Climate Risk Analytics for Real Estate Lenders: Navigating New Challenges and Opportunities

Integrating Climate Data into Loan Evaluation Processes

Understanding the Importance of Climate Data in Loan Assessments

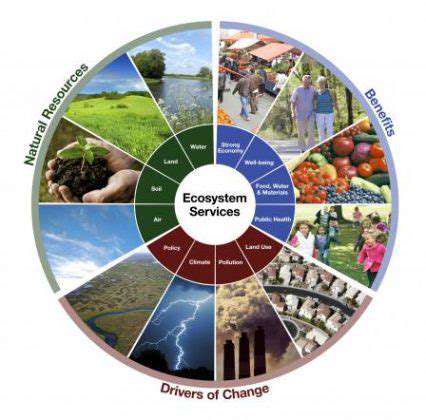

Modern lenders are now recognizing the critical need to weave climate data into their loan assessment frameworks. The growing financial toll of extreme weather events, rising sea levels, and other climate disruptions is reshaping property valuations and infrastructure stability, with ripple effects across the financial sector. Forward-thinking institutions are leveraging this data to pinpoint location-specific risks, enabling smarter lending decisions that account for long-term environmental factors.

This paradigm shift represents more than risk mitigation—it's about future-proofing investments. By baking climate considerations into their evaluations, lenders can simultaneously safeguard their portfolios and champion sustainable financial practices that benefit entire communities.

Analyzing Climate Change Impacts on Property Values

The real estate market is experiencing tectonic shifts as climate change alters valuation metrics. Coastal properties and flood-prone areas are particularly vulnerable, with rising insurance costs and declining demand creating valuation volatility that lenders simply can't ignore. The smartest financial institutions are now developing proprietary models that layer climate projections onto traditional appraisal methods.

What separates leading lenders is their commitment to hyper-local analysis. They're not just looking at regional climate patterns, but drilling down to neighborhood-specific vulnerabilities, zoning changes, and infrastructure adaptation plans that could influence a property's climate resilience over a 30-year mortgage period.

Evaluating Infrastructure Vulnerability to Climate Change

The backbone of any property's value lies in the infrastructure supporting it. When hurricanes flood substations or wildfires compromise transportation routes, the economic fallout extends far beyond individual properties to entire business ecosystems. Progressive lenders are creating multi-dimensional assessment tools that evaluate everything from sewer system capacity to emergency response times.

Some institutions have begun collaborating with civil engineers to develop proprietary scoring systems. These tools quantify how climate stressors might degrade local infrastructure over time, allowing for more nuanced risk pricing that reflects real-world vulnerability.

Developing Climate-Resilient Loan Products

Innovation in lending products is keeping pace with climate challenges. We're seeing the emergence of climate-adjusted mortgages featuring dynamic terms that incentivize resilience upgrades, and commercial loans with built-in climate risk buffers. The most creative products even offer interest rate reductions for properties meeting stringent climate adaptation standards.

Pioneering institutions are going beyond loans to create comprehensive climate finance ecosystems—blending insurance products, retrofit financing, and risk-sharing mechanisms into seamless packages. This holistic approach doesn't just manage risk—it actively builds climate resilience into the financial fabric of communities.

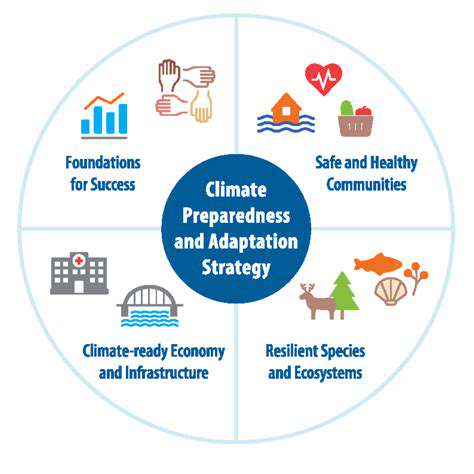

Establishing Climate Risk Management Frameworks

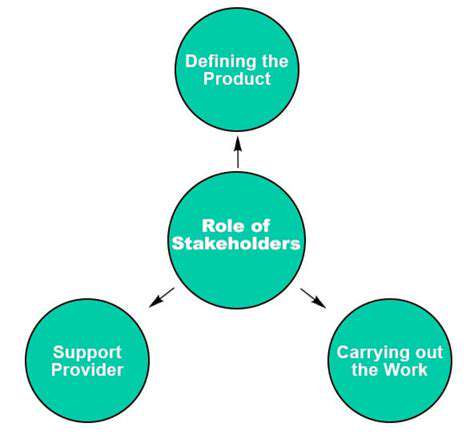

The most effective climate strategies are those embedded in institutional DNA. Leading lenders aren't just adding climate checkboxes to existing processes—they're redesigning their entire risk management frameworks around climate realities. This means climate considerations influence everything from initial underwriting to portfolio stress testing and capital allocation decisions.

What sets these frameworks apart is their living, breathing nature. They incorporate real-time climate data feeds, regularly updated scenario analyses, and adaptive risk thresholds that evolve alongside climate science. This dynamic approach ensures lending practices remain relevant in our rapidly changing world.

Developing Climate-Resilient Lending Strategies

Understanding the Fundamentals of Climate Risk

Today's lenders face a paradigm shift—climate risk is now immediate, measurable, and location-specific. The institutions thriving in this new environment are those developing granular understanding of how different climate stressors interact with various asset classes and regional economies.

The most sophisticated analyses now examine not just physical risks, but also transition risks—how policy changes, technological shifts, and market transformations might create financial exposure. This dual-lens approach provides the comprehensive view needed for truly resilient lending.

Assessing Climate Change Impacts on Borrowers

Modern credit analysis requires climate fluency. Lenders now evaluate how a manufacturing plant's water access might be affected by prolonged droughts, or how a retail center's customer base could shift with changing migration patterns. This goes far beyond traditional financial ratios to assess operational viability in a changing world.

The cutting edge involves predictive modeling that maps climate impacts across entire value chains—revealing hidden vulnerabilities in supplier networks, distribution channels, and customer demographics that traditional analysis might miss.

Developing Climate-Specific Risk Models

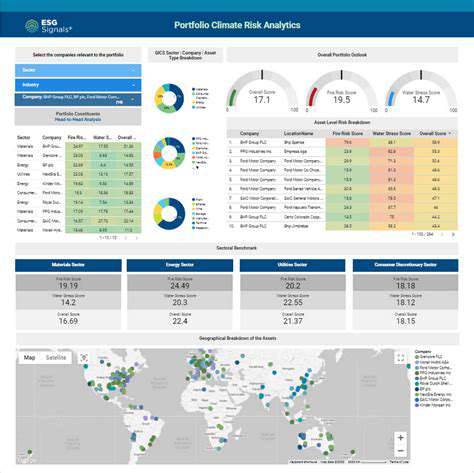

The most advanced institutions are moving beyond bolt-on climate adjustments to build climate intelligence into their core risk engines. These next-generation models integrate thousands of data points—from satellite imagery of urban heat islands to groundwater depletion rates—creating multidimensional risk profiles.

What distinguishes these models is their ability to simulate complex climate-borrower interactions across multiple time horizons and emission scenarios. This allows for more precise risk pricing that reflects both current conditions and probable futures.

Implementing Climate-Resilient Lending Practices

Climate-smart lending isn't just about saying no—it's about crafting creative solutions. The most effective programs combine rigorous screening with proactive support mechanisms like technical assistance for climate adaptations and preferential terms for resilience investments.

Some lenders are pioneering climate performance covenants that tie loan terms to measurable resilience improvements, creating powerful alignment between financial and environmental outcomes. These innovations demonstrate how finance can be a catalyst for positive climate action.

Integrating Climate Data into Loan Decisions

The most impactful climate integration happens when environmental data flows seamlessly into credit committees' decision streams. This requires transforming complex climate science into actionable financial insights through intuitive dashboards and decision-support tools.

Leading institutions are training their underwriters in climate literacy while simultaneously building automated systems that flag climate risks with the same urgency as traditional red flags like high debt-to-income ratios. This dual approach ensures climate considerations carry appropriate weight in every lending decision.

Enhancing Loan Portfolio Resilience

Climate portfolio management is becoming its own discipline, with dedicated teams analyzing climate correlations across asset classes and geographies. The smartest strategies don't just avoid risk—they actively construct portfolios where climate resilience creates competitive advantage.

This might involve overweighting regions with strong climate adaptation plans or sectors positioned to benefit from climate-driven demand shifts. Such strategic positioning turns climate challenges into opportunities for both financial returns and positive impact.

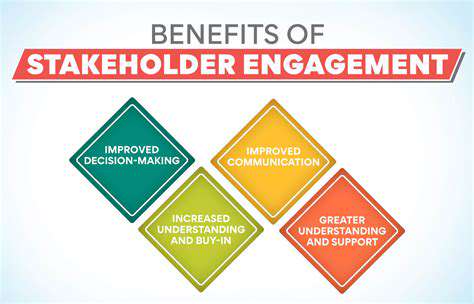

Promoting Transparency and Accountability

In an era of climate-conscious stakeholders, transparency has become a strategic imperative. Leading lenders are going beyond compliance to provide unprecedented visibility into their climate risk methodologies and portfolio exposures.

The most trusted institutions are adopting third-party verification of their climate claims and participating in industry-wide efforts to standardize climate risk disclosure. This commitment to openness builds credibility with regulators, investors, and communities alike.

Read more about Climate Risk Analytics for Real Estate Lenders: Navigating New Challenges and Opportunities

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing