Green Mortgages: Driving Sustainable Homeownership

Encouraging Sustainable Practices Through Incentives

Incentivizing Eco-Friendly Choices

Green mortgages, by offering financial incentives for sustainable home improvements, are a powerful tool for encouraging eco-friendly choices. These incentives can range from reduced interest rates to cash-back rewards, making environmentally conscious upgrades more accessible and appealing to homeowners. This approach not only benefits the environment but also fosters a culture of sustainability within communities.

The key is to make these incentives attractive enough to motivate homeowners to consider improvements that might not otherwise be prioritized. For example, a significant reduction in interest rates could make the upfront costs of solar panel installation or energy-efficient windows more manageable and ultimately lead to a lower overall cost of homeownership over time.

Financial Advantages for Borrowers

One of the most significant advantages of green mortgages is the financial benefit they offer to borrowers. Reduced interest rates and potential tax credits can substantially lower the overall cost of homeownership. This often results in lower monthly payments and a potentially higher return on investment, as these improvements can increase the value of the property in the long run.

Furthermore, the reduced environmental impact can contribute to a sense of pride and accomplishment for homeowners, further motivating them to make sustainable choices.

Environmental Impact and Benefits

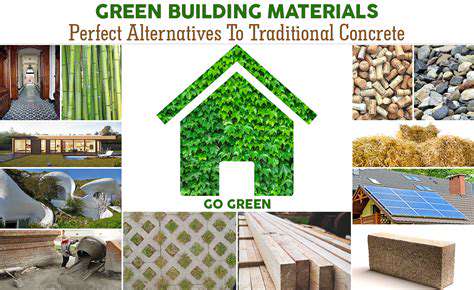

The introduction of green mortgages directly contributes to a reduction in the environmental footprint of housing. By incentivizing energy-efficient upgrades, these mortgages encourage the use of renewable energy sources, reduced water consumption, and waste management improvements. These initiatives demonstrably improve the overall sustainability of homes and communities.

Increased Property Value and Resale Potential

Sustainable home improvements, often encouraged by green mortgages, frequently increase the market value of a property. Homes equipped with energy-efficient features, renewable energy systems, and water conservation technologies generally attract higher bids in the resale market. This represents a significant return on investment for homeowners, making their green upgrades a financially sound decision.

Properties known for their environmental consciousness are often viewed more favorably by potential buyers, thus enhancing their desirability and resale potential in the future.

Government Support and Incentives

Government programs and initiatives play a crucial role in the success of green mortgages. Supportive policies, such as tax credits for renewable energy installations or rebates for energy-efficient appliances, can significantly bolster the attractiveness of sustainable upgrades. These programs create a supportive environment for homeowners to invest in green technologies and simultaneously reduce their environmental impact.

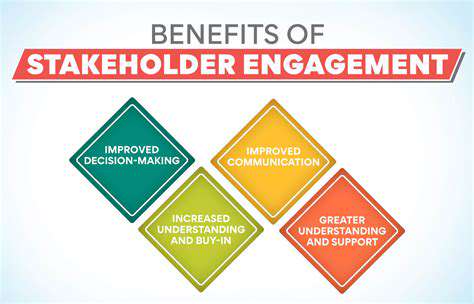

Community Engagement and Education

Green mortgages can be a catalyst for community engagement and education about sustainable practices. Financial institutions can organize workshops and seminars to educate homeowners about the benefits of green improvements and the various options available through green mortgages. This fosters a sense of community responsibility and encourages knowledge sharing about eco-friendly living.

Through interactive sessions and accessible information, communities can collectively embrace sustainable practices and contribute to a greener future.

The Future of Green Mortgages and Sustainable Homeownership

Green Mortgage Innovations

The future of green mortgages is poised for significant evolution, driven by increasing consumer awareness of environmental sustainability and government incentives. This shift is not just about financing eco-friendly renovations; it's about incorporating sustainable practices throughout the entire home lifecycle, from construction to energy efficiency. This is a crucial step towards a more environmentally conscious future, and the mortgage industry is adapting accordingly. Innovative financing structures are emerging that allow homeowners to access funds for various green improvements, such as installing solar panels, upgrading insulation, or implementing water-efficient fixtures.

One key area of innovation is the development of green mortgage products that reward borrowers for adopting sustainable practices. These mortgages often offer lower interest rates or incentives for making environmentally friendly choices. These incentives are designed to encourage responsible homeownership and contribute to a more sustainable future. These green mortgage products are becoming more attractive to both buyers and lenders as they contribute to a positive impact on the environment.

Government Policies and Incentives

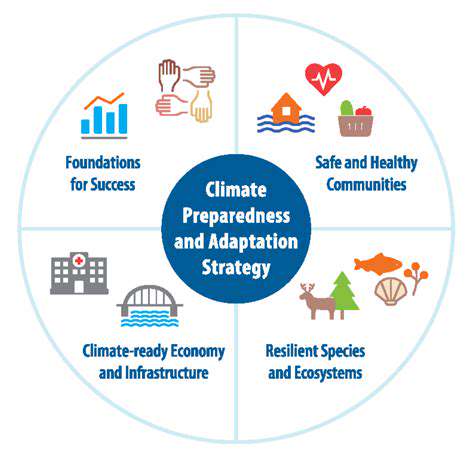

Government policies play a crucial role in shaping the future of green mortgages. Many jurisdictions are implementing regulations and incentives to encourage the adoption of sustainable building practices and energy-efficient homes. These policies can range from tax credits for green improvements to stricter building codes requiring energy efficiency. These policies are helping to drive the demand for green mortgages and are creating a more favorable environment for lenders and borrowers alike.

Furthermore, government initiatives to support green building technologies and sustainable practices are crucial for the success of green mortgages. These initiatives can include research and development programs, educational campaigns, and public awareness programs, all designed to promote the adoption of green building materials and practices. These policies and incentives are vital in fostering a culture of sustainable homeownership, and green mortgages are a key tool in achieving this objective.

Consumer Demand and Market Trends

Consumer demand for green mortgages is rapidly increasing as more and more people become environmentally conscious. This trend is being driven by a desire for eco-friendly homes, reduced energy costs, and a growing interest in making a positive environmental impact. Consumers are seeking financial products that align with their values, and green mortgages provide a direct avenue for them to achieve this. This heightened awareness is also influencing the choices of homebuyers who are considering sustainable features and practices.

Market trends suggest that the demand for green mortgages will continue to rise in the coming years. Lenders are recognizing the growing market opportunity and are developing new products and services to meet this demand. The increasing availability of green mortgage options is likely to stimulate further innovation in the industry, resulting in more sustainable homeownership options for future generations. This trend is likely to continue as more individuals and families prioritize environmental responsibility in their financial decisions.

Read more about Green Mortgages: Driving Sustainable Homeownership

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing