AI Driven Valuation: Streamlining Real Estate Due Diligence and Comprehensive Risk Assessment

Introduction to AI-Driven Valuation in Real Estate

Understanding the Core Concepts

AI-driven valuation leverages machine learning algorithms and sophisticated data analysis techniques to assess the intrinsic value of assets, businesses, or investments. This approach differs significantly from traditional methods, which often rely on subjective estimations and historical data. By incorporating vast datasets and complex patterns, AI can potentially identify factors that traditional methods might miss, leading to more accurate and comprehensive valuations.

Data Sources and Their Importance

The accuracy of AI-driven valuations hinges critically on the quality and quantity of the data used. This data encompasses a wide range of information, including financial statements, market trends, industry benchmarks, and even social media sentiment. Proper data management and preprocessing are essential steps, ensuring that irrelevant or erroneous data doesn't skew the results. This crucial step guarantees the reliability of the valuation process.

Machine Learning Algorithms at Work

Various machine learning algorithms are employed to analyze the data and derive meaningful insights. These algorithms can range from simple regression models to complex neural networks, each tailored to the specific valuation task. Regression models, for instance, establish relationships between variables to predict future values. Neural networks, on the other hand, excel in uncovering complex patterns and relationships within large datasets.

The Role of Expert Input

While AI plays a dominant role in the valuation process, human expertise remains invaluable. Experts in the specific industry or asset class can provide context and refine the results generated by the algorithms. Their input helps to identify potential biases or limitations in the data or model, ensuring a more robust and reliable valuation. Expert input is crucial to interpret the complex data points and validate the accuracy of AI-generated estimates.

Potential Benefits of AI-Driven Valuation

AI-driven valuation offers several significant benefits over traditional methods, including improved speed and efficiency. The automation of tasks allows for faster turnaround times, enabling more agile decision-making in dynamic market environments. Furthermore, AI can analyze vast datasets far beyond human capabilities, leading to potentially more accurate and comprehensive valuations, especially for complex or unique assets.

Limitations and Challenges

Despite the potential advantages, AI-driven valuation isn't without its limitations. The reliance on data quality is paramount, and biased or incomplete data can lead to inaccurate results. Interpretability of the models can also be a challenge, making it difficult to understand the reasoning behind the valuation. Understanding these limitations is crucial to effectively leverage the technology and avoid potential pitfalls.

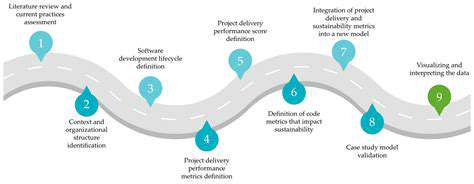

Future Trends and Developments

The field of AI-driven valuation is rapidly evolving. Ongoing research focuses on improving the accuracy and interpretability of AI models, while also integrating new data sources. The incorporation of real-time data and advanced natural language processing techniques promises to revolutionize how we assess and value assets in the future. This continuous evolution will likely lead to even more sophisticated and efficient valuation strategies.

Analyzing Market Trends with AI

Leveraging AI for Predictive Analysis

AI algorithms can analyze vast datasets of market data, including historical sales prices, property characteristics, local economic indicators, and even social media trends. This allows for the identification of patterns and correlations that might otherwise be missed by human analysts. By processing these complex relationships, AI can predict future market movements with greater accuracy, providing valuable insights into potential price fluctuations and emerging trends. This predictive capability is crucial for informed decision-making, enabling investors to anticipate market shifts and adjust their strategies accordingly, potentially maximizing returns and minimizing risks.

The power of AI extends beyond simple price predictions. Sophisticated models can also identify factors driving specific market segments, such as the growing popularity of eco-friendly features or the impact of zoning regulations on property values. This granular level of analysis allows for a deeper understanding of market dynamics, enabling more nuanced valuation strategies and tailored investment portfolios. Understanding these intricate connections between various factors is key to navigating the complexities of the real estate market and capitalizing on emerging opportunities.

AI-Powered Valuation Tools and Their Benefits

AI-driven valuation tools are transforming the way real estate professionals approach due diligence. These tools can quickly and accurately assess property values by considering numerous variables, including location, size, condition, and market trends. This streamlined process allows for a more comprehensive evaluation of potential investments, accelerating the due diligence process and reducing the risk of overlooking crucial market factors. Incorporating these AI-powered tools into the valuation process significantly enhances efficiency and accuracy, leading to more informed investment decisions.

Furthermore, these tools can provide real-time market insights, allowing investors to track changes in property values and adjust their strategies accordingly. This dynamic feedback loop allows for a more agile and responsive approach to investment, enabling investors to capitalize on emerging opportunities and mitigate potential risks. By integrating AI into the valuation process, investors can gain a substantial competitive advantage, ensuring they are making well-informed decisions based on the most up-to-date and comprehensive market data available.

Beyond the valuation itself, AI can also identify potential risks and opportunities within a property's surrounding environment. Analyzing factors like crime rates, school districts, and proximity to amenities allows for a more holistic assessment of a property's long-term value potential. This proactive approach to due diligence can prevent costly mistakes and highlight undervalued opportunities within the market. Ultimately, these AI-powered tools enable a more informed and strategic approach to real estate investment.

Integrating AI into Real Estate Valuation Processes

Improving Accuracy and Efficiency

Integrating AI into real estate valuation processes offers significant improvements in accuracy and efficiency, streamlining the entire process. By leveraging vast datasets and complex algorithms, AI can analyze a multitude of factors influencing property value, including comparable sales data, market trends, neighborhood characteristics, and even property features like square footage and amenities. This comprehensive analysis surpasses the limitations of traditional methods, often relying on subjective assessments or limited data availability, leading to a more precise and reliable valuation.

The automated nature of AI-powered valuation tools drastically reduces the time and resources required for a comprehensive assessment. This speed and efficiency translate directly into faster turnaround times for clients, enabling quicker decision-making in transactions and investment strategies. Real estate agents, appraisers, and investors can all benefit from this streamlined approach, maximizing productivity and minimizing the potential for human error.

Addressing Data Limitations and Biases

Traditional real estate valuation methods often struggle with limited or incomplete data, potentially leading to inaccurate or biased assessments. AI algorithms, however, can process a significantly larger and more comprehensive dataset, including historical records, market trends, and even social media data, to create a more holistic and balanced picture of a property's value. This capability allows AI to identify and mitigate potential biases inherent in traditional approaches, leading to more equitable and objective valuations.

Moreover, AI can identify and highlight patterns and anomalies in data that might be missed by human analysts. By constantly learning and adapting to new information, AI models can continuously improve their accuracy and reduce the risk of relying on outdated or incomplete data. This iterative learning process ensures that AI-driven valuations remain relevant and reliable in rapidly changing market conditions.

Enhancing Transparency and Explainability

Transparency is a crucial aspect of any valuation process, and AI-powered systems can enhance this by providing detailed explanations of their assessments. While some AI models can be black boxes, advancements are being made to develop more transparent models that allow users to understand the factors influencing a property's valuation. This transparency builds trust and confidence in the valuation process, particularly for stakeholders involved in complex transactions, such as institutional investors.

Explainable AI (XAI) is a growing field focused on developing models that not only provide accurate valuations but also offer insights into the reasoning behind those valuations. This feature empowers users to understand the rationale behind the AI's conclusions, allowing them to challenge or validate the assessment, fostering a collaborative and more informed decision-making process. This level of transparency is particularly valuable in litigation or disputes regarding property valuations.

Future Applications and Implications

The integration of AI into real estate valuation processes has far-reaching implications that extend beyond immediate applications. Future developments are likely to include more sophisticated models that incorporate predictive analytics to forecast market trends and anticipate future property values. This foresight will empower investors to make more informed decisions and manage risk more effectively.

The potential for AI also extends to dynamic pricing and personalized valuations, tailored to specific investor needs and risk tolerances. This level of customization will create a more efficient and responsive market, driving greater liquidity and investor confidence. Ultimately, AI-driven valuations will continue to evolve, shaping the future of real estate transactions and investment strategies.

Read more about AI Driven Valuation: Streamlining Real Estate Due Diligence and Comprehensive Risk Assessment

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing