AI Driven Valuation: The Competitive Edge in a Rapidly Evolving Real Estate Market

The rise of algorithmic appraisal signifies a paradigm shift in the way we value assets. Leveraging sophisticated algorithms and vast datasets, these systems are transforming traditional appraisal methods, enabling faster, more comprehensive, and often more objective valuations. This shift is particularly impactful in industries where traditional methods struggled to keep pace with market fluctuations and complex variables, like real estate and art.

These algorithms can process an unprecedented amount of data, from market trends to individual property characteristics, to arrive at a valuation that takes into account a broader range of factors. This data-driven approach often leads to more accurate and timely appraisals, benefiting both buyers and sellers.

The Data-Driven Approach to Valuation

At the core of algorithmic appraisal lies a data-driven approach. These systems analyze massive datasets, including historical sales data, comparable property information, location specifics, and even market sentiment indicators. The algorithms learn from these data points, identifying patterns and correlations that traditional methods might miss.

This data-rich environment allows for a more nuanced understanding of market dynamics and individual property value, leading to valuations that better reflect the complexities of the current market.

The Impact on Real Estate Valuation

Real estate, a sector traditionally reliant on human appraisal, is experiencing a significant transformation due to algorithmic valuation. Algorithms can analyze property characteristics, neighborhood trends, and market conditions to generate a more precise and timely valuation. This allows real estate agents and buyers to make informed decisions more quickly and efficiently.

The use of algorithms can also reduce the subjectivity inherent in traditional appraisal methods, leading to fairer and more consistent valuations.

The Role of AI in Enhancing Accuracy

Artificial intelligence (AI) plays a pivotal role in the development and refinement of these algorithmic appraisal systems. AI algorithms can identify subtle patterns and correlations within vast datasets, enabling them to produce more accurate and comprehensive valuations. This enhanced accuracy is crucial in ensuring fair and equitable valuations, especially in complex markets.

The integration of AI enhances the speed and efficiency of the appraisal process, freeing up valuable time for professionals to focus on other critical tasks.

Challenges and Considerations in Algorithmic Appraisal

While algorithmic appraisal offers numerous advantages, it's crucial to acknowledge the potential challenges. Data bias, algorithmic transparency, and the need for regulatory oversight are critical considerations. Ensuring fairness and accuracy in the face of potential biases within the data is paramount.

Furthermore, the lack of transparency in some algorithms can raise concerns about accountability and the potential for manipulation. Addressing these challenges will be essential for the widespread adoption and acceptance of algorithmic appraisal.

Ethical Implications and Future Trends

The ethical implications of algorithmic appraisal warrant careful consideration. Issues of bias, transparency, and accountability need to be addressed as this technology evolves. The development of robust ethical frameworks and regulatory guidelines is vital to ensure responsible and equitable use of these systems.

Future trends suggest a continued integration of AI and machine learning into appraisal processes. Expect to see more sophisticated algorithms, greater data accessibility, and increased automation in the near future, transforming the valuation landscape.

The Future of Valuation in a Data-Driven Economy

The future of valuation is inextricably linked to the continued evolution of algorithmic appraisal. As data becomes more readily available and more sophisticated algorithms emerge, we can anticipate even more accurate, efficient, and transparent valuation methods. This shift will undoubtedly redefine how we assess and understand the value of assets in a data-driven economy.

The adoption of these technologies will not only revolutionize the appraisal process but also unlock new opportunities for investment, lending, and asset management in the years to come.

Leveraging Data for Enhanced Accuracy and Speed

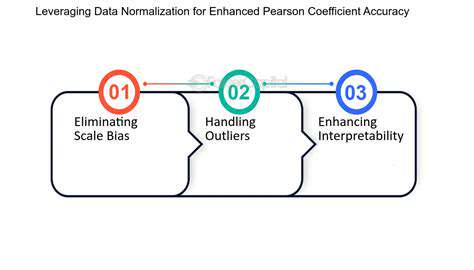

Data-Driven Insights for Improved Accuracy

Data analysis plays a crucial role in achieving enhanced accuracy in various fields. By systematically collecting, processing, and interpreting data, businesses and organizations can gain valuable insights that lead to better decision-making. This process allows for a more objective and informed approach to problem-solving, ultimately reducing errors and improving the overall quality of outcomes. For instance, in manufacturing, data analysis can pinpoint bottlenecks and inefficiencies, leading to optimized production processes and higher quality products.

Data-driven insights enable a more nuanced understanding of complex phenomena. Analysis of historical data can reveal patterns and trends that might otherwise remain hidden. These patterns can then be used to develop predictive models, allowing for proactive measures to be taken and mitigating potential risks. This approach is vital in areas such as finance and healthcare, where timely and accurate predictions can have a significant impact.

Accuracy Enhancement through Predictive Modeling

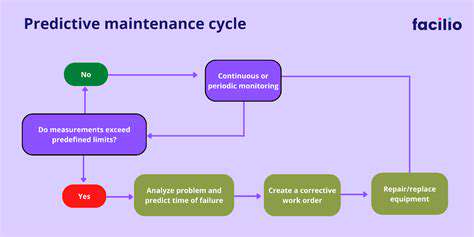

Predictive modeling is a powerful technique that leverages historical data to forecast future outcomes. By identifying patterns and relationships within the data, predictive models can provide valuable insights into potential future events. This capability is particularly useful in scenarios where accurate predictions can lead to significant improvements in operational efficiency and resource allocation. This is especially true in areas like supply chain management where accurate predictions minimize delays and optimize resource utilization.

Building accurate predictive models requires careful consideration of the data used. The quality and relevance of the data directly impact the accuracy of the model's predictions. Thorough data cleaning, feature engineering, and model validation are essential steps in the process to ensure reliability and minimize potential biases. This ensures that the models developed are robust and provide reliable insights.

Optimizing Processes for Enhanced Accuracy

Process optimization is a crucial element in improving accuracy. By identifying and eliminating inefficiencies in existing processes, organizations can significantly reduce errors and improve overall performance. Analyzing data related to process steps can reveal bottlenecks and areas where improvements can be made, leading to a more streamlined and effective workflow. Implementing process improvements, in turn, leads to increased accuracy in outcomes.

Implementing automation tools based on data analysis can further enhance accuracy and efficiency. Automating repetitive tasks reduces the risk of human error and allows for consistent execution, ensuring accuracy and speed. Automation also frees up human resources to focus on more complex and strategic tasks. This approach is particularly valuable in industries like finance and manufacturing, where speed and precision are paramount.

The Role of Technology in Achieving Enhanced Accuracy

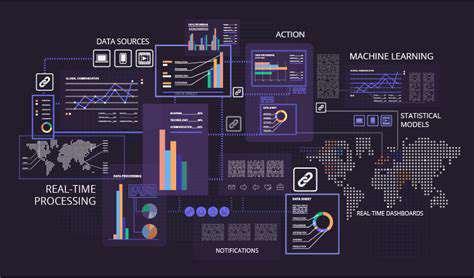

Advanced technologies play a crucial role in enhancing accuracy by providing tools and platforms to manage and analyze data effectively. Data visualization tools, for example, enable users to identify trends and patterns in large datasets, accelerating the process of gaining insights. Furthermore, cloud-based platforms provide scalable storage and processing capabilities, enabling organizations to handle massive datasets and perform complex analyses. These technologies are essential for organizations seeking to leverage the power of data for enhanced accuracy.

The integration of artificial intelligence (AI) and machine learning (ML) algorithms is transforming data analysis capabilities. AI-powered systems can identify intricate patterns and relationships in vast datasets, enabling more accurate predictions and decision-making. The integration of these technologies in business operations is leading to significant improvements in accuracy across various sectors. Machine learning algorithms, in particular, can uncover hidden insights in complex data sets, leading to more precise and reliable outcomes.

Beyond Traditional Metrics: Predictive Analytics in Action

Beyond the Balance Sheet: Unveiling Hidden Opportunities

Traditional financial metrics, while valuable, often fail to capture the full potential of a company. Predictive analytics, leveraging vast datasets and sophisticated algorithms, can unearth hidden opportunities and risks. This approach goes beyond simply analyzing historical performance, allowing businesses to anticipate future trends and make more informed decisions. By incorporating factors like market sentiment, technological advancements, and competitive landscapes, predictive models can provide a more comprehensive view of a company's true value proposition and its potential for growth.

For instance, predictive models can identify emerging markets with high growth potential, enabling companies to strategically allocate resources for expansion. Furthermore, by analyzing customer behavior and market trends, organizations can anticipate shifts in demand, allowing them to adjust their product offerings and pricing strategies proactively. This proactive approach, rooted in data-driven insights, is critical for navigating an increasingly volatile economic landscape.

From Data to Decisions: The Power of AI in Valuation

Predictive analytics, powered by AI, plays a pivotal role in modern valuation models. Sophisticated algorithms can analyze a multitude of data points, including financial statements, industry trends, and even social media sentiment, to develop more accurate and nuanced valuations. This allows investors to make more informed investment decisions by understanding the hidden potential and risks associated with a particular company.

By integrating AI-driven insights into the valuation process, investors can gain a deeper understanding of a company's future prospects. This translates into more accurate assessments of intrinsic value, ultimately leading to better investment returns and risk mitigation strategies.

Tailoring Strategies for Success: Personalized Insights for Investors

Predictive analytics enables a more personalized approach to investment strategies. By analyzing individual investor profiles, risk tolerance, and investment goals, AI-powered tools can suggest tailored investment portfolios and strategies. This personalized approach allows investors to optimize their returns and align their investments with their unique financial objectives.

Enhancing Due Diligence: Identifying Risks and Opportunities

Beyond investment decisions, predictive analytics significantly enhances due diligence procedures. By analyzing historical performance, market trends, and regulatory changes, companies can identify potential risks and opportunities well in advance. This proactive approach allows businesses to make informed decisions about acquisitions, partnerships, and strategic initiatives.

This proactive risk assessment, facilitated by predictive analytics, ultimately helps safeguard investments and ensure long-term sustainability. By anticipating potential challenges and capitalizing on emerging opportunities, businesses can build resilience and adapt to market fluctuations more effectively.

The Future of Real Estate Valuation: Adaptability and Integration

Real-time Valuation Models

The evolution of real-time data streams and advanced algorithms is revolutionizing real estate valuation. Real-time valuation models, powered by machine learning and AI, are poised to provide more accurate and up-to-date assessments of property values. These models can analyze vast amounts of data, including market trends, comparable sales, economic indicators, and even social media sentiment, to produce instantaneous valuations. This dynamic approach promises to be invaluable for investors and real estate professionals navigating rapidly changing markets.

Traditional methods often lag behind market fluctuations. Real-time models, however, can provide near-instantaneous insights, allowing for quicker decision-making and more informed investment strategies. This immediacy is crucial in today's volatile real estate environment, where market shifts can occur in a matter of hours.

The Role of Artificial Intelligence

AI is rapidly transforming various sectors, and real estate valuation is no exception. AI-powered algorithms can identify complex patterns and relationships within vast datasets that humans might miss. This ability to analyze intricate data points leads to more precise valuations, potentially reducing the risk of significant over or underestimation. AI's capacity for continuous learning and adaptation further enhances its efficacy over time, making it an invaluable tool for future valuation practices.

By automating the process, AI also reduces the potential for human error and bias, resulting in more objective and reliable appraisals. This is especially important in diverse markets where biases can significantly skew valuations.

Integration of Big Data

The sheer volume of data available today, encompassing everything from public records to social media trends, creates a wealth of information for real estate valuation. Integrating big data into valuation models offers a more comprehensive understanding of market dynamics and regional trends. This broader perspective allows for a more nuanced and accurate assessment of property value, considering factors beyond traditional metrics.

Impact of Blockchain Technology

Blockchain technology, known for its transparency and immutability, has the potential to revolutionize how real estate transactions are recorded and verified. The secure and transparent nature of blockchain facilitates a more trustworthy and efficient valuation process. By recording all relevant data on a shared, immutable ledger, blockchain streamlines the validation process and reduces the risk of fraud.

Improving Accessibility and Affordability

The future of real estate valuation aims to make the process more accessible and affordable for a broader range of stakeholders. By leveraging technology, valuations can be performed more efficiently and at a lower cost, potentially benefiting both buyers and sellers. This is particularly important in underserved communities where access to traditional valuation services might be limited.

Technology-driven valuation tools will empower individuals with limited resources to make informed decisions in the real estate market. This increased accessibility is crucial for fostering a more equitable and inclusive real estate environment.

The Future of Valuation Professionals

While technology is transforming the field, the role of human valuation professionals will evolve, not disappear. Experts will continue to play a critical role in interpreting the data generated by AI and machine learning models. Their expertise in market analysis, local knowledge, and client communication will remain essential to the process. The future of valuation professionals is one of adaptation, embracing technology while maintaining the human touch.