AI Driven Valuation: The Future of Property Assessment

Unveiling the Vast Potential of Big Data

Big data, encompassing massive datasets from diverse sources, offers a profound opportunity to transcend traditional valuation methods. This wealth of information, encompassing everything from social media trends to sensor data from industrial processes, provides a comprehensive view of market dynamics and company performance that traditional methods often miss. By leveraging this intricate network of information, we can develop more nuanced and accurate valuations, moving beyond simplistic models towards a more holistic understanding of value.

The sheer volume, velocity, and variety of big data allow us to identify patterns and correlations previously hidden from view. This deeper understanding of underlying market forces and company performance indicators is crucial for making informed investment decisions and predicting future market movements with greater accuracy.

The Role of Artificial Intelligence in Data Analysis

Artificial intelligence (AI) plays a pivotal role in extracting meaningful insights from the vast ocean of big data. AI algorithms excel at identifying complex relationships and patterns within data, which are often beyond the capabilities of human analysts. This ability to sift through and process massive datasets in a fraction of the time enables AI to uncover critical information that can dramatically improve valuation models.

Enhancing Accuracy and Precision in Valuation

Traditional valuation methods often rely on limited datasets, leading to potential inaccuracies and biases. By incorporating big data and AI, we can dramatically enhance the accuracy and precision of valuation models. This is achieved by considering a broader range of factors and market influences, resulting in valuations that are more representative of the true underlying value of an asset or company.

Identifying Emerging Trends and Market Shifts

Big data allows us to proactively identify emerging trends and market shifts with remarkable speed. The constant influx of real-time data enables AI to detect subtle changes in consumer preferences, market sentiment, and economic indicators, providing early warnings and facilitating more agile investment strategies. This ability to anticipate future market movements is invaluable for maximizing returns and mitigating potential risks.

Improving Risk Assessment and Mitigation

Accurate risk assessment is crucial for informed investment decisions. Big data and AI provide a powerful tool for evaluating and mitigating risks associated with specific investments. By analyzing historical data and real-time market conditions, AI can identify potential risks and provide insights into how to manage them effectively. This proactive approach to risk management can lead to significantly improved investment outcomes.

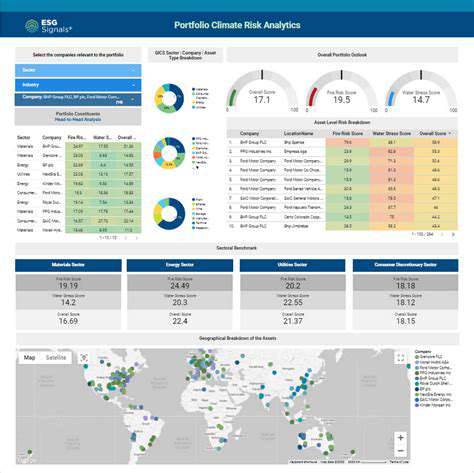

Data Visualization and Interpretation for Decision-Making

Presenting the insights derived from big data analysis in a clear and concise manner is critical for effective decision-making. Sophisticated data visualization techniques, coupled with AI-powered interpretation tools, can transform complex data into understandable and actionable insights. These tools empower stakeholders with the information needed to make informed decisions regarding asset allocation, investment strategies, and overall portfolio management.

Ethical Considerations and Data Security in Big Data Valuation

The use of big data in valuation necessitates careful consideration of ethical implications and data security. Ensuring data privacy and avoiding bias in algorithms are paramount. Robust data governance frameworks and ethical guidelines must be implemented to ensure responsible use of big data in financial analysis and decision-making. Transparency and accountability in data collection, processing, and interpretation are crucial for building trust and maintaining ethical standards.

Enhanced Efficiency and Reduced Costs

Improved Valuation Accuracy

AI-powered valuation models can analyze vast datasets of property characteristics, market trends, and comparable sales with unprecedented speed and accuracy. This level of detail surpasses traditional methods, minimizing the margin of error and leading to valuations that more closely reflect the true market value of a property. By incorporating factors like neighborhood demographics, crime rates, and even local school performance, AI algorithms can generate more nuanced and reliable estimations compared to human analysts, who may be limited by time constraints and subjective interpretations.

Streamlined Valuation Process

Automation is key to enhanced efficiency. AI-driven valuation tools automate many of the tedious and time-consuming steps involved in traditional appraisals. This includes data collection, analysis, and report generation. This streamlined process reduces the time taken to complete a valuation, enabling faster decision-making for investors, lenders, and real estate professionals. The reduction in manual labor also translates into considerable cost savings, making the entire valuation process more efficient and profitable.

Reduced Valuation Costs

By automating the appraisal process and minimizing the need for extensive human intervention, AI-driven valuations significantly reduce overall costs. This translates to lower fees for clients, thereby increasing accessibility and wider adoption of valuation services. The reduced costs are not just for the client; they also affect the institutions offering these services, allowing them to maintain competitive pricing and expand their reach.

Enhanced Transparency and Objectivity

AI algorithms, when properly designed and implemented, offer a high degree of transparency. The steps taken in the valuation process, and the factors considered, are documented and easily accessible. This transparency fosters trust and confidence in the valuation process, as stakeholders can understand the methodology behind the valuation. The objectivity inherent in AI algorithms, free from human bias, further strengthens the reliability of the valuation process, ensuring fairer and more accurate assessments for all parties involved.

Faster Turnaround Times

The ability of AI to process vast amounts of data at incredible speeds dramatically reduces the turnaround time for valuations. This is a significant advantage in today's fast-paced real estate market. From initial data input to final report delivery, the entire process can be completed in a fraction of the time compared to traditional methods. This speed is crucial in situations requiring quick decisions, such as real estate investment or lending opportunities.

Data-Driven Insights

AI valuation tools don't just provide a final value; they also generate valuable insights into market trends and property performance. This data-driven understanding of market dynamics allows for better strategic decision-making. By identifying patterns and correlations in the data, stakeholders can make more informed choices regarding investment strategies, property management, and future market projections. This predictive capability is a powerful tool for anyone involved in the real estate industry.

Improving Accuracy and Objectivity

Enhanced Data Collection Procedures

Implementing rigorous data collection methods is crucial for improving accuracy. This involves meticulously defining the scope of data needed, ensuring clear and concise data entry protocols, and utilizing reliable data sources. By standardizing these procedures, we minimize errors and inconsistencies, leading to more trustworthy results. Careful consideration must be given to potential biases during the data collection phase and measures to mitigate them should be incorporated.

Employing multiple data collection methods, whenever possible, can provide a more comprehensive and robust dataset. This approach allows for cross-validation and verification of findings, strengthening the overall objectivity of the analysis.

Bias Mitigation Strategies

Identifying and mitigating potential biases is paramount to achieving objectivity. This involves recognizing inherent biases in existing datasets and in the research methodology itself. Recognizing these biases is the first step toward developing strategies to counteract them. For example, researchers should consider the demographics of their study participants and strive for a representative sample to avoid skewed results.

Transparency in research methods and data analysis techniques is vital. Clearly documenting the methodologies employed, including potential limitations, builds trust and allows for scrutiny by peers, ultimately contributing to a more objective evaluation of the findings.

Improved Analytical Techniques

Employing advanced analytical techniques allows for a deeper understanding of the data and potentially reveals patterns that might have been missed with simpler methods. Statistical modeling, machine learning algorithms, and other advanced techniques can provide valuable insights that contribute to a more accurate interpretation of the results. This is crucial for identifying trends and drawing well-supported conclusions.

Careful consideration of the limitations of each analytical technique is essential. Understanding the assumptions underlying the techniques used and acknowledging potential sources of error is critical for interpreting results accurately. This will allow researchers to draw appropriate conclusions and avoid overgeneralization.

Rigorous Quality Control Measures

Establishing and implementing rigorous quality control measures throughout the entire research process is essential for maintaining accuracy and objectivity. This includes periodic verification of data entry accuracy, validation of analytical procedures, and peer review of research findings. These measures ensure that errors are identified and corrected early on, preventing them from propagating through the entire study.

Regular audits of data and methods should be conducted by independent reviewers to provide an objective perspective and identify potential flaws or inconsistencies. Feedback from these audits can be invaluable in refining the research process and ensuring the reliability of the results.

Objective Reporting and Interpretation

Presenting findings in a clear and unbiased manner is crucial. Objectively reporting the results, regardless of whether they support or contradict the initial hypothesis, is essential for scientific integrity. Avoid making unsubstantiated claims or drawing conclusions that are not supported by the data.

Clearly articulating the limitations of the study and acknowledging areas requiring further investigation is crucial for responsible reporting. This demonstrates transparency and allows for a more comprehensive evaluation of the findings.

The Future of Property Assessment: Integration and Advancement

Integration with Real-Time Data

The future of property assessment hinges on its seamless integration with real-time data sources. This integration will allow for more accurate and dynamic valuations, reflecting the ever-changing market conditions. Imagine a system that instantly updates property assessments based on new construction permits, sales transactions in neighboring areas, and even social media trends related to local amenities. This real-time feedback loop will empower assessors with the most up-to-date information, enabling them to respond to market fluctuations with greater speed and precision. This constant stream of data also allows for more proactive assessments and anticipatory adjustments to property values, ultimately leading to fairer and more equitable taxation.

Furthermore, integrating diverse data sources, including satellite imagery, demographic projections, and even energy consumption patterns, will provide a more comprehensive understanding of a property's worth. This multi-faceted approach will consider not only the physical characteristics of the property but also its location, market trends, and future potential, creating a more nuanced and accurate valuation process. This integration will be crucial for property owners, lenders, and investors, as they will have access to a detailed and trustworthy evaluation of the market.

Advancements in AI-Powered Valuation Models

Artificial intelligence (AI) is poised to revolutionize property assessment by developing more sophisticated and accurate valuation models. These models will go beyond traditional methods by analyzing vast datasets of historical and real-time property information, identifying complex patterns, and predicting future trends with exceptional accuracy. This will result in more reliable and consistent valuations, minimizing the potential for bias and error in human judgment.

AI algorithms can be trained on massive amounts of data, allowing them to identify subtle correlations and relationships between various factors that influence property values. This includes factors such as neighborhood characteristics, school ratings, crime statistics, and even proximity to public transportation. By incorporating these factors into the valuation process, AI can provide a more holistic and comprehensive assessment of a property's worth, leading to more equitable and efficient property taxation.

The use of machine learning techniques will also enable the models to adapt and refine themselves over time, continuously learning from new data and improving their accuracy. This continuous learning process will ensure that the valuation models remain relevant and effective in the face of rapidly changing market conditions. This dynamic adaptation will prevent outdated models from producing inaccurate valuations.

AI-powered models will also have the potential to analyze vast amounts of unstructured data, including social media posts, news articles, and online reviews, providing further insights into the local market and the perceived desirability of different properties. This will allow for more sophisticated and relevant property valuations. This comprehensive analysis will provide a more holistic understanding of a property's worth.

The integration of AI into property assessment will not only enhance accuracy but also streamline the entire process, reducing processing time and administrative costs. This efficiency will ultimately benefit both assessors and property owners.

Read more about AI Driven Valuation: The Future of Property Assessment

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing