Real Estate Climate Risk: Navigating Regulatory Challenges

Regulatory Frameworks and Their Impact on Real Estate

Regulatory Responses to Climate Change

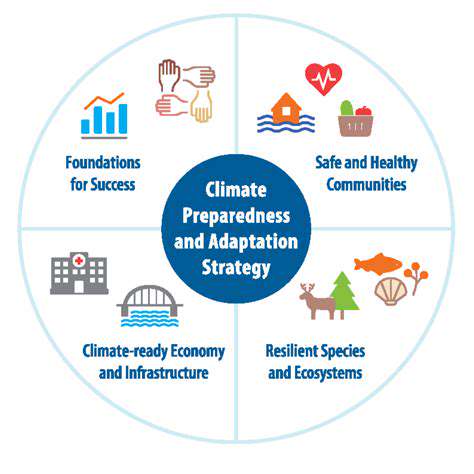

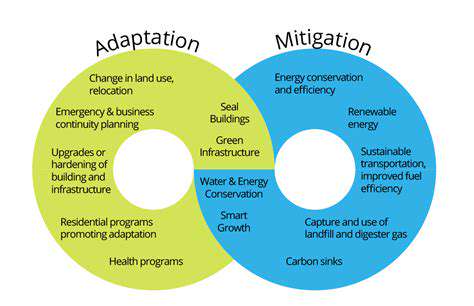

The increasing frequency and intensity of extreme weather events, coupled with rising sea levels, are prompting governments worldwide to develop and implement regulatory frameworks to address climate change's impact on real estate. These frameworks aim to reduce vulnerabilities, promote resilience, and encourage sustainable development practices within the built environment. Such regulations often focus on building codes and construction standards that incorporate climate-related considerations, such as enhanced storm drainage systems, flood-resistant foundations, and improved energy efficiency measures. These proactive measures are intended to minimize the financial and societal repercussions of climate-induced damages to real estate assets.

Furthermore, regulatory bodies are also establishing standards for assessing climate risks in real estate valuations and investments. This shift acknowledges the critical need to incorporate climate change into traditional property appraisals, ensuring that market values reflect the potential vulnerabilities and risks associated with climate-related hazards. By incorporating such risk assessments, investors and lenders can make more informed decisions, reducing the likelihood of high-risk investments and potentially mitigating future losses.

The Impact of Regulations on Property Values and Investment

Regulations designed to mitigate climate risks can have profound effects on property values and investment decisions. Properties located in high-risk zones, for example, may experience a decrease in market value due to increased insurance premiums and perceived vulnerability to climate-related damage. Conversely, properties situated in areas with robust climate resilience measures may see an increase in value due to their enhanced safety and sustainability. This dynamic interplay between regulatory measures and property values necessitates careful consideration for investors and developers navigating the evolving real estate landscape.

The financial implications of climate regulations are multifaceted, impacting both individual property owners and large-scale investors. Insurance companies, for instance, are adjusting their underwriting practices to reflect climate-related risks, potentially increasing premiums for properties in high-risk areas. This shift in insurance costs can significantly affect the affordability and accessibility of certain properties, impacting both homeowners and the broader real estate market. Additionally, the need to retrofit existing properties to meet new standards can represent a considerable financial burden for property owners.

Incentives and Financial Mechanisms Supporting Sustainable Development

Recognizing the financial burden associated with implementing climate-resilient measures, many jurisdictions are exploring incentives and financial mechanisms to support sustainable development in real estate. These initiatives often include tax breaks, grants, and subsidies for homeowners and developers who adopt climate-friendly building practices and retrofit existing structures. Government programs and tax credits can encourage the adoption of renewable energy sources, energy-efficient appliances, and sustainable building materials, further driving the transition towards a low-carbon future in the real estate sector.

Furthermore, innovative financial instruments, such as green bonds and climate-linked insurance products, are emerging to facilitate investment in climate-resilient real estate projects. These mechanisms provide a dedicated funding stream for projects promoting sustainability and resilience, while also offering investors an opportunity to participate in this evolving market. These financial incentives and mechanisms are crucial in helping to bridge the gap between the need for climate-resilient infrastructure and the financial resources necessary to achieve it.

The long-term benefits of these initiatives extend beyond environmental protection, fostering economic growth and creating new job opportunities in the green building and renewable energy sectors. By integrating climate resilience into regulatory frameworks and financial mechanisms, governments can catalyze a transition towards a more sustainable and resilient real estate sector.

Assessing and Managing Physical Climate Risks

Initial Assessment and Planning

A thorough initial assessment is crucial for effectively managing physical clutter. This involves identifying the sources of the clutter, understanding the reasons behind its accumulation, and evaluating the current storage solutions in place. Careful observation and documentation are key steps in this process. This initial step allows you to develop a personalized plan that targets the root causes and avoids simply addressing the symptoms.

The planning phase should consider the desired outcome. Do you want a more organized workspace? A more spacious living area? A more relaxing and aesthetically pleasing environment? Defining clear goals will motivate you and keep you focused throughout the decluttering process. This also helps to prioritize items and tasks.

Decluttering Strategies

Successful decluttering involves employing specific strategies, such as the one-in, one-out rule, the donate, discard, or keep method, and the touch-and-go technique. These strategies help to systematically eliminate items that are no longer needed or used. Implementing these strategies will help you avoid accumulating more clutter in the future. Understanding the reasons for keeping items—whether sentimental value, potential future need, or simple attachment—is essential to making informed decisions.

Using specific containers and designated areas for different items can significantly improve organization. This helps to reduce the visual impact of clutter and create a more controlled environment. A well-organized space is a more efficient and productive space. Furthermore, labeling containers and organizing items by category will aid in the process.

Addressing Underlying Causes

Clutter often reflects underlying issues, such as stress, anxiety, or a lack of time management skills. Understanding and addressing these underlying causes is essential for long-term clutter management. Addressing the root causes of the problem is more sustainable than simply clearing out the clutter. This step focuses on improving your overall well-being and efficiency.

Consider if there are emotional or psychological factors contributing to the accumulation of clutter. Acknowledging and addressing these factors will aid in maintaining a tidy and organized environment over time.

Storage and Organization Techniques

Implementing efficient storage solutions is vital for maintaining a clutter-free environment. This involves utilizing various storage systems, such as shelves, drawers, and containers, in a thoughtful and organized manner. Effective storage solutions make a huge difference in the overall look and feel of a space. Using vertical space effectively can maximize storage capacity and minimize the visual impact of clutter.

Investing in appropriate containers for various items is essential. Labeling containers with clear and concise descriptions ensures easy access and reduces confusion. This makes finding what you need a simple task and prevents further clutter from accumulating.

Maintaining a Clutter-Free Environment

Maintaining a clutter-free environment requires a consistent approach and a commitment to ongoing organization. This involves establishing routines and procedures for handling items that enter the home or workspace. Consistency in decluttering and organizing is essential for long-term success.

Regular review and adjustments to storage and organizational systems are crucial for maintaining a clean and organized environment. Regular decluttering sessions will help you stay ahead of the clutter curve and feel more in control.

Professional Assistance

If you're struggling to manage physical clutter effectively, consider seeking professional assistance from an organizer or consultant. They can provide personalized guidance and support, ensuring a more effective and sustainable solution. Professional help can be a significant investment in time and resources, but it's an investment that yields great returns.

Professional organizers can assess your specific needs and develop a tailored plan for managing clutter, addressing the root causes, and establishing sustainable habits. They can provide invaluable support and guidance.

Opportunities in the Transition to a Sustainable Real Estate Sector

Decarbonizing Existing Buildings

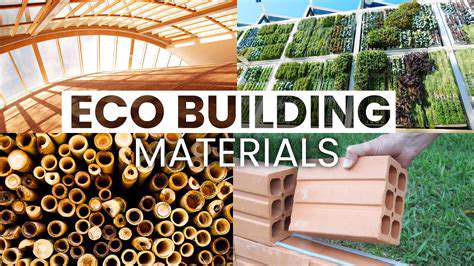

A crucial aspect of the transition to a sustainable real estate sector involves retrofitting existing buildings to reduce their environmental impact. This requires significant investment in energy-efficient upgrades, such as improved insulation, modern HVAC systems, and the integration of renewable energy sources. These upgrades not only lower operational costs for building owners but also contribute significantly to reducing carbon emissions, aligning with broader sustainability goals. This process necessitates a multi-faceted approach, considering factors like building age, construction materials, and the specific needs of tenants.

Retrofitting initiatives also present opportunities for the development of innovative technologies. For example, advancements in smart building technologies allow for real-time monitoring and optimization of energy usage, leading to further reductions in environmental impact.

Sustainable Development Practices

The shift towards sustainable real estate development necessitates a fundamental change in design and construction practices. This includes prioritizing the use of sustainable materials, such as recycled content and locally sourced wood, and implementing green building certifications like LEED. This approach not only minimizes the environmental footprint of new developments but also fosters healthier indoor environments for occupants.

Furthermore, incorporating renewable energy sources, such as solar panels and geothermal systems, into new construction projects significantly reduces reliance on traditional energy grids and enhances the long-term sustainability of the property.

Investment Opportunities in Green Technologies

The increasing demand for sustainable real estate creates a substantial investment opportunity for companies involved in green technologies. This encompasses everything from developing and manufacturing energy-efficient building materials to creating smart building management systems. Investors can capitalize on this trend by supporting companies that are developing and implementing innovative solutions for reducing the environmental impact of the real estate sector.

The potential for return on investment in green technologies is significant as the market for sustainable real estate continues to grow. Furthermore, environmental, social, and governance (ESG) factors are becoming increasingly important considerations for investors, further driving demand for sustainable real estate solutions.

Financing Sustainable Real Estate Projects

Securing funding for sustainable real estate projects is a key challenge that needs innovative solutions. Governments and financial institutions can play a crucial role by developing dedicated financing mechanisms, such as green bonds and low-interest loans, specifically designed for sustainable development. These initiatives provide attractive incentives for developers and investors to adopt sustainable practices, accelerating the transition to a greener real estate sector.

Urban Regeneration and Mixed-Use Developments

Transforming existing urban areas into mixed-use developments that integrate residential, commercial, and recreational spaces presents significant opportunities. Sustainable urban planning can enhance the quality of life for residents and create vibrant, interconnected communities. This approach also promotes energy efficiency by reducing reliance on individual transportation and maximizing the use of shared resources.

Furthermore, the development of green spaces and public transportation systems within these mixed-use developments fosters a more sustainable and resilient urban environment.

The Role of Government Policies

Government policies play a critical role in shaping the transition to a sustainable real estate sector. Implementing incentives, such as tax breaks for green building projects and stricter regulations on energy consumption, encourages the adoption of sustainable practices. These policies create a supportive environment for developers and investors, accelerating the market's shift towards sustainability. Clear and consistent regulations regarding environmental impact assessments and building codes are crucial in achieving meaningful change.

Emerging Trends in Sustainable Real Estate

The real estate sector is constantly evolving, and new trends are emerging to address the need for sustainability. These include the increasing adoption of modular construction techniques, which offer greater efficiency and reduced waste compared to traditional construction methods. Furthermore, the development of innovative building materials, such as bio-based composites, offers exciting possibilities for reducing the environmental impact of construction.

The integration of technology, including smart building management systems and data analytics, is also reshaping how buildings are designed and operated, maximizing energy efficiency and reducing operational costs.

Read more about Real Estate Climate Risk: Navigating Regulatory Challenges

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing