AI Driven Valuation: Transparency and Accuracy in Real Estate

The Rise of AI in Property Appraisal

The Impact of Machine Learning

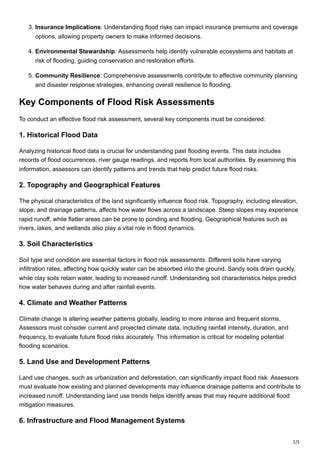

Machine learning algorithms are revolutionizing property appraisal by analyzing vast datasets of comparable sales, property characteristics, and market trends. This allows for a more comprehensive and nuanced understanding of market value, potentially leading to more accurate appraisals. The speed and efficiency of these algorithms are significantly faster than traditional methods, enabling quicker turnaround times for clients.

By identifying patterns and correlations that might be missed by human appraisers, machine learning models can provide insights into factors influencing property value that are not readily apparent. This includes considering the interplay of location, neighborhood amenities, and even social trends. This data-driven approach can lead to more consistent and reliable appraisals across different properties and locations.

Enhanced Data Analysis Capabilities

AI-powered systems can process significantly larger and more diverse datasets than traditional methods. This includes integrating data from various sources, such as public records, real estate listings, social media, and even satellite imagery. This comprehensive approach allows for a more holistic view of the property and its surrounding environment.

The ability to incorporate a wide range of data points leads to a more detailed and accurate understanding of market dynamics. This allows for more precise estimations of market value, taking into account a broader range of factors influencing the property's worth, such as local economic indicators, crime rates, and even school district performance.

Increased Efficiency and Speed

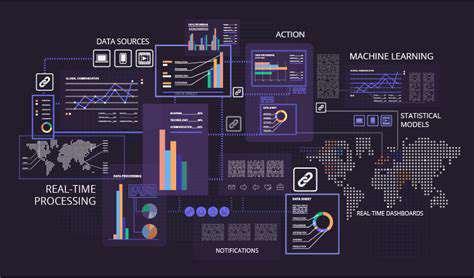

Automation of tasks, such as data collection, analysis, and report generation, is a major benefit of AI in property appraisal. This automation significantly reduces the time required for completing appraisals, allowing appraisers to focus on more complex or specialized cases. This increased speed translates into faster turnaround times for clients and greater overall efficiency for appraisal firms.

The streamlined process enabled by AI reduces the potential for human error, leading to greater consistency and accuracy in the appraisal process. This is especially crucial when dealing with large volumes of appraisals or complex properties. The result is a more efficient and streamlined workflow for property appraisal professionals, ultimately making the process more cost-effective.

Improved Accuracy and Consistency

AI algorithms can identify subtle patterns and correlations in data that might be missed by human appraisers, leading to more precise valuations. This enhanced accuracy contributes to a more trustworthy and reliable appraisal process. By minimizing subjective judgment, AI helps to ensure consistency in appraisal values across different properties and locations.

Furthermore, AI models can be continuously updated and refined based on new data and market trends. This adaptability ensures that appraisals remain relevant and accurate in a dynamic real estate market. This iterative learning approach makes AI appraisal systems more reliable and better equipped to handle changing market conditions.

Challenges and Ethical Considerations

While AI promises significant advancements in property appraisal, there are challenges to consider. Ensuring the fairness and equity of AI-driven appraisals is crucial, given the potential for bias in algorithms trained on historical data. Careful data selection and ongoing monitoring are essential to mitigate these potential issues.

The potential for job displacement among human appraisers is a concern that needs careful consideration. However, it's also important to recognize that AI can create new opportunities for professionals in areas such as data analysis and algorithm development. The transition to an AI-powered appraisal system needs to be carefully managed, considering the impact on both appraisers and the broader real estate industry.

Boosting Efficiency and Accessibility

Improving Valuation Accuracy

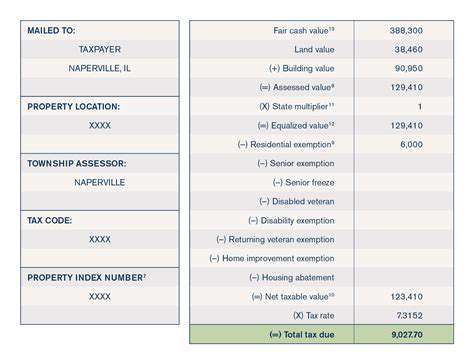

AI-powered valuation models can analyze vast datasets of financial information, market trends, and comparable transactions with remarkable speed and precision. This detailed analysis allows for a more nuanced and accurate assessment of asset value compared to traditional methods which often rely on limited data points and subjective estimations. By incorporating real-time data, AI systems can adapt to fluctuating market conditions, providing a more dynamic and responsive valuation process. This leads to a reduction in errors and a more reliable evaluation of market worth.

Enhancing Transparency in Valuation

One of the key benefits of AI-driven valuation is the inherent transparency it offers. AI algorithms are typically designed with clear parameters and inputs. This transparency allows stakeholders to understand the rationale behind the valuation, including the specific data points considered and the weighting assigned to each factor. This approach counters the potential for ambiguity and subjectivity often associated with traditional valuation methods, fostering trust and confidence in the results.

By providing detailed explanations of the AI's decision-making process, stakeholders can identify potential biases and ensure a more objective assessment. This clear and detailed explanation of the valuation process is crucial to achieving stakeholder buy-in and supporting informed decision-making.

Automating the Valuation Process

AI algorithms can automate many steps in the valuation process, significantly reducing the time and resources required. This automation streamlines the workflow, allowing valuation professionals to focus on more complex tasks and strategic considerations. By handling repetitive tasks like data collection and analysis, AI frees up valuable time and enables more efficient resource allocation. This automation not only reduces costs but also enables faster turnaround times, critical in today's fast-paced business environment.

Facilitating Accessibility of Valuation

AI-powered valuation tools can be designed to be more accessible to a wider range of users. Simplified interfaces and intuitive dashboards can make the process more user-friendly for individuals with varying levels of technical expertise. This accessibility allows for more widespread participation in the valuation process, promoting collaboration and knowledge sharing across diverse teams and stakeholders. In addition, the ability to access and interpret valuations quickly and easily fosters greater engagement and understanding.

Streamlining Data Collection and Analysis

AI-driven valuation systems can integrate data from various sources, including financial statements, market news, and social media trends, to create a comprehensive picture of the asset's value. This integration allows for a more complete and holistic valuation, encompassing a broader range of factors that may influence the asset's worth. This streamlined data collection process reduces the time and resources needed for manual data aggregation and ensures the analysis is as comprehensive and objective as possible.

Improving Valuation Frequency and Speed

AI can perform valuations on a much more frequent basis than traditional methods. This increased frequency allows for real-time adjustments to asset values as market conditions change. AI-powered valuation tools can process data in real-time, adapting to fluctuations and providing up-to-the-minute assessments. This rapid valuation process enables more responsive investment decisions and helps to minimize potential losses and maximize potential gains.

Cost-Effectiveness of AI-Driven Valuation

AI-driven valuation tools can significantly reduce the overall cost of the valuation process, both in terms of time and resources. By automating tasks and reducing the need for extensive manual labor, AI solutions can lower overhead costs and improve efficiency. This cost-effectiveness extends to both large and small organizations, making AI-driven valuation a viable option for a broader range of businesses and investors. Ultimately, these cost savings translate into increased profitability and improved investment outcomes.

Read more about AI Driven Valuation: Transparency and Accuracy in Real Estate

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing