Real Estate Climate Risk: Assessing Portfolio Vulnerabilities

Examples of Physical Transformations

Everyday life abounds with physical transformation examples. Freezing water into ice preserves water's chemical properties while changing its state. Crushing rock creates smaller pieces without altering composition. Water boiling into steam demonstrates another common physical change. These examples show how physical transformations modify substance states without creating new chemical entities.

The Role of Energy in Transitions

Energy fundamentally drives matter's state transitions. Melting ice requires energy to overcome molecular bonds in the solid state, while solid formation typically releases energy. Understanding these energy dynamics proves essential for predicting process outcomes across engineering and biological applications. Temperature and pressure changes often critically influence these transitions.

Integrating Climate Change into Portfolio Management

Understanding Climate Change's Impact on Real Estate

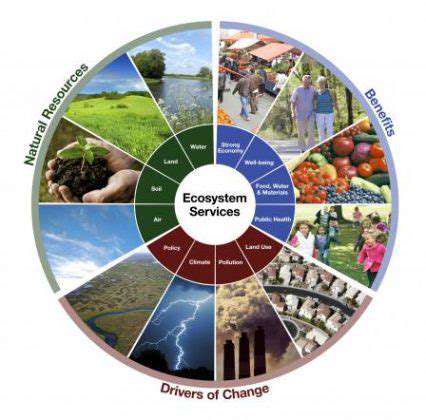

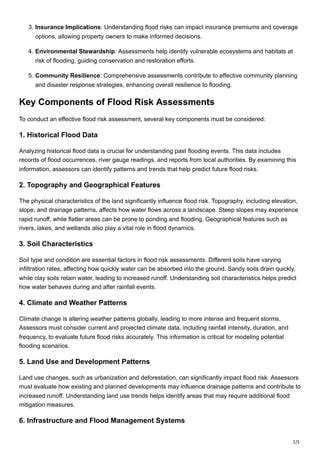

Climate change poses a significant threat to real estate investments, affecting property values, rental yields, and overall portfolio performance. Recognizing risks from rising seas, extreme weather, and temperature pattern shifts is critical for proactive management. This necessitates analysis of flood potential, fire risks, and other climate-related damages that could negatively impact asset valuations and operational expenses.

Assessing Climate-Related Financial Risks

Comprehensive evaluation of climate-related financial risks is essential. This process examines property vulnerability to various climate hazards including heat waves, droughts, and storms. Quantifying potential financial losses from these risks enables effective mitigation strategy development and climate factor incorporation into risk frameworks.

The assessment should consider both direct physical damage and secondary effects like supply chain disruptions and demand changes. Such thorough evaluation supports informed decisions about portfolio diversification and risk allocation.

Identifying Climate-Resilient Properties

Prioritizing climate-resilient properties is crucial for risk mitigation. Evaluation criteria should include construction materials, design features, location characteristics, and surrounding infrastructure. Properties with resilience-enhancing features like elevated foundations or storm-resistant windows are more likely to maintain value and generate stable returns despite climate impacts. Focusing on such properties supports sustainable long-term portfolio performance.

Developing Climate-Specific Investment Strategies

Creating climate-specific investment strategies is vital for adapting to environmental changes. These strategies should anticipate future climate events and incorporate risk reduction measures. Options might include investing in properties less vulnerable to sea-level rise or adopting energy-efficient technologies to lower operational costs. Such approaches help achieve long-term investment objectives while addressing climate challenges.

Integrating Climate Data into Valuation Models

Incorporating climate data into valuation models enables more accurate risk assessment. This process should utilize historical climate records, future climate projections, and local adaptation regulations. Models must account for both physical risks (flooding, extreme heat) and transition risks (policy changes affecting energy-intensive buildings). This integration represents a critical advancement in comprehensive property valuation.

Implementing Climate Risk Management Plans

Effective climate risk management plans are essential for protecting real estate portfolios. These plans should specify actions to reduce climate risk exposure, such as adaptation investments or mitigation measures. They should also include contingency plans to maintain operations during climate-related disruptions. This proactive approach safeguards capital and ensures sustainable investment practices.

Engaging with Stakeholders and Policy Changes

Stakeholder engagement and policy awareness are crucial portfolio management components. Staying informed about evolving sustainability regulations, energy efficiency incentives, and climate resilience standards is vital. Collaboration with local governments helps align investment strategies with long-term climate objectives. Partnering with climate experts and organizations facilitates navigation of complex policy landscapes and their investment implications.