The Role of AI in Real Estate Pricing Strategies

Dynamic Pricing Strategies Tailored to Market Fluctuations

Understanding Dynamic Pricing

The concept of adjusting prices in response to real-time market conditions has transformed how businesses operate in competitive sectors. Rather than static pricing models, companies now leverage advanced computational techniques to align their pricing with current demand patterns. This data-driven approach enables organizations to optimize revenue streams while maintaining market competitiveness. The methodology has proven particularly valuable in industries where consumer demand experiences significant volatility, requiring agile responses to shifting market dynamics.

The Impact of Market Fluctuations

External factors including seasonal variations, economic indicators, and competitive pressures create constant shifts in market conditions. Pricing strategies that adapt to these changes help businesses capitalize on peak demand periods while minimizing losses during downturns. Accurate interpretation of market signals forms the foundation for effective price optimization, allowing companies to maintain profitability across different economic cycles.

Advanced Analytics in Pricing Decisions

Modern computational systems process extensive datasets encompassing historical sales patterns, competitor strategies, and environmental factors to generate actionable pricing insights. These systems eliminate reliance on intuition, instead providing empirical evidence to guide strategic decisions. The ability to process multiple variables simultaneously gives businesses a significant advantage in anticipating market movements.

Advantages of Responsive Pricing Models

Implementation of adaptive pricing structures offers multiple organizational benefits. Beyond immediate revenue optimization, these systems enhance operational efficiency by aligning resource allocation with actual market conditions. The insights generated through continuous data analysis provide valuable intelligence about consumer behavior patterns, enabling more informed strategic planning and competitive positioning.

Implementation Challenges

While the benefits are substantial, organizations must address several implementation hurdles. Establishing the necessary technical infrastructure requires significant investment in both hardware and expertise. Additionally, businesses must carefully balance profit optimization with customer satisfaction, ensuring pricing strategies don't negatively impact brand perception or customer loyalty.

Ethical Implementation Considerations

The success of responsive pricing models depends on ethical application and transparent communication with customers. Clear explanations of pricing mechanisms help maintain trust, while avoiding practices that could be perceived as exploitative. Long-term success requires balancing profitability objectives with fair value propositions, ensuring sustainable business growth and positive customer relationships.

Predictive Modeling for Future Market Trends

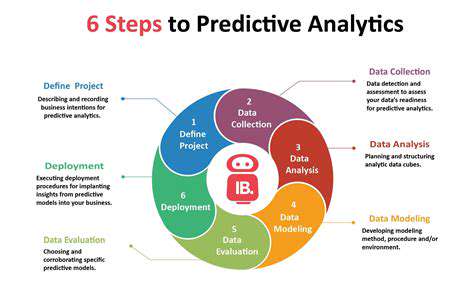

Fundamentals of Predictive Analysis

Advanced analytical techniques in property valuation examine historical patterns and multiple influencing factors to project future market conditions. These methodologies employ sophisticated computational processes to identify meaningful relationships within complex datasets. Critical variables including geographic factors, property characteristics, and economic indicators are analyzed to generate accurate forecasts that support decision-making for investors and industry professionals.

Effective forecasting requires comprehensive datasets that capture diverse property attributes and market conditions. The predictive accuracy directly correlates with data quality and the appropriateness of selected analytical methods. Different computational approaches yield varying results depending on data characteristics and prediction objectives, making method selection a crucial consideration.

Computational Techniques in Property Valuation

Modern analytical systems using iterative learning algorithms demonstrate particular effectiveness in processing real estate data. These systems can detect subtle patterns and nonlinear relationships that traditional statistical approaches might overlook. This enhanced analytical capability produces more precise forecasts while providing deeper understanding of the complex factors influencing market behavior.

Incorporating live data streams allows continuous refinement of predictive models, ensuring relevance amidst changing market conditions. This adaptive capability represents a significant advancement over static predictive frameworks, enabling more responsive and accurate forecasting.

Critical Factors Affecting Valuation Predictions

Multiple variables significantly influence property valuation forecasts. Geographic considerations remain paramount, with accessibility to essential services, educational institutions, and employment centers substantially impacting values. Physical characteristics including square footage and maintenance condition also significantly affect pricing, as do broader market forces like economic indicators and demographic shifts.

Data Processing and Analytical Validation

Reliable predictive modeling requires rigorous data preparation, including normalization, error correction, and standardization procedures. Addressing data inconsistencies and anomalies through preprocessing techniques ensures analytical integrity. Comprehensive validation using holdout samples and statistical testing verifies model accuracy before operational deployment, safeguarding against unreliable predictions.

Strategic Application in Investment Analysis

Forward-looking analytical models provide critical support for investment decision-making. By projecting market trajectories, investors can identify high-potential opportunities while assessing risk exposure. These tools enable evaluation of potential capital appreciation, income generation capacity, and market stability indicators. Strategic application of these insights allows investors to focus resources in markets demonstrating favorable conditions, optimizing returns while mitigating potential downsides.

Read more about The Role of AI in Real Estate Pricing Strategies

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing