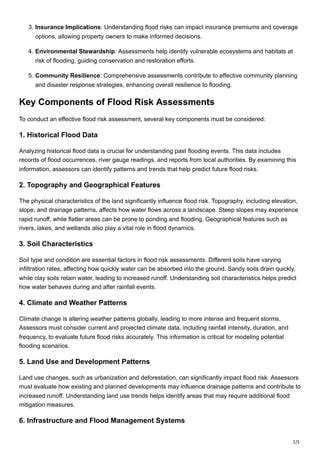

Climate volatility introduces multi-dimensional threats to financial viability, from acute weather events to gradual regulatory shifts. Location-specific vulnerability assessments now form essential components of due diligence processes. Projects in flood-prone regions require fundamentally different safeguards than those facing wildfire risks or rising temperatures.

Identifying and Quantifying Climate-Related Financial Risks

Advanced modeling techniques now enable financiers to stress-test projects against multiple climate scenarios. These analyses consider not just physical damage probabilities but also transition risks like carbon pricing impacts. The most robust assessments incorporate probabilistic modeling of compound events—where multiple climate hazards interact to amplify losses.

Developing Robust Climate Risk Mitigation Strategies

Leading organizations implement layered protection frameworks combining engineered solutions with financial hedges. A coastal development might integrate elevated foundations with parametric insurance products triggered by specific storm surge heights. This dual approach addresses both immediate physical risks and long-term financial exposures.

Implementing Climate-Resilient Project Designs

Forward-looking developers now mandate climate-adaptive specifications for all new constructions. This includes using materials with higher thermal tolerance in regions facing extreme heat, or installing modular components that facilitate post-disaster repairs. Such design considerations often yield long-term cost savings exceeding initial investments.

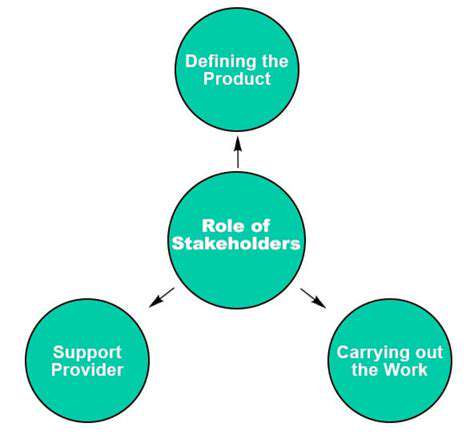

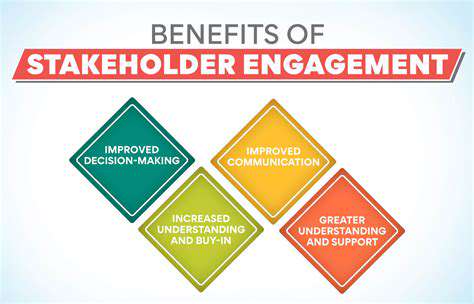

Engaging Stakeholders and Seeking Expert Advice

Effective risk management requires cross-disciplinary collaboration combining local knowledge with scientific expertise. Indigenous communities often provide invaluable insights about historical climate patterns, while engineers contribute technical solutions. Regular stakeholder workshops help identify blind spots in conventional risk assessments.

Monitoring and Evaluating Climate Risk Performance

Leading organizations establish dynamic monitoring systems that track both environmental indicators and financial impacts. Smart sensors might measure structural stress during extreme weather, while financial dashboards track climate-related cost overruns. This real-time data enables proactive adjustments to mitigation strategies.

Read more about Climate Finance for Resilient Real Estate Projects

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing