Affordable Green Housing: Innovation and Implementation

Financial Incentives and Policy Support for Implementation

Financial Incentives for Green Housing Development

Financial incentives play a crucial role in encouraging the development and adoption of green building practices in affordable housing. These incentives can take various forms, including tax credits, grants, and subsidies specifically targeted at projects incorporating sustainable materials, energy-efficient designs, and renewable energy sources. By reducing the upfront costs associated with green building technologies, these incentives make it more economically viable for developers and builders to incorporate environmentally friendly features into their projects.

Furthermore, streamlined permitting processes and expedited approval timelines for green building projects can significantly reduce the administrative burden and encourage faster implementation of these initiatives. This efficient approach fosters a more favorable environment for developers to pursue environmentally conscious designs, ultimately contributing to a larger-scale adoption of sustainable practices in affordable housing.

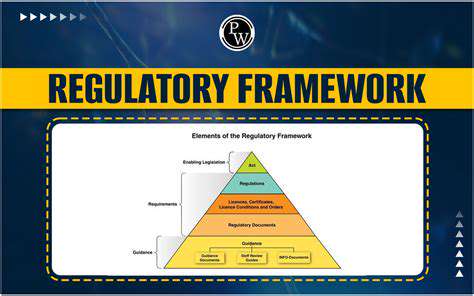

Policy Support for Green Building Codes and Standards

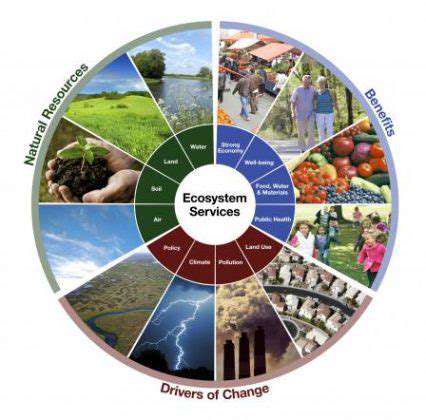

Strong policy support is essential for creating a robust framework that promotes green building practices in affordable housing. This support often involves the implementation of stringent building codes and standards that mandate energy efficiency, water conservation, and the use of sustainable materials. By establishing clear and consistent regulations, governments can incentivize developers to prioritize environmental considerations and ensure that affordable housing developments meet specific green building criteria.

Government Grants and Subsidies for Green Home Improvements

Government grants and subsidies can provide significant financial assistance to homeowners who wish to improve the energy efficiency and sustainability of their affordable housing units. These programs can help offset the costs associated with upgrades like installing solar panels, improving insulation, or upgrading windows and doors. Such financial support can empower homeowners to make informed decisions about energy-efficient improvements and contribute to overall energy savings in the long run.

Tax Credits and Deductions for Green Building Materials and Practices

Offering tax credits and deductions for the use of green building materials and practices can effectively stimulate the market for sustainable building materials. These incentives make it more attractive for builders and developers to incorporate eco-friendly materials, such as recycled content, locally sourced materials, and sustainable wood products, into affordable housing projects. Tax incentives can also encourage the use of energy-efficient appliances and systems, further reducing the environmental impact of the housing.

Community-Based Initiatives and Partnerships

Community-based initiatives and partnerships can play a vital role in promoting green building practices within affordable housing communities. These initiatives can involve collaborations between local governments, non-profit organizations, and community groups to provide educational workshops, technical assistance, and training programs for developers and homeowners. Such programs can enhance awareness and understanding of green building techniques, fostering a supportive environment for sustainable practices within the community. Furthermore, these partnerships can lead to the development of innovative financing mechanisms tailored to the specific needs of affordable housing projects.

Read more about Affordable Green Housing: Innovation and Implementation

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing