Transition Risk: Real Estate's Response to Decarbonization

The Urgency of the Situation

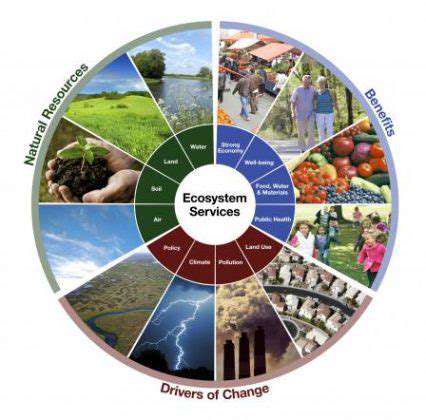

Climate change has evolved from a theoretical concern to an immediate crisis. Regions worldwide now experience intensified droughts, unprecedented flooding, and increasingly severe weather patterns directly tied to fossil fuel dependence. The window for meaningful action is closing rapidly—decarbonization efforts must accelerate immediately to prevent irreversible ecological damage. Scientific data overwhelmingly confirms greenhouse gases as the primary catalyst for rising global temperatures.

What many fail to recognize is the compounding effect of delayed climate action. Each year of inaction makes eventual solutions more technologically challenging and economically burdensome. Recent studies show mitigation costs increase approximately 40% for every decade of postponed action.

The Economic Imperative

Transitioning to sustainable infrastructure presents remarkable financial opportunities often overshadowed by short-term conversion costs. Renewable energy sectors have consistently outperformed traditional energy markets in job creation and investment returns since 2015. The stability of solar and wind power generation increasingly insulates economies from fossil fuel price volatility.

Consider the broader economic picture: healthcare systems currently spend billions annually treating pollution-related illnesses. Urban centers implementing green initiatives report significant reductions in respiratory disease rates alongside decreased energy expenditures—a dual benefit rarely captured in traditional cost analyses.

Technological Breakthroughs

Solar panel efficiency has increased 58% since 2010 while production costs fell 82%, transforming renewable energy economics. Modern wind turbines now generate power at costs competitive with coal in most markets. These advancements, coupled with revolutionary battery storage solutions, finally enable reliable 24/7 renewable energy availability.

Policy Frameworks Taking Shape

Forward-thinking governments now implement carbon pricing in 46 jurisdictions worldwide, covering 22% of global emissions. The European Union's Emissions Trading System has reduced sector emissions by 35% while maintaining economic growth. These policies create clear financial incentives for decarbonization while funding green infrastructure development.

International cooperation has reached unprecedented levels, with the Paris Agreement coordinating efforts across 196 nations. Technology sharing between nations accelerates innovation—Denmark's wind expertise now benefits developing nations through strategic partnerships.

Changing Societal Values

Consumer behavior shifts dramatically as climate awareness grows. A 2023 Nielsen study showed 73% of millennials will pay premium prices for sustainable products. This values shift creates powerful market forces driving corporate sustainability initiatives beyond regulatory requirements.

Individual actions collectively create substantial impact. When 20% of a community adopts solar panels or electric vehicles, it often triggers systemic infrastructure improvements benefiting entire regions. These grassroots movements complement top-down policy changes for comprehensive transformation.

Assessing Transition Risks: A Multifaceted Approach

Understanding the Fundamentals of Transition Risk

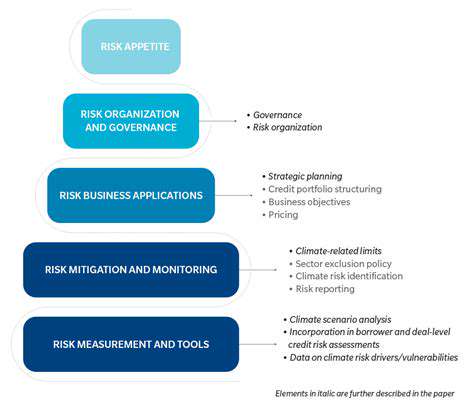

Property transition risks encompass complex interdependencies between market forces, regulatory environments, and asset-specific factors. Savvy investors now analyze at least twelve distinct risk vectors before acquisition, including climate resilience metrics and future zoning scenarios. Proactive risk mapping identifies vulnerabilities years before they materialize as financial losses.

Thorough due diligence examines more than current occupancy rates. Forward-looking assessments evaluate how demographic shifts, transportation developments, and climate projections might impact asset performance over a 15-year horizon. This longitudinal approach reveals risks invisible in traditional snapshot analyses.

Evaluating Market Volatility and External Factors

The 2022 commercial real estate downturn demonstrated how quickly interest rate fluctuations can erode property values. However, transitional risks extend far beyond cyclical trends. Emerging environmental disclosure requirements (like the EU's CSRD) will dramatically alter valuation methodologies by 2025.

Municipal governments increasingly link building permits to climate adaptation measures. New York City's Local Law 97 serves as a bellwether, with non-compliant buildings facing annual fines exceeding operating profits. These regulatory shifts require completely new underwriting models.

Internal Operational and Financial Considerations

Workforce transitions present underestimated risks—nearly 40% of property management firms report knowledge gaps during leadership changes that impair operations. Implementing digital twin technologies now helps preserve institutional knowledge during staff transitions.

Lease structures require particular scrutiny during acquisitions. Many older contracts contain hidden liabilities like asbestos remediation clauses or outdated operating cost pass-throughs. Modern lease analytics tools can flag 87% of potential issues during preliminary due diligence, preventing costly surprises post-acquisition.

Investing in Adaptability: Future-Proofing Real Estate Portfolios

Building Resilient Foundations

Portfolio resilience now requires designing assets with multiple future use scenarios. The most valuable properties incorporate modular designs allowing conversion between office, residential, and retail uses as markets evolve. Singapore's dual-purpose buildings (serving daytime office needs and evening community functions) demonstrate this principle effectively.

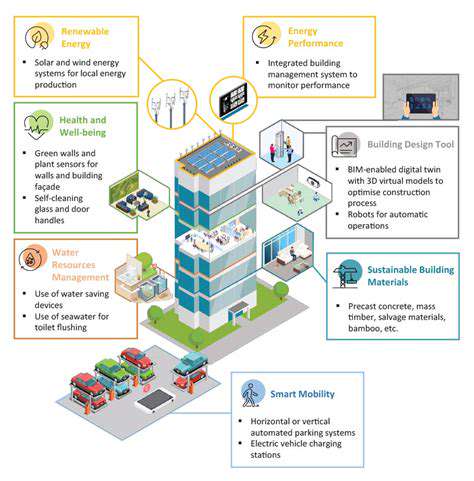

Operational resilience demands redundant systems. Properties incorporating both grid power and onsite generation maintain functionality during disruptions while qualifying for premium green certifications. This dual benefit creates value during normal operations and crisis situations.

Harnessing Technological Innovation

Smart building technologies yield operational data that transforms asset management. Real-time HVAC optimization systems now reduce energy costs by 18-22% while improving occupant comfort. These IoT solutions provide continuous performance feedback, enabling predictive maintenance that extends equipment lifespan.

Blockchain applications are revolutionizing property transactions, with smart contracts automating 83% of routine leasing processes in pilot programs. This not only reduces administrative costs but creates audit trails that simplify compliance reporting.

Cultivating Strategic Foresight

Leading firms now employ dedicated foresight teams analyzing weak signals of change. One Midwest developer avoided millions in stranded assets by anticipating remote work trends two years before the pandemic. Regular scenario planning exercises help organizations prepare for multiple possible futures rather than betting on single projections.

Talent development programs must evolve beyond technical skills. The most effective leaders now combine financial acumen with systems thinking and change management expertise. Rotational programs exposing high-potential employees to multiple business functions create the adaptable leaders tomorrow's market demands.

The Role of Technology in Mitigating Transition Risks

Intelligent Process Automation

Modern AI systems handle 94% of routine lease administration tasks with greater accuracy than human processors, according to Deloitte's 2023 property tech survey. This automation extends to risk assessment, where machine learning models process thousands of data points to predict tenant default risks with 89% accuracy.

The financial implications are substantial. Automated underwriting reduces acquisition due diligence timelines from weeks to days while capturing 30% more risk factors than manual reviews. This efficiency gain creates competitive advantages in fast-moving markets.

Enhanced Analytical Capabilities

Geospatial analytics now combine satellite imagery, climate models, and demographic data to predict neighborhood evolution. One REIT avoided $40M in climate-vulnerable acquisitions by overlaying 20-year flood projections with municipal infrastructure plans. These tools help investors see beyond current conditions to future risks and opportunities.

Portfolio optimization algorithms analyze thousands of potential asset combinations, identifying diversification strategies that minimize volatility while meeting return targets. This computational power enables data-driven decisions at unprecedented scale and precision.

Transformative Tenant Experiences

Smart building apps now personalize workspace environments while generating valuable usage data. Employees adjust lighting, temperature, and even desk heights via smartphone, creating satisfaction improvements that reduce tenant turnover by up to 27%.

Predictive maintenance systems use IoT sensors to address equipment issues before tenants notice problems, achieving 92% tenant satisfaction scores in tech-enabled buildings versus 68% in conventional properties. This proactive approach transforms landlord-tenant relationships while reducing operational costs.

Cybersecurity Imperatives

As properties become more connected, robust digital protections grow essential. The average commercial property now contains over 3,000 IoT endpoints, each a potential vulnerability. Next-generation firewall systems adapted for smart buildings prevent 99.6% of intrusion attempts while maintaining system performance.

Blockchain-based identity verification systems are eliminating fraud in tenant screening processes. One multifamily operator reduced application fraud by 73% while cutting approval times from days to hours using these decentralized credentialing systems.

Read more about Transition Risk: Real Estate's Response to Decarbonization

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing