Climate Stress Testing for Real Estate Investment Funds

Integrating Climate Considerations into Portfolio Management

Understanding the Implications of Climate Change

Climate change is no longer a distant threat; its impacts are already being felt across the globe, affecting various sectors and industries. Understanding the specific risks associated with climate change, like extreme weather events, rising sea levels, and shifting precipitation patterns, is crucial for investors. These risks can manifest in a variety of ways, including disruptions to supply chains, increased operational costs, and damage to physical assets. It's imperative to recognize that these risks are not evenly distributed, and some regions and sectors will be disproportionately affected. A nuanced understanding of these implications is vital for effective portfolio management.

Investors need to move beyond a passive approach to risk assessment. Simply considering historical data is insufficient when dealing with rapidly evolving climate-related threats. Proactive, forward-looking analysis and scenario planning are necessary to anticipate potential disruptions and their cascading effects. This includes considering the potential for physical damage, regulatory changes, and shifting consumer preferences in response to climate change. A thorough understanding of these factors helps in identifying and managing potential risks within an investment portfolio.

Incorporating Climate Stress Testing into Investment Strategies

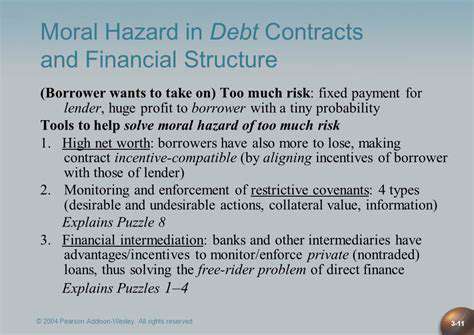

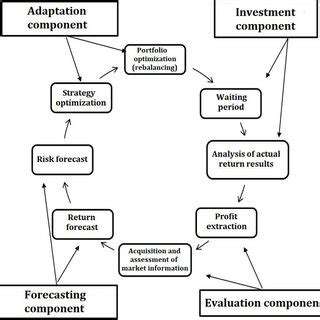

Climate stress testing has emerged as a critical tool for investors to evaluate the resilience of their portfolios in the face of climate-related risks. This involves systematically analyzing how different climate scenarios might impact the financial performance of companies and assets within the portfolio. It requires considering the potential for physical damage, transition risks, and reputational damage. By incorporating climate stress testing, investors can gain a more comprehensive understanding of the long-term financial implications of climate change, enabling them to make more informed investment decisions.

A key aspect of climate stress testing is developing tailored scenarios that reflect different degrees of climate change severity. This allows for a range of potential outcomes to be evaluated, from moderate disruptions to more extreme impacts. By analyzing these scenarios, investors can identify vulnerabilities and develop mitigation strategies to protect their portfolios. Furthermore, it allows investors to assess the potential for stranded assets and anticipate the impact of evolving regulations and policies related to climate change.

Developing a Framework for Climate-Conscious Portfolio Management

Moving toward climate-conscious portfolio management requires a robust framework that integrates climate considerations into every stage of the investment process. This includes incorporating climate factors into due diligence, portfolio construction, and risk management. This necessitates collecting and analyzing data on a company's exposure to climate risks. This data should not only consider direct physical risks, but also indirect risks like supply chain vulnerabilities, and the influence of climate change on customer demand. Comprehensive data collection is essential for informed investment decisions.

Furthermore, the framework should encompass robust reporting and transparency mechanisms. Investors need to be able to track and report on their climate-related performance, including their progress in mitigating climate risks and their contributions to a sustainable future. Open communication and collaboration with stakeholders, including clients and other investors, are crucial. By establishing clear reporting standards and transparent communication practices, investors can enhance their credibility and build trust with stakeholders.

The framework should also outline clear strategies for engaging with companies to encourage sustainable practices and transition to a low-carbon economy. Actively participating in shareholder dialogues and engaging with company management on climate-related issues is essential for driving positive change and incentivizing sustainable practices. This proactive engagement can help investors identify companies committed to mitigating climate risks and transitioning to a low-carbon economy. A clear framework is essential for ensuring that climate considerations are seamlessly integrated into every aspect of portfolio management.

Read more about Climate Stress Testing for Real Estate Investment Funds

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing