AI Powered Real Estate Analytics: Actionable Insights

AI-Driven Market Insights

Artificial intelligence (AI) is revolutionizing real estate market analysis, providing unprecedented access to data and insights that were previously unavailable or incredibly time-consuming to compile. AI algorithms can sift through massive datasets of property listings, transaction histories, neighborhood demographics, and even social media trends to identify emerging market patterns and predict future price movements with remarkable accuracy. This allows real estate professionals to make informed decisions, anticipate market fluctuations, and adjust strategies accordingly, ultimately maximizing investment returns and minimizing risks.

Imagine a scenario where an investor can instantly analyze the potential profitability of a property based on a comprehensive AI assessment. This assessment considers not only the property's features and location, but also factors like local economic indicators, competitor activity, and even consumer preferences derived from extensive market research. By automating this complex process, AI empowers investors with data-driven decisions, leading to more efficient and lucrative investment strategies.

Personalized Property Recommendations

AI algorithms are adept at understanding individual preferences and needs. This capability is transforming the way real estate agents and platforms recommend properties to potential buyers. By analyzing user profiles, search history, and even browsing behavior, AI can suggest properties that perfectly align with individual tastes and criteria, leading to a more efficient and satisfying home-buying experience. This personalized approach not only enhances the user experience but also helps real estate agents connect buyers with the ideal properties, increasing their chances of successful sales.

Imagine a potential buyer searching for a house in a specific neighborhood with a particular style. The AI-powered platform can quickly identify suitable properties based on a vast range of criteria, from square footage and number of bedrooms to preferred amenities and even school districts. This level of precision and personalization ensures that buyers find homes that genuinely meet their needs, significantly reducing the time and effort involved in the home-buying process. Instead of endlessly browsing through irrelevant listings, users are directed to properties that align with their precise specifications.

Enhanced Property Valuation and Pricing

Accurate property valuation is critical in real estate transactions. AI-powered tools can analyze various factors influencing property value, such as comparable sales, property condition, neighborhood characteristics, and market trends. This detailed analysis allows for more precise valuations, enabling more informed negotiation strategies and potentially leading to more favourable transaction outcomes. This capability is especially useful in complex market conditions, where traditional valuation methods may struggle to keep pace with rapid changes.

AI algorithms can consider a wide range of factors that are often overlooked in traditional valuation methods, leading to a more comprehensive and accurate assessment. This includes considering the impact of recent renovations, the quality of local schools, and even the aesthetic appeal of the property. This detailed analysis helps agents and sellers to establish fair market values, leading to a smoother transaction process and potentially higher sale prices.

Streamlined Real Estate Operations

AI automates tedious tasks in real estate operations, from property management to marketing. This automation improves efficiency, reduces costs, and frees up valuable time for agents to focus on client interactions and strategic initiatives. Imagine an AI system handling routine tasks like scheduling appointments, generating reports, and responding to client inquiries, allowing agents to focus on building relationships and closing deals.

From automating the tedious process of sending emails and generating reports to handling routine inquiries, AI empowers real estate professionals to focus on high-value tasks. By taking care of mundane administrative tasks, AI allows real estate agents to spend more time building client relationships, conducting market research, and strategizing for future growth. This streamlined approach enhances efficiency and productivity, ultimately benefiting both agents and clients.

Market Segmentation and Targeted Marketing Strategies

Understanding Market Segmentation in Real Estate

Market segmentation in real estate, like in any industry, involves dividing a broad market into smaller, more manageable groups based on shared characteristics. This crucial step allows real estate professionals, particularly those utilizing AI-powered analytics, to tailor their strategies effectively. Identifying distinct segments, such as first-time homebuyers, investors, or families seeking specific amenities, enables a deeper understanding of their unique needs, preferences, and motivations. This detailed understanding is essential for crafting marketing campaigns that resonate with each segment and effectively communicate the value proposition of specific properties.

Segmentation criteria can range from demographic factors like age and income to psychographic factors like lifestyle and values. Analyzing historical data and incorporating user preferences gleaned from online interactions, coupled with AI-driven insights, helps refine these segments and identify emerging trends. This data-driven approach allows for a more focused and efficient allocation of marketing resources, ensuring that efforts are directed towards the most receptive audiences.

Developing Targeted Marketing Strategies

Once market segments are defined, targeted marketing strategies can be implemented. This involves crafting customized messaging and materials that speak directly to the specific needs and desires of each segment. For instance, a marketing campaign aimed at first-time homebuyers might highlight affordability and low-maintenance properties, while a campaign targeting investors could emphasize potential returns and market trends. AI-powered tools can analyze vast amounts of data to identify the most effective communication channels for each segment, such as social media platforms or specific online real estate portals.

Utilizing AI to personalize the customer journey is critical in this process. Imagine an AI-driven platform that analyzes a prospective buyer's search history, preferred property types, and financial profile to recommend tailored listings and communicate relevant information. This level of personalization fosters a more engaging and effective interaction, ultimately increasing the likelihood of a successful transaction. These targeted strategies, enabled by AI, help real estate professionals connect with the right audience at the right time with the right message, optimizing their marketing ROI.

Leveraging AI for Enhanced Segmentation and Targeting

AI-powered tools play a pivotal role in modern real estate market segmentation and targeted marketing. These sophisticated systems can analyze vast datasets, including property listings, market trends, buyer demographics, and even social media activity, to identify patterns and insights that human analysts might miss. This ability to process and interpret complex information allows for more precise and comprehensive segmentation, enabling real estate professionals to understand not just who their target audience is, but also *why* they are making certain decisions.

Furthermore, AI algorithms can predict future market trends and adjust strategies accordingly. By continuously learning and adapting to evolving market dynamics, AI-powered systems can optimize marketing campaigns in real-time, ensuring that messaging remains relevant and impactful. The result is a more efficient and effective marketing approach that yields better results for both buyers and sellers, ultimately driving success in the competitive real estate market.

AI facilitates the creation of dynamic marketing campaigns. Imagine a system that automatically adjusts ad copy and imagery based on the specific segment a prospective buyer falls into. This hyper-personalization leads to a more engaging and effective experience, maximizing the likelihood of a successful transaction. The use of AI in real estate is transforming how we approach marketing, enabling a more data-driven and personalized approach to connect with potential clients.

AI's ability to identify micro-segments within broader groups allows for even more tailored messaging. For instance, within the first-time homebuyer segment, AI could pinpoint differences between those seeking affordability and those prioritizing specific location preferences. This granular level of understanding allows for even more effective targeting and increases the likelihood of closing deals. AI is revolutionizing the way real estate professionals operate.

The integration of AI into real estate market segmentation and targeted marketing strategies is not just a trend—it's the future. By harnessing the power of AI, real estate professionals can gain a deeper understanding of their target markets, optimize their marketing efforts, and ultimately drive more successful transactions.

Climate change is no longer a distant threat; its impacts are being felt globally, and these impacts are increasingly affecting property development projects. Understanding the specific risks associated with climate change, such as more frequent and intense extreme weather events, rising sea levels, and changing precipitation patterns, is crucial for developers to make informed decisions. This involves analyzing historical data, employing climate models, and consulting with climate scientists to project potential future scenarios.

Property Valuation and Risk Assessment

Understanding Property Valuation

Accurate property valuation is crucial for informed real estate decisions. AI-powered tools analyze vast datasets, including comparable sales, market trends, and property characteristics, to generate precise valuations. This automated process significantly reduces the time and effort required for traditional valuation methods, while increasing the accuracy and consistency of results. By leveraging historical data and current market conditions, AI can identify hidden patterns and nuances that might be missed by human analysts, leading to more reliable valuations.

Assessing Market Risk Factors

Real estate markets are dynamic and susceptible to various risks. AI can identify and quantify these risks by analyzing market trends, economic indicators, and regulatory changes. This proactive risk assessment allows investors to make informed decisions, mitigating potential losses and maximizing returns. By evaluating factors like interest rate fluctuations, employment rates, and local zoning regulations, AI algorithms can predict market shifts and adjust investment strategies accordingly.

Identifying Property-Specific Risks

Beyond broader market risks, individual properties hold unique vulnerabilities. AI can analyze property characteristics, such as structural integrity, location, and maintenance history, to identify potential issues. This detailed assessment allows investors to anticipate and address potential problems, minimizing costly repairs and maximizing property value. Further, AI can analyze comparable properties to identify unusual characteristics that might indicate hidden risks, or even opportunities, in a given market.

Predicting Future Value Appreciation

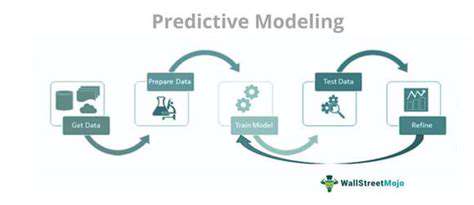

AI algorithms can predict future property value appreciation by considering a multitude of factors. These include location, local economic growth, demographic trends, and even social and environmental factors. This predictive capability empowers investors to target properties with high growth potential and optimize their investment strategies. By continuously learning and adapting to changing market conditions, AI can provide valuable insights into future market trends, enabling investors to make more strategic decisions.

Optimizing Investment Strategies

AI can analyze historical data and market trends to identify optimal investment strategies tailored to individual investor profiles. By considering risk tolerance, investment goals, and available capital, AI algorithms can recommend specific properties, investment timelines, and diversification strategies. This personalized approach allows investors to maximize returns while mitigating risks, aligning investment decisions with their specific financial objectives.

Streamlining the Valuation Process

Traditional property valuation processes can be time-consuming and resource-intensive. AI-powered systems automate many aspects of the process, from data collection to analysis and reporting. This automation significantly reduces the time required for valuations, leading to faster turnaround times and improved efficiency. Moreover, the standardized approach offered by AI minimizes human error, ensuring greater accuracy and consistency in the valuation process, leading to more reliable and trustworthy property valuations.

Read more about AI Powered Real Estate Analytics: Actionable Insights

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing