AI in Real Estate Underwriting Automation

Automation of Manual Tasks

Streamlining Operational Efficiency

Automating manual tasks significantly improves operational efficiency by reducing the time and resources spent on repetitive processes. This frees up human employees to focus on more complex and strategic initiatives, leading to a more productive and efficient workforce. The overall result is a considerable boost in productivity and a more optimized workflow.

By automating these tasks, businesses can reduce errors and ensure consistency in output, ultimately leading to better quality and reduced costs. This is crucial for maintaining a competitive edge in today's fast-paced market.

Reduced Labor Costs

One of the most immediate benefits of automating manual tasks is the potential reduction in labor costs. Automating repetitive and time-consuming tasks allows businesses to reduce the number of employees needed to perform those tasks, resulting in significant savings. This can be particularly beneficial for companies with large, manual operations.

Improved Accuracy and Consistency

Human error is inevitable in manual processes. Automation eliminates the risk of human error, ensuring greater accuracy and consistency in task execution. This is vital for maintaining high-quality standards and delivering reliable results.

Enhanced Data Collection and Analysis

Automated systems often collect and store data more efficiently than manual methods. This allows for better data analysis, enabling businesses to gain valuable insights into processes and performance. This data-driven approach allows for informed decision-making and strategic adjustments to improve efficiency.

Increased Productivity and Output

By offloading repetitive tasks to automated systems, employees can focus on higher-value activities. This leads to a significant increase in overall productivity and output. Companies can achieve greater output with the same or fewer resources, resulting in a more profitable operation.

Scalability and Flexibility

Automated systems are often more scalable than manual processes. As business needs evolve, automated systems can be easily adjusted and scaled up or down to accommodate changes in demand. This flexibility is crucial for adapting to fluctuating market conditions and expanding operations.

Improved Safety and Security

Certain manual tasks can involve inherent safety risks. Automation can eliminate these risks, creating a safer working environment for employees. Furthermore, automation can enhance data security by implementing robust access controls and encryption protocols. These security measures are crucial for protecting sensitive information and ensuring compliance with data protection regulations.

The Future of Real Estate Underwriting with AI

AI-Powered Risk Assessment

Artificial intelligence is poised to revolutionize real estate underwriting by significantly enhancing risk assessment. AI algorithms can analyze vast datasets, including property records, market trends, and even social media information, to identify potential risks and opportunities more accurately and efficiently than traditional methods. This allows lenders to make more informed decisions, reducing the risk of loan defaults and improving overall portfolio health. By leveraging historical data and predictive modeling, AI can identify patterns and anomalies that might be missed by human underwriters, leading to a more comprehensive and objective evaluation of the borrower and property.

This advanced risk assessment process can also improve the speed of underwriting. Instead of relying on lengthy manual reviews, AI can quickly assess applications, making the entire process more streamlined and accessible for both borrowers and lenders. Moreover, AI's ability to adapt and learn from new data ensures continuous improvement in the accuracy and efficiency of risk assessment, ultimately leading to a more robust and reliable real estate underwriting system.

Automated Document Review and Verification

One of the most time-consuming aspects of traditional real estate underwriting is the manual review and verification of numerous documents. AI-powered systems can automate this process, significantly reducing processing time and freeing up underwriters to focus on more complex aspects of the loan approval process. This automation can involve the extraction of key information from documents, such as property appraisals, financial statements, and title reports, and comparing this data to established criteria for verification.

By using optical character recognition (OCR) and natural language processing (NLP), AI can accurately extract data from various document formats, including scanned images and PDFs. This ensures that all relevant information is captured and processed efficiently, while also mitigating the risk of human error in data entry and interpretation. This streamlined process leads to quicker turnaround times for loan applications, a more efficient use of resources, and a better customer experience.

Personalized Loan Offerings

AI can personalize loan offerings to better meet the needs of individual borrowers. By analyzing borrower data, including credit history, income, and financial goals, AI can recommend the most suitable loan terms and conditions. This personalized approach can lead to more favorable loan structures for borrowers and reduced risk for lenders. AI can identify specific borrowing patterns and requirements, allowing lenders to tailor their products to cater to diverse borrower needs and preferences, ultimately improving the overall loan approval process.

Furthermore, AI can identify potential red flags and risks in real time, allowing lenders to proactively address and mitigate issues that could jeopardize a loan. This proactive approach to risk management can help lenders avoid costly mistakes and ensure the long-term health of their portfolios. AI's ability to adapt and learn from new data also ensures that loan offerings remain relevant and competitive in a dynamic market.

Improved Compliance and Reduced Fraud

AI can play a crucial role in ensuring compliance with regulations and reducing fraud in real estate underwriting. By continuously monitoring and analyzing loan applications, AI can identify patterns and anomalies that might indicate fraudulent activity or non-compliance with lending regulations. This proactive approach to fraud detection can prevent significant financial losses for lenders and help maintain the integrity of the entire real estate market.

AI systems can also automatically flag potentially problematic information, such as inconsistencies in financial statements or suspicious property valuations, enabling underwriters to investigate these issues thoroughly and promptly. This enhanced vigilance helps maintain compliance with lending regulations and minimize the risk of fraud, protecting both lenders and borrowers from potentially harmful outcomes. The system's ability to learn and adapt to new fraud patterns is essential for maintaining a strong defense against sophisticated fraudulent activities.

Read more about AI in Real Estate Underwriting Automation

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

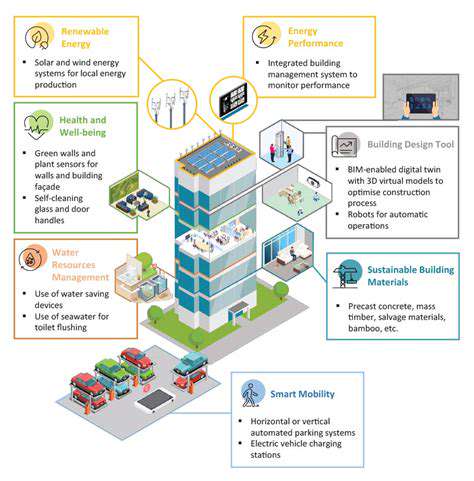

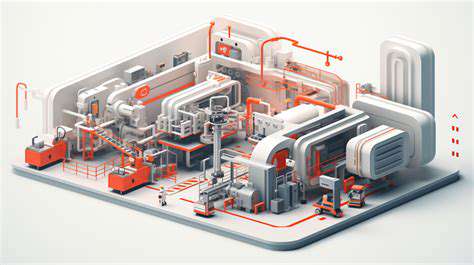

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing