Sustainable Real Estate: Investing in Long Term Value and Sustainability

The Growing Demand for Green Buildings

Sustainable Design Principles in Green Buildings

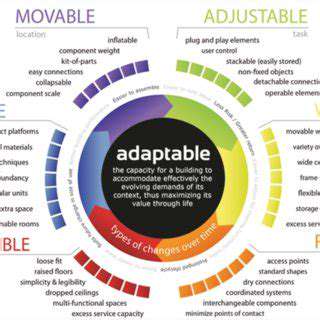

Green buildings are designed with sustainability in mind, incorporating environmentally friendly materials, energy-efficient systems, and responsible water management. These principles extend beyond just the construction phase, encompassing the entire lifecycle of the building, from the sourcing of materials to the end-of-life disposal. This holistic approach prioritizes resource conservation, minimizing waste, and reducing the building's overall environmental impact, which ultimately benefits both the environment and the occupants.

A core component of sustainable design is the use of renewable energy sources. Solar panels, wind turbines, and geothermal systems are increasingly integrated into green building projects, reducing reliance on fossil fuels and lowering operational costs in the long run. Moreover, green buildings often employ innovative strategies for natural ventilation and daylighting, minimizing the need for artificial lighting and heating, thereby further contributing to energy efficiency.

Economic Benefits and Investment Opportunities

Beyond their environmental advantages, green buildings also present compelling economic benefits. Energy efficiency translates directly into lower utility bills for occupants, potentially leading to significant savings over the lifespan of the building. The increasing demand for green spaces and sustainable practices also creates new investment opportunities in this sector, attracting investors seeking both social and financial returns.

The green building market is experiencing significant growth, driven by government incentives, evolving consumer preferences, and the growing awareness of the importance of environmental responsibility. This creates a promising landscape for investors seeking to capitalize on this trend. Furthermore, the long-term value proposition of green buildings is enhanced by their enhanced marketability and higher tenant retention rates, which are all attracting more investors to this sector. Sustainable real estate, including green buildings, is increasingly seen as a crucial aspect of long-term investment strategies.

The use of recycled and locally sourced materials, while adding to the environmental benefits, also fosters a more circular economy, reducing the reliance on resource-intensive, distant supply chains. This approach further enhances the economic resilience and sustainability of the entire project.

Green buildings are not just environmentally responsible; they also offer a return on investment through lower operational costs, higher tenant satisfaction, and increased marketability. This combination of environmental and economic advantages makes them an attractive option for both developers and investors seeking a sustainable future.

The growing demand for green buildings is a significant indicator of a shift towards a more sustainable future in real estate development. This trend is likely to continue, making green buildings a strategic investment for the long term.

Financial Advantages of Sustainable Real Estate

Reduced Operational Costs

Sustainable practices often lead to significant cost savings in the long run. Implementing energy-efficient technologies, like LED lighting and optimized HVAC systems, can drastically reduce energy consumption and associated utility bills. This translates to substantial savings, especially for large-scale operations. Furthermore, waste reduction initiatives, such as recycling and composting programs, can lower disposal costs and free up valuable resources.

Minimizing waste and maximizing resource efficiency are crucial to realizing these savings. Careful planning and implementation of these strategies can yield substantial returns on investment, making sustainability a fiscally sound choice in the long term.

Improved Brand Reputation and Increased Customer Loyalty

Consumers are increasingly conscious of environmental and social issues, and they are actively seeking out brands that align with their values. Companies that demonstrate a commitment to sustainability often attract a loyal customer base. A positive brand image fosters trust and credibility, leading to increased customer loyalty and positive word-of-mouth referrals. This, in turn, can drive sales and market share growth.

Demonstrating a genuine commitment to sustainability through transparent practices and measurable results can strengthen your brand's reputation and attract environmentally conscious customers.

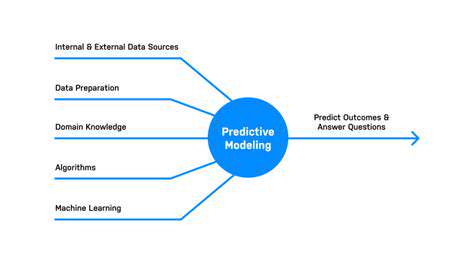

Access to New Investment Opportunities

Investors are increasingly looking for opportunities that align with environmental, social, and governance (ESG) principles. Sustainable businesses often attract greater investment capital due to their alignment with these values. This access to capital can be used to fund expansion, innovation, and other strategic initiatives, ultimately driving growth and profitability.

Sustainable practices can open doors to new investment opportunities, potentially leading to greater financial returns and long-term success for the company. This can be a significant advantage for companies seeking to expand their operations or introduce innovative solutions.

Enhanced Employee Engagement and Retention

A commitment to sustainability can foster a more engaged and motivated workforce. Employees are often drawn to companies that prioritize ethical and environmental responsibility, and they are more likely to stay with an organization that reflects their values. This leads to a more stable and productive workforce, resulting in reduced employee turnover and increased efficiency.

Creating a positive and ethical work environment, where employees feel valued and aligned with the company's mission, can lead to increased job satisfaction and loyalty. This, in turn, can reduce recruitment and training costs associated with high employee turnover.

Read more about Sustainable Real Estate: Investing in Long Term Value and Sustainability

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing