Real Estate's Role in Climate Change Mitigation

Energy efficiency retrofits are crucial for reducing energy consumption and lowering utility bills. By implementing these improvements, businesses and homeowners can significantly decrease their environmental footprint and contribute to a more sustainable future. These upgrades often lead to long-term cost savings, making them a wise investment for the future.

Retrofitting existing buildings or infrastructure can be a game-changer in reducing carbon emissions. Careful planning and execution of these projects are essential to maximize the return on investment. Choosing the right energy efficiency retrofits can lead to considerable savings in the long run.

Types of Energy Efficiency Retrofits

A variety of energy efficiency retrofits are available, ranging from simple measures to more complex installations. These include upgrading insulation, installing energy-efficient windows and doors, implementing smart thermostats, and improving lighting systems. Each type of retrofit has different potential benefits and costs.

Implementing advanced technologies, such as solar panels and geothermal systems, can significantly reduce energy dependence on external sources. This is particularly relevant for businesses and organizations seeking to enhance their operational sustainability.

Cost Analysis and Return on Investment (ROI)

A crucial aspect of any energy efficiency retrofit project is a thorough cost analysis. This involves evaluating the initial investment cost, potential energy savings, and the projected return on investment (ROI). Careful consideration of these factors is vital for determining the financial viability of the project.

Evaluating the long-term cost savings and quantifying the environmental benefits are key to justifying the investment. Understanding the ROI is critical for making informed decisions.

Financing Options for Retrofits

Financing options for energy efficiency retrofits can vary depending on the project's scope and the investor's financial situation. Government incentives, grants, and loans are often available to support such initiatives. Exploring these options can significantly reduce the upfront costs associated with the project.

Many financial institutions offer specialized loans for energy efficiency upgrades, making the investment more accessible. Understanding the different financing options is essential for securing the best possible terms and conditions.

Environmental Benefits and Sustainability

Energy efficiency retrofits contribute significantly to environmental sustainability. By reducing energy consumption, these projects lessen the demand for fossil fuels, decreasing greenhouse gas emissions and improving air quality. This is a key factor for environmentally conscious organizations and individuals.

These projects help lessen the strain on the environment by reducing carbon footprints and promoting sustainable practices. Sustainable practices and reduced reliance on fossil fuels are crucial for a healthier planet.

Maintenance and Ongoing Support

To ensure the long-term effectiveness of energy efficiency retrofits, ongoing maintenance and support are crucial. Regular inspections and servicing of the upgraded systems are essential to prevent malfunctions and optimize performance. This is important for ensuring the longevity of the improvements.

Proper maintenance ensures that the energy efficiency measures continue to operate at peak performance. This is crucial for maximizing the long-term cost savings and environmental benefits of the investment.

The Role of Real Estate in Urban Planning and Development

The Impact of Real Estate Development on Urban Growth

Real estate development plays a crucial role in shaping the urban landscape, influencing everything from population density to economic activity. New construction projects, particularly residential developments, can significantly increase the population of a city or region, leading to a surge in demand for local services and infrastructure. This increased demand can stimulate economic growth by creating jobs in related sectors like construction, transportation, and retail. Furthermore, the type of real estate developed, whether high-rise apartments or single-family homes, can influence the social and cultural composition of a neighborhood, impacting the overall vibrancy and character of the city.

Conversely, poorly planned or executed real estate projects can have detrimental effects. Inadequate infrastructure, such as transportation systems, can strain existing resources, leading to traffic congestion and other issues that negatively impact the quality of life for residents. The presence of vacant or underutilized properties can also contribute to blight and create an undesirable environment for businesses and residents alike. Careful consideration of the long-term implications of real estate developments is essential for sustainable and equitable urban growth.

The Influence of Real Estate Investment on Urban Economies

Real estate investment is a significant driver of economic activity in urban areas. Investment in commercial real estate, such as office buildings and retail spaces, can attract businesses and create jobs, boosting the local economy. The construction and operation of these properties generate revenue for the city through taxes and fees, contributing to public services and infrastructure development. Real estate investment trusts (REITs) and other investment vehicles often play a vital role in funding these projects, further stimulating economic growth.

Real estate transactions, including sales and rentals, also contribute substantially to the financial health of cities. Property values, influenced by factors such as location, amenities, and economic conditions, directly impact the tax revenue generated by municipalities. Increased property values often indicate a robust and thriving economy, while declining values can signal economic challenges and potentially necessitate adjustments in city planning and development strategies.

The availability and cost of housing also significantly affect urban economies. Affordable housing options are essential for attracting and retaining skilled workers and employees, contributing to the overall economic strength of a city. Conversely, high housing costs can make a city less attractive to potential residents and businesses, potentially slowing down economic growth.

The Role of Real Estate in Shaping Urban Spaces

Real estate development profoundly shapes the physical and social fabric of urban spaces. The design and construction of buildings, from residential homes to skyscrapers, impact the aesthetic appeal and functionality of urban areas. Urban planning initiatives often prioritize the integration of green spaces, parks, and recreational areas within real estate developments, aiming to enhance the quality of life for residents and create more sustainable environments.

Furthermore, the diversity of real estate options, including mixed-use developments, influences the character and vibrancy of neighborhoods. These developments often combine residential, commercial, and recreational spaces, fostering a more dynamic and integrated urban environment. The choices made in real estate development can shape the social interactions within a city, influencing the types of communities that form and the overall experience of living in that urban space.

The Future of Real Estate and Climate Action

The Intertwined Fate of Real Estate and Climate Change

The real estate industry, a cornerstone of global economies, is inextricably linked to climate change. From the construction materials used to the energy consumption of buildings, every facet of real estate development, ownership, and operation has a carbon footprint. Understanding this connection is crucial to navigating the future and mitigating the impact of climate change on the industry and the planet as a whole. This connection is not just about environmental responsibility; it's about long-term financial stability and societal well-being.

Sustainable Construction Practices: A New Imperative

Adopting sustainable construction practices is no longer a luxury but a necessity. Utilizing eco-friendly materials, optimizing energy efficiency in building designs, and incorporating renewable energy sources into new and existing structures are vital steps towards reducing the industry's carbon footprint. These practices not only minimize environmental impact but also contribute to long-term cost savings for building owners and occupants. Furthermore, these practices can create attractive and healthy living spaces, attracting environmentally conscious consumers.

The Rise of Green Building Certifications and Regulations

Green building certifications, such as LEED, and increasingly stringent regulations are playing a significant role in driving the adoption of sustainable practices. These certifications provide a framework for evaluating and promoting environmentally responsible building design and construction, ensuring that the built environment aligns with sustainability goals. The growing demand for environmentally conscious properties is pushing the industry towards greater compliance with these standards. Governments are also increasingly implementing regulations to incentivize and mandate green building practices.

Energy Efficiency and Renewable Energy Integration

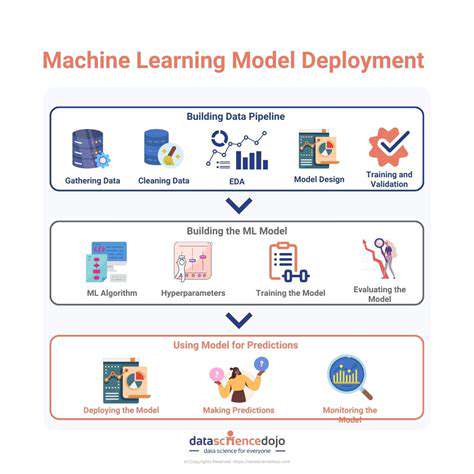

Optimizing energy efficiency in existing buildings and integrating renewable energy sources are crucial for reducing operational carbon emissions. Retrofitting existing structures with energy-efficient appliances, insulation, and smart technologies can significantly lower energy consumption. Similarly, incorporating solar panels, wind turbines, and other renewable energy sources into building designs can reduce reliance on fossil fuels. These initiatives are vital to shifting the real estate industry towards a more sustainable and resilient future.

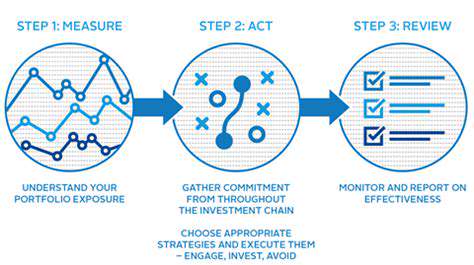

The Impact of Climate Change on Real Estate Investment

Climate change poses significant risks to real estate investments. Flooding, wildfires, and other extreme weather events can damage properties, disrupt operations, and reduce property values. Understanding and assessing these risks is essential for investors and property owners. Insurance costs are likely to increase, and the potential for significant financial losses is substantial. Therefore, responsible investment strategies must incorporate climate change considerations.

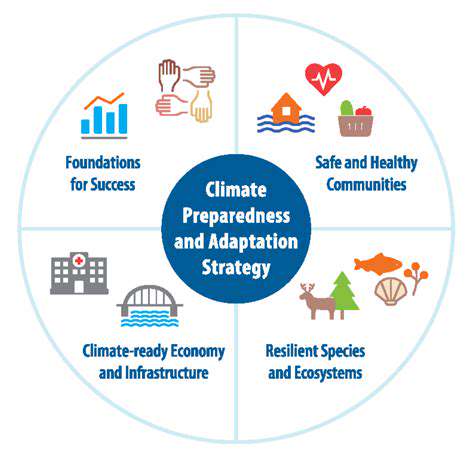

Adapting to a Changing Climate: Resilience and Mitigation

Real estate must adapt to the changing climate by prioritizing resilience and mitigation strategies. This includes incorporating climate-resistant design elements into new construction, such as elevated foundations and flood-resistant materials. This also includes developing strategies for mitigating the impacts of climate change on existing properties, such as investing in flood defenses and drought-resistant landscaping. These proactive measures will ensure the long-term viability and value of real estate assets in the face of climate change impacts.

The Role of Policy and Incentives in Driving Change

Government policies and financial incentives can play a critical role in encouraging the adoption of sustainable practices in the real estate sector. Incentivizing green building construction, providing tax breaks for energy-efficient upgrades, and enacting regulations to limit emissions from buildings are all necessary steps towards transitioning to a more sustainable real estate industry. Public awareness and education are also crucial in driving the widespread adoption of sustainable practices, and policies that encourage this are also necessary.