Coastal Property Insurance in a Changing Climate

The Rising Threat of Coastal Flooding and Storm Surge

Understanding Coastal Flooding

Coastal flooding, a significant concern for coastal property owners, encompasses a range of phenomena driven primarily by rising sea levels and intense storm events. This includes not only high tides but also storm surges, which can dramatically elevate water levels above normal, inundating coastal areas and causing substantial damage. Understanding these dynamics is crucial for assessing risks and developing appropriate mitigation strategies.

The increasing frequency and intensity of storms, exacerbated by climate change, are making coastal flooding a more pressing issue, threatening homes, businesses, and infrastructure. This necessitates a proactive approach to insurance and property management for coastal communities.

The Impact of Sea Level Rise

Sea level rise, driven by the melting of glaciers and thermal expansion of water, is a primary contributor to the growing threat of coastal flooding. This gradual but persistent increase in sea levels makes even relatively low-intensity storms more damaging. The consequences are far-reaching, affecting not only coastal properties but also the stability of entire coastal ecosystems.

The cumulative effect of rising sea levels over time results in a higher base flood elevation, increasing the vulnerability of coastal areas and demanding a comprehensive understanding of risk assessment for insurance purposes.

Storm Surge and its Devastating Effects

Storm surges are temporary but intense increases in sea level caused by low-pressure weather systems, particularly hurricanes and cyclones. These surges can push water far inland, flooding previously unaffected areas and causing significant damage to coastal properties and infrastructure. The destructive power of storm surges often exceeds the damage caused by the storm itself.

Homes, businesses, and critical infrastructure in coastal regions are particularly vulnerable to the devastating impact of storm surges. The sheer volume of water and the speed at which it moves can lead to widespread destruction, posing a significant challenge to insurance providers and recovery efforts.

The Role of Coastal Property Insurance

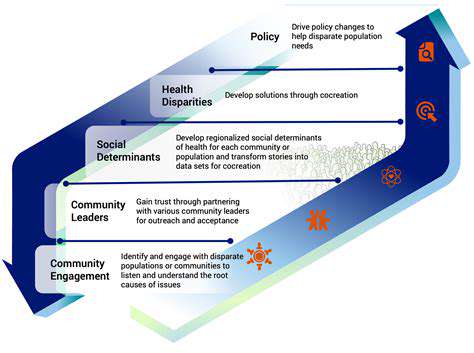

Coastal property insurance plays a vital role in protecting homeowners and businesses from the financial burdens associated with coastal flooding and storm surges. Insurance policies can help cover the costs of repairs, rebuilding, and even relocation in cases of severe damage. However, the increasing risk of coastal flooding necessitates adapting insurance models to reflect the evolving threat.

Recognizing the specific needs of coastal property owners, insurance providers are continuously evaluating and adjusting policies to better manage the risks associated with these events. This involves incorporating updated flood risk assessments and implementing measures to mitigate the impact of rising sea levels and storm surges.

Mitigation Strategies and Adaptation

Implementing effective mitigation strategies is crucial for reducing the impact of coastal flooding on property and infrastructure. These strategies can range from elevating buildings and structures above flood levels to implementing robust drainage systems and coastal protection measures. Investing in flood-resistant design standards for new construction is also critical for long-term resilience.

The Importance of Early Warning Systems

Early warning systems play a vital role in minimizing the loss of life and property during coastal flooding and storm surge events. These systems allow for timely evacuation of vulnerable areas and the implementation of emergency measures. Investment in sophisticated weather forecasting and monitoring technologies is essential to enhance the effectiveness of these systems.

Accurate and timely warnings are critical to minimizing the impact of coastal flooding and storm surges, allowing for preemptive actions that can save lives and protect property. Improved communication and public awareness campaigns are vital for effective implementation of these systems.

Financial Implications for Coastal Communities

The financial implications of coastal flooding and storm surge events extend far beyond individual property owners. Communities face significant costs associated with damage to infrastructure, emergency response, and long-term recovery efforts. Insurance premiums are often affected by these risks, and there may be a need for government funding to support vulnerable communities in the event of severe damage.

The economic impact of coastal flooding and storm surge events necessitates a comprehensive approach that considers the needs of both individual property owners and the broader community. This includes evaluating the cost of insurance, the need for public assistance, and the long-term planning to mitigate future risks.

Adapting Insurance Strategies for a Changing Coastline

Understanding Coastal Erosion and its Impact on Insurance

Coastal erosion is a significant factor influencing the risk assessment for property insurance. Understanding the specific rate of erosion in a given area is crucial for insurers to accurately gauge the long-term viability and potential for damage to coastal properties. This necessitates detailed historical data analysis, including aerial photography, topographic surveys, and even local historical records to identify trends and predict future erosion patterns. The unpredictability of extreme weather events, like hurricanes and storm surges, further complicates the picture, requiring insurers to factor in the potential for catastrophic damage alongside gradual erosion.

Coastal erosion isn't simply a matter of land disappearing; it also impacts the structural integrity of properties. As the shoreline retreats, the foundation of homes and other structures may become increasingly vulnerable to undermining, leading to costly repairs or even complete loss. This necessitates proactive measures from both homeowners and insurance companies to understand and mitigate these risks.

Assessing Flood Risk and Insurance Coverage

Rising sea levels and increased frequency of extreme weather events pose a significant flood risk to coastal areas. Insurers must accurately assess the flood risk associated with specific properties, taking into account factors like elevation, proximity to water bodies, and historical flood data. This assessment is critical to determining appropriate insurance coverage levels and premiums to adequately protect against potential flood damage.

Accurate flood risk assessments are essential for both homeowners and insurers. Homeowners can use this information to make informed decisions about property improvements, such as elevating structures or implementing flood mitigation measures. Insurers benefit from a clear understanding of the flood risk to adjust premiums and provide tailored coverage to better reflect the individual risk profile of each property.

Evaluating Property Resilience and Mitigation Strategies

Evaluating the resilience of coastal properties to natural disasters is a key component of modern insurance strategies. This evaluation considers factors such as the structural integrity of buildings, the effectiveness of existing flood defenses, and the potential for future damage due to erosion and storm surge. Insurers must consider how well properties are prepared to withstand these events, and incentivize homeowners to implement appropriate mitigation strategies.

A crucial aspect of resilience evaluation is assessing the effectiveness of mitigation strategies. This includes evaluating the effectiveness of seawalls, levees, and other flood control measures, and determining if they are sufficient to protect the property from anticipated risks. Homeowners who have implemented robust mitigation strategies may qualify for lower premiums, reflecting the reduced risk they pose to insurers.

The Role of Climate Change in Coastal Insurance

Climate change is significantly altering coastal landscapes, making long-term insurance planning increasingly complex. The enhanced frequency and intensity of extreme weather events, coupled with rising sea levels, necessitate a more proactive approach to risk assessment and coverage. Insurers must consider the potential long-term impacts of climate change on coastal properties when calculating premiums and setting coverage limits.

Adapting Insurance Products and Policies

Insurance companies are adapting their products and policies to address the evolving challenges posed by coastal erosion and rising sea levels. This includes the introduction of new coverage options, such as flood insurance, and the development of innovative risk assessment models that take into account climate change projections. These changes aim to better protect coastal communities and provide adequate coverage for potential damages.

One important aspect of adapting insurance products and policies is offering incentives for sustainable practices. This could include discounts on premiums for homeowners who implement eco-friendly building techniques or invest in resilient infrastructure. This incentivizes responsible development and reduces the overall risk for insurers.

The Future of Coastal Property Insurance

The future of coastal property insurance will undoubtedly be shaped by the ongoing impacts of climate change and rising sea levels. Insurers will need to invest in advanced risk modeling and forecasting techniques to accurately assess future risks. This will involve incorporating climate change projections into their assessments and adapting their products to reflect the increasing likelihood of extreme weather events and coastal erosion.

The future of coastal property insurance also involves collaboration between insurers, homeowners, and government agencies. Open communication and shared resources will be necessary to develop comprehensive strategies for mitigating coastal risks and promoting the long-term sustainability of coastal communities. This will ensure that insurance remains a viable option for protecting coastal property investments.

Rethinking Coastal Development Strategies

The challenges of coastal erosion and climate change demand a re-evaluation of coastal development strategies. This includes promoting sustainable practices, such as building with climate-resilient materials, and incentivizing the relocation of vulnerable properties to safer locations. Ultimately, a holistic approach that considers the long-term impacts of climate change is crucial for ensuring the long-term viability of coastal communities and the effectiveness of property insurance.

The Impact of Climate Change on Insurance Availability

The Rising Temperatures

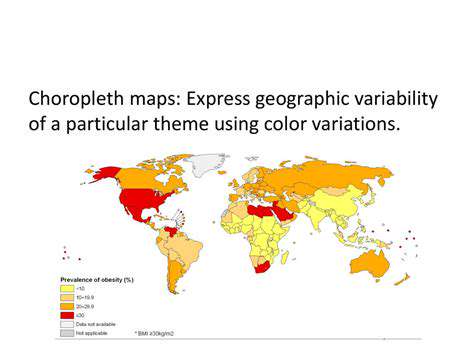

Global temperatures are increasing at an alarming rate, primarily due to the buildup of greenhouse gases in the atmosphere. This warming trend is not uniform across the globe, but the overall impact is profound, affecting weather patterns, ecosystems, and human societies. The consequences of this rising heat are far-reaching and include more frequent and intense heatwaves, which pose significant risks to human health, particularly for vulnerable populations. Furthermore, this escalating temperature rise contributes to the melting of glaciers and ice sheets, leading to rising sea levels.

Shifting Precipitation Patterns

Climate change is altering precipitation patterns worldwide, leading to more intense and erratic rainfall events. This disruption in the water cycle has significant implications for agriculture, water resources, and infrastructure. Some regions are experiencing prolonged droughts, while others face devastating floods, highlighting the uneven distribution of this impact and the challenges it presents for communities worldwide. The unpredictable nature of these changes makes adaptation and resilience building crucial.

Sea Level Rise

The melting of glaciers and ice sheets, coupled with the thermal expansion of water, is causing a relentless rise in sea levels. This poses a significant threat to coastal communities and ecosystems, potentially displacing millions of people and flooding low-lying areas. The long-term effects of sea level rise are severe and require urgent action to mitigate the damage and develop effective adaptation strategies. Coastal infrastructure, including roads, ports, and buildings, will likely be severely affected.

Extreme Weather Events

Climate change is intensifying extreme weather events, including hurricanes, cyclones, floods, and droughts. These events cause widespread destruction, displacement, and economic losses. The frequency and intensity of these events are increasing, putting pressure on disaster response systems and demanding greater investment in preparedness and resilience. The infrastructure needed to withstand these events must be strengthened to reduce vulnerability.

Impacts on Ecosystems

Climate change is disrupting ecosystems worldwide, impacting biodiversity and the delicate balance of nature. Changes in temperature and precipitation patterns are altering the distribution and behavior of plant and animal species, leading to shifts in ecosystems and potentially threatening entire species with extinction. The loss of biodiversity is a profound and irreversible consequence of climate change, which further impacts the crucial services ecosystems provide to humans. Maintaining healthy ecosystems is critical for the future.

Economic Consequences

The economic consequences of climate change are substantial and multifaceted. Damage to infrastructure, disruptions to agriculture, and losses in tourism and other sectors can lead to significant economic hardship. The costs associated with adapting to climate change and mitigating its effects are substantial, requiring significant investments in renewable energy, sustainable practices, and disaster preparedness. These investments will need to be made globally to effectively combat climate change.

Human Health Impacts

Climate change is directly impacting human health through various pathways. Rising temperatures contribute to heat-related illnesses and deaths, while changes in precipitation patterns can exacerbate waterborne diseases. The spread of infectious diseases and the increased risk of malnutrition are also significant concerns linked to climate change. Protecting human health in the face of climate change requires comprehensive strategies that address the underlying causes of the problem and implement appropriate public health measures.

Securing Long-Term Financial Protection for Coastal Properties

Long-Term Financial Security Strategies

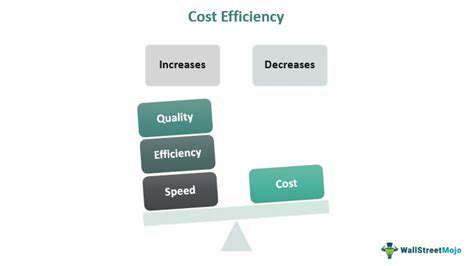

Achieving long-term financial security requires a multifaceted approach that considers various aspects of your financial life. This involves more than just saving; it encompasses careful budgeting, smart investment choices, and a proactive approach to managing debt. Understanding your financial goals and creating a roadmap to achieve them is crucial for long-term financial well-being. This plan should be adaptable to unexpected life changes, ensuring your financial stability remains intact.

A solid foundation for long-term financial security begins with a comprehensive budget. Regularly reviewing and adjusting your budget ensures that your spending aligns with your income and financial goals. This process helps identify areas where you can cut back and allocate resources more effectively towards savings and investments.

Diversifying Investment Portfolios

Diversifying your investment portfolio is essential for mitigating risk and maximizing potential returns over the long term. Investing in a range of assets, such as stocks, bonds, and real estate, helps spread the risk associated with any single investment. This strategy can help to ensure that your portfolio can withstand market fluctuations without significant losses.

Diversification is a critical aspect of long-term financial security. It allows you to capture growth opportunities across different asset classes, while also protecting your capital from potential declines in a particular market segment. Understanding the risks and potential rewards of different investment options is crucial for creating a diversified portfolio.

Exploring various investment vehicles such as mutual funds, exchange-traded funds (ETFs), and individual stocks can help diversify your portfolio. It's important to consult with a financial advisor to understand the appropriate level of diversification for your specific needs and risk tolerance.

Debt Management and Reduction

Managing and reducing debt is a critical component of achieving long-term financial security. High-interest debt, such as credit card debt, can quickly erode your financial resources and make it challenging to build savings or achieve other financial goals. A proactive approach to debt management is crucial for freeing up your resources and putting you on a path to financial freedom.

Creating a debt reduction plan is vital for long-term financial well-being. This plan should prioritize high-interest debts and establish a realistic repayment schedule. Consistent and disciplined payments towards debt reduction will significantly improve your financial standing over time.

Implementing strategies like the debt snowball or debt avalanche method can help you tackle your debts effectively. Understanding the difference between these methods and choosing the one that best suits your financial situation can be instrumental in your debt reduction journey.

Retirement Planning and Savings

Planning for retirement is an integral part of achieving long-term financial security. Retirement planning involves estimating your future expenses, assessing your current savings, and developing a strategy to bridge the gap between your current income and your desired retirement lifestyle. Establishing a retirement plan early in your life gives you more time to build a substantial nest egg. This is essential for maintaining your desired standard of living during your retirement years.

Saving for retirement is a long-term commitment, and starting early is highly recommended. Even small contributions made consistently can accumulate to a substantial amount over time. The power of compound interest can significantly amplify your savings over the long term.

Understanding your retirement needs and potential expenses is crucial for creating a realistic retirement plan. This includes considering factors such as healthcare costs, potential inflation, and potential changes in your lifestyle.

Regularly reviewing and adjusting your retirement plan, especially as your circumstances and financial goals evolve, is crucial for maintaining financial stability.

Read more about Coastal Property Insurance in a Changing Climate

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing