Climate Risk in Real Estate: Investment Opportunities

The Evolving Landscape of Climate-Related Real Estate Risks

Understanding the Shifting Sands of Climate Risk

Climate change is no longer a distant threat; its impacts are being felt acutely across the globe, and the real estate sector is increasingly vulnerable. Understanding these evolving risks is crucial for investors, developers, and policymakers alike. From rising sea levels jeopardizing coastal properties to increased frequency and intensity of extreme weather events impacting structures and infrastructure, the potential for financial loss and disruption is substantial. This necessitates a proactive and adaptable approach to assessing and mitigating these risks.

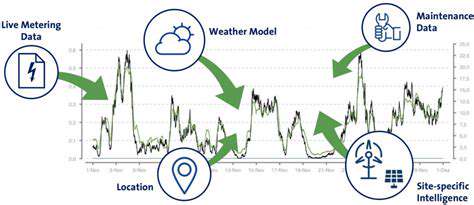

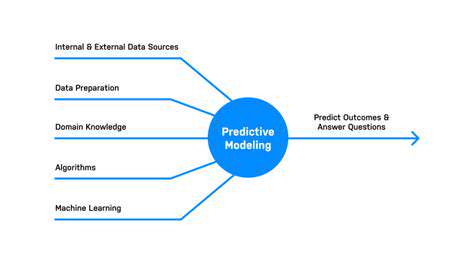

The traditional methods of risk assessment often fail to capture the dynamic nature of climate-related hazards. A robust approach must consider not only historical data but also projected future scenarios, incorporating factors like changing precipitation patterns, rising temperatures, and escalating storm surges. This more comprehensive approach enables a clearer understanding of potential vulnerabilities and allows for more effective risk management strategies.

The Financial Implications of Climate-Related Damage

The financial consequences of climate-related damage to real estate are substantial and far-reaching. Property values can plummet due to flooding, wildfires, or other extreme weather events, impacting not only individual homeowners but also insurance companies and investment portfolios. Insurance premiums often rise due to increased claims, making insurance inaccessible for vulnerable communities or even rendering it prohibitively expensive.

Furthermore, the cost of repairs and rebuilding after a climate-related disaster can be staggering, placing a significant burden on both public and private entities. This can lead to economic slowdowns, disruptions in supply chains, and long-term economic instability. The need for climate-resilient infrastructure and building practices is becoming increasingly apparent, and the long-term financial costs of inaction are substantial.

Adapting Building Codes and Regulations

The evolving climate necessitates a reassessment and adaptation of building codes and regulations to ensure greater resilience. Modernizing building codes to incorporate climate-related risks, such as stronger building materials for extreme wind and flood protection, is becoming increasingly important. This process requires proactive engagement from local authorities, architects, and construction professionals.

Stricter regulations on new construction in high-risk areas, coupled with incentives for retrofitting existing structures, are crucial steps in mitigating climate-related risks. Implementing these measures can significantly reduce the vulnerability of real estate assets and safeguard communities from the escalating impacts of climate change.

Evaluating Property Values in a Changing Climate

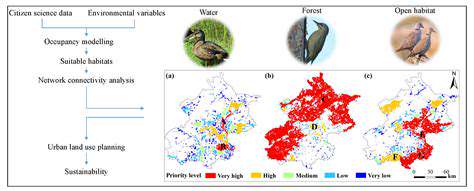

Assessing property values in the context of climate risk is no longer optional; it's a necessity for informed investment decisions. Traditional valuation methods often fail to adequately account for the future impacts of climate change, potentially leading to inaccurate estimations of property worth. This necessitates the development of new valuation models that incorporate climate-related variables, such as flood risk, wildfire risk, and sea-level rise.

Detailed analysis of historical climate data, coupled with projections of future climate scenarios, is essential for a more comprehensive and accurate valuation process. This can better inform investment decisions, promote more responsible development practices, and ultimately safeguard against potential losses resulting from climate-related disasters. These new approaches help ensure that property valuations reflect the true risk profile of the asset.

The Role of Insurance and Risk Transfer Mechanisms

The insurance industry plays a vital role in managing climate-related risks in the real estate sector. Insurance companies are increasingly scrutinizing the climate risk profiles of properties, adjusting premiums and coverage accordingly. This can create challenges for homeowners and businesses in high-risk areas. Innovative risk transfer mechanisms, such as catastrophe bonds and climate insurance products, are emerging as critical tools to manage these risks.

These mechanisms help spread the financial burden of climate-related disasters across a broader range of stakeholders, reducing the impact on any single entity. Furthermore, the development of climate-resilient building practices and proactive risk management strategies can help to reduce the need for costly insurance claims in the long run.

Read more about Climate Risk in Real Estate: Investment Opportunities

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing