Stranded Assets: Climate Risk for Developers

The Evolving Threat of Climate Change on Real Estate Investments

The Growing Risk of Physical Damage

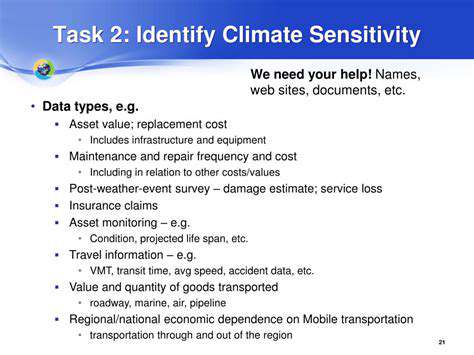

Climate change is manifesting in increasingly frequent and severe weather events, posing a significant threat to real estate investments. Flooding, wildfires, hurricanes, and droughts are causing substantial physical damage to properties, impacting their value and rendering them uninhabitable. The rising sea levels are further exacerbating the issue, with coastal properties facing increased vulnerability to storm surges and erosion, leading to costly repairs or even complete loss. These events are not isolated incidents but rather a growing pattern that demands careful consideration for investors.

Shifting Regulatory Landscapes

Governments worldwide are responding to the escalating climate crisis by enacting stricter environmental regulations. These regulations often include building codes, zoning laws, and emission standards, which can significantly impact the profitability and marketability of certain real estate investments. Developers and property owners need to adapt to these evolving standards, potentially incurring substantial costs for renovations or modifications to comply with new regulations. The regulatory landscape is constantly shifting, requiring ongoing vigilance and adaptation.

The Impact on Insurance Costs

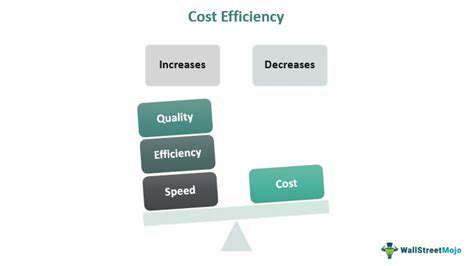

Climate change is driving up insurance premiums for properties situated in high-risk areas. As insurers face increased payouts due to weather-related damages, they are forced to adjust their pricing models, often leading to substantial increases in insurance costs. This price hike can make certain properties less attractive to potential buyers, negatively impacting their value and potentially leading to a decrease in investment returns. This is a major concern for investors who need to factor rising insurance costs into their financial projections.

The Diminishing Value of Stranded Assets

Properties located in areas vulnerable to climate change impacts, such as rising sea levels or increased flooding, are increasingly considered stranded assets. This means these properties may lose value or become completely unsellable in the future. Investors need to carefully assess the long-term viability of these assets and factor in the potential for decreased future returns due to environmental degradation. This presents a significant risk for investors who hold properties in vulnerable areas.

Adapting Investment Strategies for a Changing Climate

Investors need to adapt their strategies to account for the evolving climate risk. This includes conducting thorough due diligence on properties, assessing their vulnerability to climate change impacts, and factoring in future regulatory changes. Diversification into more resilient property types and locations is also a crucial element of a climate-conscious investment strategy. Developing a comprehensive risk assessment protocol is paramount for mitigating potential losses.

The Importance of Climate-Resilient Design

Integrating climate-resilient design principles into new construction and renovations is becoming increasingly important. This includes incorporating features like flood-resistant foundations, drought-tolerant landscaping, and energy-efficient systems. These design choices not only mitigate climate risks but also contribute to long-term sustainability, potentially enhancing property value and attracting environmentally conscious buyers. Sustainability should be a key factor in evaluating new investment opportunities.

The Financial Implications for Real Estate Funds

Real estate investment funds need to take proactive steps to address the financial implications of climate change. This includes incorporating climate risk assessments into their investment processes, diversifying their portfolios to include more climate-resilient properties, and engaging with developers and property owners to promote sustainable practices. These funds must adapt their investment strategies to ensure the long-term viability of their holdings and mitigate the growing financial risks associated with climate change. Failure to do so could lead to substantial losses in the future.

Read more about Stranded Assets: Climate Risk for Developers

Hot Recommendations

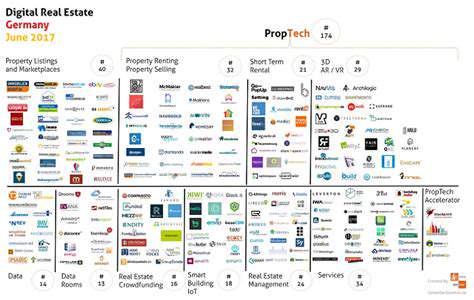

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing