AI in Real Estate Lending: Risk Assessment

Navigating Challenges and Ethical Implications in Modern Lending

Protecting Sensitive Financial Information

In today's digital lending environment, safeguarding borrower data has become increasingly complex. Financial institutions must implement multi-layered security protocols that go beyond basic encryption to protect against sophisticated cyber threats. Regular penetration testing and employee training on data handling protocols have become standard requirements rather than optional measures.

The implementation of zero-trust architecture in lending platforms represents a significant advancement in data protection. This approach verifies every access request regardless of origin, dramatically reducing the potential for unauthorized data exposure. Continuous monitoring systems now provide real-time alerts for suspicious activities, enabling immediate response to potential breaches.

Algorithmic Decision-Making and Equity Concerns

The reliance on historical data in machine learning models presents unique challenges for equitable lending. Recent studies have shown that even carefully designed algorithms can develop subtle biases during the training process. To combat this, progressive lenders are implementing continuous bias detection frameworks that monitor outcomes across demographic groups.

Innovative approaches to model development include synthetic data generation techniques that help balance underrepresented groups in training datasets. Some institutions have established ethics review boards that evaluate algorithms before deployment and at regular intervals thereafter, ensuring ongoing compliance with fair lending standards.

Demystifying AI Decision Processes

The financial industry is moving toward greater transparency in automated underwriting systems. New regulatory requirements now mandate that lenders using AI must provide clear, actionable explanations for credit decisions. This has led to the development of sophisticated model interpretation tools that translate complex algorithmic outputs into understandable terms.

Some lenders now provide applicants with detailed breakdowns showing how specific factors influenced their loan terms. These disclosures include not just the negative factors but also those that worked in the applicant's favor, creating a more balanced understanding of the decision-making process.

Adapting to Evolving Regulatory Requirements

The regulatory environment for AI in lending changes rapidly across different markets. Major institutions now employ dedicated teams that monitor regulatory developments in real-time, allowing for swift adaptation to new compliance requirements. This proactive approach helps avoid costly violations while maintaining operational flexibility.

Documentation practices have evolved to include comprehensive audit trails of model development, testing, and deployment. These records demonstrate compliance with relevant laws and regulations while providing valuable insights for continuous improvement of lending processes.

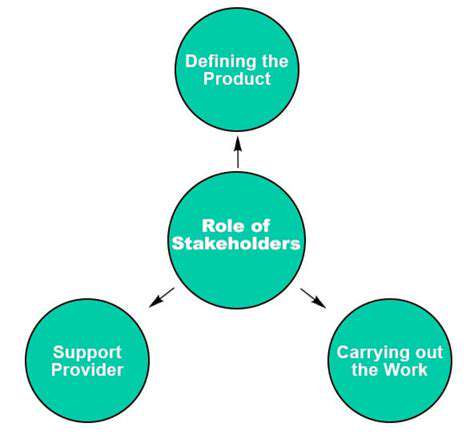

The Changing Role of Lending Professionals

Automation is transforming rather than eliminating human roles in real estate finance. Loan officers now focus more on complex case evaluation and customer relationship management, leaving routine processing to AI systems. This shift requires new skill sets focused on interpreting AI outputs and providing personalized guidance.

Forward-thinking firms are investing heavily in training programs that help employees transition to these new roles. The most successful transition strategies combine technical education with mentoring programs that help staff apply their institutional knowledge in the context of automated systems.

Managing Emerging Risks in Automated Lending

Comprehensive risk management frameworks now incorporate specialized protocols for AI systems. These include scenario testing under extreme market conditions that traditional models might not anticipate. Stress testing has become more sophisticated, evaluating not just the models themselves but also their interactions with other system components.

Contingency planning now includes detailed procedures for reverting to manual processes when needed, ensuring business continuity during system outages or unexpected performance issues. These plans are regularly tested and updated to reflect changes in both technology and market conditions.

Emerging Trends in Automated Real Estate Finance

Transforming Loan Evaluation Through Advanced Analytics

Modern lending platforms are leveraging cutting-edge analytical techniques that consider hundreds of data points for each application. These systems can detect subtle patterns in financial behavior that might indicate creditworthiness beyond traditional metrics. This nuanced analysis enables lenders to serve borrowers who might have been overlooked by conventional methods, expanding access to financing.

The most advanced systems now incorporate real-time market data into their evaluations, adjusting risk assessments as conditions change. This dynamic approach helps both lenders and borrowers make more informed decisions about loan terms and timing.

Advanced Techniques for Risk Prediction

Contemporary risk modeling integrates macroeconomic indicators with micro-level borrower data to create highly granular risk profiles. Some models now incorporate alternative data sources such as utility payment histories or educational backgrounds (where permitted by law) to build more complete financial pictures.

Machine learning models continuously refine their predictions as new data becomes available, creating a feedback loop that improves accuracy over time. This continual learning process helps lenders stay ahead of emerging risks while identifying new opportunities.

Streamlining Borrower Interactions

Digital lending platforms now offer seamless, personalized experiences through intelligent automation. Borrowers can complete applications in minutes using pre-filled data and real-time validation. Chatbots and virtual assistants provide instant answers to common questions, while more complex inquiries are efficiently routed to human specialists.

The application process has become more transparent, with many platforms providing real-time updates on application status and clear explanations of any additional requirements. This transparency builds trust and reduces borrower anxiety during what can be a stressful process.

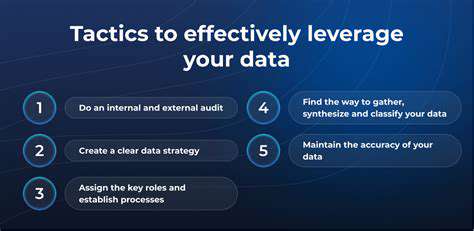

Leveraging Comprehensive Data Analytics

Today's lending decisions incorporate analysis of diverse data streams ranging from property-specific details to broader neighborhood trends. Satellite imagery analysis can assess property conditions, while mobility data might reveal emerging neighborhood patterns. This multidimensional approach creates a more holistic view of both property and borrower risk.

Data visualization tools help lenders quickly interpret complex relationships between variables, enabling faster yet more informed decisions. These tools also facilitate clearer communication with borrowers about the factors influencing their loan terms.

Balancing Innovation With Responsible Practices

As automated lending becomes more sophisticated, industry groups are developing voluntary standards for ethical AI use. These guidelines address issues like explainability, data provenance, and appropriate use of alternative data. Some jurisdictions are implementing certification programs for AI systems used in financial services.

Regular third-party audits of lending algorithms are becoming more common, providing independent verification of fairness and compliance. These audits examine not just the models themselves but also the data pipelines that feed them, ensuring integrity throughout the decision-making process.

Read more about AI in Real Estate Lending: Risk Assessment

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing