Regulatory Climate Risk Disclosure for Real Estate

Importance of Consistency and Comparability

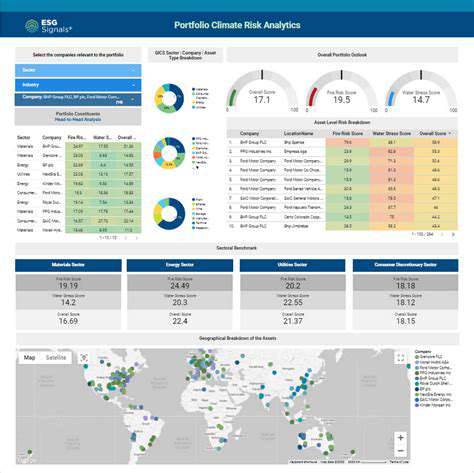

Consistent and comparable climate risk disclosure is essential for investors to make informed decisions and for stakeholders to assess the overall risk profile of companies. The absence of standardized reporting standards can lead to confusion and potentially misallocation of capital. This is particularly crucial in the context of a global economy where companies operate across different jurisdictions with varying regulatory landscapes.

The need for consistent reporting transcends national borders, highlighting the importance of international collaboration and the development of globally recognized standards. This will foster a more robust and transparent market for climate-related information, supporting the transition to a low-carbon economy.

Challenges and Future Directions

Despite the growing importance of climate risk disclosure, numerous challenges remain, including the evolving nature of climate science, the complexity of climate-related risks, and the need for robust data collection and analysis methodologies. Overcoming these hurdles requires a collaborative effort from companies, regulators, investors, and other stakeholders.

Future directions in climate risk disclosure likely involve further refinement of reporting standards, the development of more sophisticated metrics and targets, and a greater emphasis on scenario analysis to assess the potential impacts of various climate change pathways. Increased transparency and accountability are key to fostering trust and encouraging responsible corporate behavior in the face of climate change.

Strategic Adaptation and Mitigation Strategies

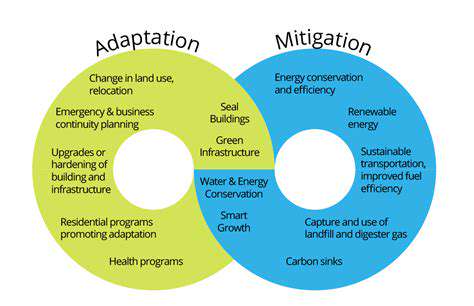

Strategic Adaptation to Changing Market Dynamics

Companies must proactively adapt to the ever-evolving landscape of the modern market. This involves continuous monitoring of trends, customer preferences, and emerging technologies. Understanding these shifts is crucial for identifying opportunities and mitigating potential threats. By embracing agility and fostering a culture of innovation, organizations can effectively navigate challenges and capitalize on new possibilities. This adaptability is not a one-time event; it's an ongoing process that requires a commitment to learning and growth.

Strategic adaptation also encompasses a thorough understanding of the competitive environment. Companies need to analyze their competitors' strategies, strengths, and weaknesses to identify areas where they can differentiate themselves. This includes examining pricing models, product offerings, and marketing approaches. A clear understanding of the competitive landscape allows for the development of strategies that position the company for success in the long term. Regular reviews and adjustments to the strategic plan are essential to ensure it remains aligned with market realities.

Mitigation Strategies for Potential Risks

Identifying potential risks and developing mitigation strategies is paramount for any organization. A thorough risk assessment process should consider a wide range of factors, including economic downturns, regulatory changes, and technological disruptions. Proactive risk management involves developing contingency plans for various scenarios and ensuring that resources are allocated to address potential issues.

Effective mitigation strategies often involve diversification of products, services, or markets. This reduces dependence on a single source of revenue and allows the organization to adapt to changing conditions more easily. Diversification can also help mitigate risks associated with dependence on specific geographic regions or customer segments. Implementing robust financial controls and insurance strategies is another crucial aspect of risk mitigation.

Furthermore, building strong relationships with key stakeholders, such as suppliers and partners, can help mitigate risks associated with supply chain disruptions or market volatility. Understanding the potential impact of external factors on the organization's operations is essential for developing effective mitigation strategies. Establishing clear communication channels and fostering collaboration with stakeholders are key elements of effective risk management.

Implementing Effective Change Management Processes

Implementing strategic adaptations and mitigation strategies requires effective change management. Change management initiatives should be carefully planned and executed to minimize disruption and ensure smooth transitions. A clear communication plan is essential to keep all stakeholders informed about the changes and their implications. This includes outlining the reasons for the changes, the expected outcomes, and the timeline for implementation.

Strong leadership is critical to driving successful change management. Leaders must be able to inspire and motivate their teams to embrace the changes and work towards the desired outcomes. Providing adequate training and support to employees is also essential to ensure a smooth transition and maximize the benefits of the changes. This will help the organization to achieve its goals and maintain a competitive edge in the marketplace.

Evaluating and Refining Strategies

Regular evaluation and refinement of adaptation and mitigation strategies are crucial for maintaining effectiveness. This ongoing process involves monitoring key performance indicators (KPIs) to assess the impact of the implemented strategies. Analyzing market trends, competitor activities, and internal performance metrics can provide valuable insights into areas where strategies need adjustment. This process involves a comprehensive review of the strategies and their effectiveness in achieving the desired outcomes.

Feedback mechanisms from employees and customers are essential for identifying areas for improvement. Gathering data from various sources and using analytics tools to assess the performance of the strategies can help pinpoint areas that need adjustment. This iterative approach allows organizations to remain adaptable and responsive to market changes and internal needs. Continuous improvement is key to long-term success.