Climate Risk Analytics for Real Estate Portfolios: A Comprehensive Guide for Astute Investors

Assessing Physical Climate Risks

Understanding the Physical Climate Risks

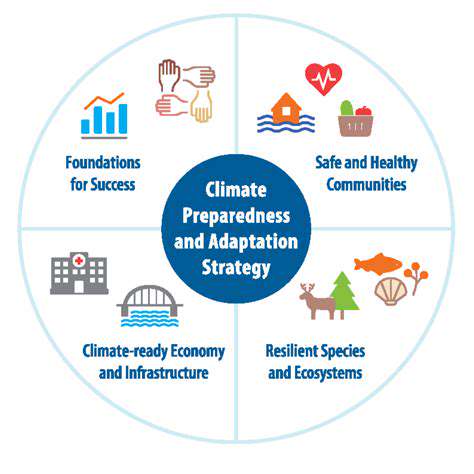

Assessing physical climate risks in real estate portfolios is crucial for long-term investment viability. These risks encompass a wide range of potential impacts from extreme weather events, rising sea levels, and changing precipitation patterns. Understanding the specific vulnerabilities of individual properties, such as their location relative to floodplains or drought-prone regions, is paramount. This requires detailed analysis of historical climate data, projected future scenarios, and the potential consequences for property values, occupancy, and operational costs. Thorough research into the specific climate risks relevant to each property within the portfolio is essential for developing effective mitigation strategies.

Climate change is not a uniform threat. Different regions experience varying degrees of risk based on factors like topography, proximity to coastlines, and existing infrastructure. For instance, coastal properties face heightened vulnerability to storm surges and flooding, while inland areas may be more susceptible to prolonged droughts and wildfires. Evaluating these localized risks and their potential impacts on the specific properties in a portfolio is key to making informed decisions about asset allocation, risk management, and adaptation strategies.

Evaluating Property Vulnerability

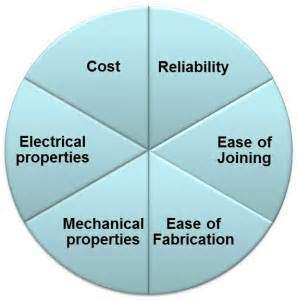

A critical component of assessing physical climate risks involves evaluating the vulnerability of each property within a real estate portfolio. This assessment considers factors like building construction materials, design features, and existing infrastructure. For example, a property built on a foundation susceptible to liquefaction in a high-seismic zone presents a significantly higher risk compared to a modern structure with reinforced foundations. The degree of property resilience to different climate hazards needs to be quantified. A thorough review of building codes, insurance policies, and historical property damage records will offer valuable insight into past vulnerabilities and inform future risk mitigation strategies.

Beyond the physical structure of the property, the surrounding environment plays a significant role. Proximity to bodies of water, drainage systems, and vegetation patterns can all influence the property's vulnerability to flooding, landslides, or other natural disasters. Analyzing these contextual factors alongside the built environment is essential for a comprehensive vulnerability assessment. Furthermore, understanding the potential for future changes in these environmental conditions, such as sea-level rise or altered storm patterns, is vital for long-term planning.

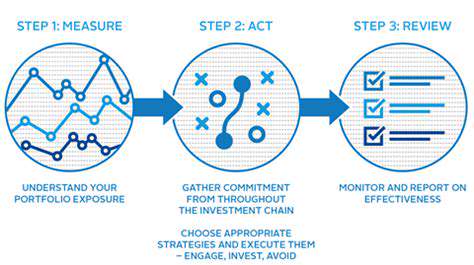

Developing Mitigation and Adaptation Strategies

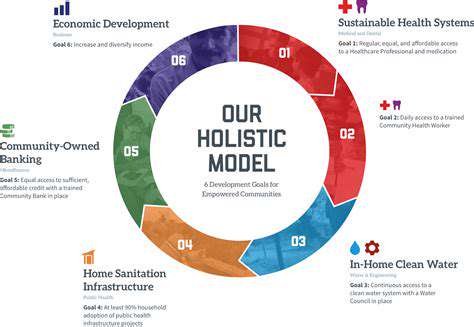

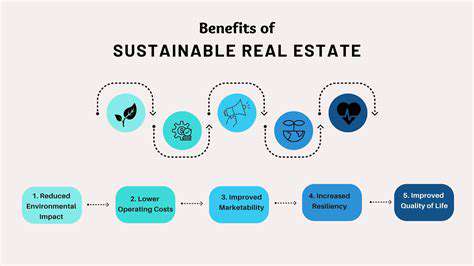

Once the physical climate risks and property vulnerabilities are identified, the next step is developing robust mitigation and adaptation strategies. This involves exploring options for enhancing property resilience, such as implementing flood defenses, reinforcing building structures, or relocating assets from high-risk zones. These strategies must consider the specific characteristics of each property and the potential financial implications of implementing mitigation measures. Evaluating the cost-effectiveness of different solutions and their long-term benefits is critical.

Adapting to climate change also involves reassessing the long-term viability of certain investment strategies. This may include divesting from properties in high-risk areas, diversifying the portfolio across different climate zones, or incorporating climate-resilient design principles into new developments. Ultimately, the goal is to reduce the portfolio's exposure to physical climate risks while maximizing long-term value and minimizing potential losses.

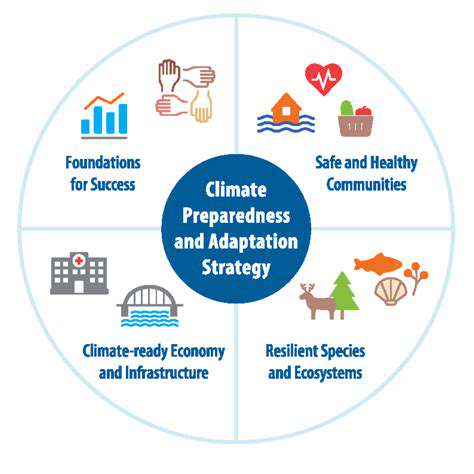

Incorporating climate change considerations into the overall real estate investment strategy is crucial. This could involve engaging with local authorities to understand their policies on climate resilience, consulting with experts in climate risk assessment, and partnering with organizations focused on climate-related solutions. The long-term success of a real estate portfolio hinges on its ability to adapt to a changing climate and navigate the evolving risks associated with extreme weather events.

Building a Robust Climate Risk Management Plan

Understanding the Scope of Climate Risks

Climate change presents a multifaceted set of risks to real estate investments, spanning from rising sea levels and increased flood frequency to more intense heat waves and shifting precipitation patterns. Assessing these risks requires a comprehensive understanding of how different properties and portfolios are exposed to these evolving environmental factors. This involves analyzing historical climate data, projecting future scenarios, and evaluating the potential impacts on property values, rental income, and operational costs. A detailed understanding of these risks is the cornerstone of any effective climate risk management plan.

Identifying specific vulnerabilities within a portfolio is crucial. This includes factors like proximity to floodplains, coastal erosion zones, and areas prone to wildfires. Analyzing historical weather patterns, including extreme events, is essential for understanding the likelihood and potential severity of future climate-related impacts. Understanding these localized vulnerabilities, and their varying degrees of impact across different property types, is essential in developing a targeted and effective climate risk mitigation strategy.

Developing a Data-Driven Approach to Risk Assessment

A robust climate risk management plan must leverage robust data and sophisticated analytics to quantify and prioritize the risks faced by real estate assets. This involves developing comprehensive datasets that integrate historical climate data, projected future scenarios, and local regulatory information. Such datasets must be rigorously validated and updated regularly to reflect evolving climate conditions and regulatory changes. This data-driven approach allows for a more precise evaluation of potential losses and the development of targeted mitigation strategies.

Integrating climate models and predictive analytics into the assessment process is vital. These models can project future climate scenarios, allowing for scenario planning and the development of risk profiles for different properties or portfolios. This helps to anticipate potential impacts on property values, rental income, and operational costs under various climate change conditions. This forward-looking approach enables proactive risk mitigation measures, rather than simply reacting to events after they occur.

Furthermore, incorporating publicly available climate data sources, such as government reports and scientific studies, is essential for a comprehensive understanding of local and regional climate risks. This broader perspective enhances the accuracy of risk assessments, allowing for the development of more comprehensive and adaptable risk management strategies.

Implementing Practical Mitigation Strategies

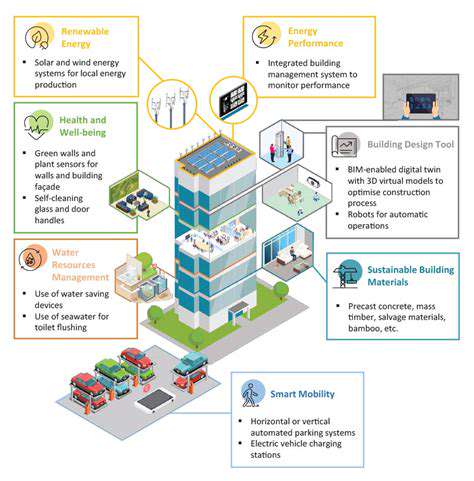

Once the risks have been identified and quantified, the next step is implementing practical mitigation strategies. This might involve elevating buildings to avoid flooding, installing flood mitigation systems, or implementing sustainable building practices to reduce energy consumption and carbon emissions. These strategies can not only mitigate climate risks but also enhance the long-term value and resilience of the properties.

Implementing building codes and regulations that consider climate change impacts is critical to ensuring the long-term resilience of the built environment. These measures should address issues like building materials, construction techniques, and energy efficiency standards. This will help to minimize the vulnerability of properties to future climate events and ensure their continued viability in the face of climate change.

Developing adaptation strategies for specific properties based on their unique characteristics is crucial. For example, properties located in coastal areas may need seawall construction or elevated foundations, while those in arid regions may require drought-resistant landscaping or water conservation measures. Tailoring mitigation strategies to the specific context of each property or portfolio optimizes the effectiveness of the risk management plan. This approach considers the diverse needs of different properties and ensures that mitigation efforts align with the specific risks they face.

Read more about Climate Risk Analytics for Real Estate Portfolios: A Comprehensive Guide for Astute Investors

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing