Real Estate Innovation: The Rise of PropTech and Smart Buildings

The Rise of Digital Transformation

Modern real estate is experiencing a seismic shift as digital innovations reshape traditional practices. Gone are the days of paper listings and manual processes; today's market thrives on cutting-edge technologies that connect buyers, sellers, and investors in unprecedented ways. What makes this revolution remarkable is how it simplifies complex transactions while maintaining human oversight where it matters most. Virtual tours now complement physical showings, and algorithmic valuations work alongside expert appraisers to create a balanced ecosystem.

This evolution extends beyond mere convenience - it's democratizing property markets globally. First-time homebuyers can now access tools previously reserved for industry professionals, leveling the playing field in remarkable ways. The ripple effects are evident as more diverse participants enter markets that were once exclusive domains, facilitated by intuitive platforms that guide users through each step of their real estate journey.

Innovative Solutions for Existing Challenges

Forward-thinking companies are addressing age-old industry pain points with creative technological solutions. Manual paperwork that once took weeks now completes in hours through automated systems, while blockchain applications bring unprecedented transparency to title transfers. The financing sector particularly benefits from these advances, with digital platforms creating efficient bridges between capital sources and development projects.

Property management undergoes its own quiet revolution through smart automation. Predictive maintenance algorithms alert managers to issues before they become problems, while tenant portals streamline communication in both directions. These improvements create tangible value - buildings operate more efficiently, residents enjoy better service, and owners see improved returns on their investments.

Future Trends and Implications

Looking ahead, the intersection of real estate and technology promises even more transformative developments. Artificial intelligence will likely become the industry's invisible assistant, handling routine tasks while providing insights drawn from vast datasets. Virtual reality may evolve beyond property tours to become standard tools for remote collaboration between international partners on development projects.

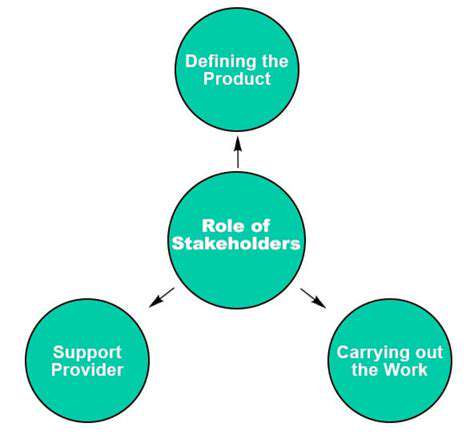

These advancements will fundamentally alter career paths in real estate. Professionals will spend less time on administrative work and more on strategic advisory roles where human judgment adds irreplaceable value. The most successful firms will likely be those that best integrate new tools while maintaining the personal relationships that have always been the industry's foundation.

Digitizing the Real Estate Transaction Process

Streamlining the Home Buying Journey

Modern transaction platforms have transformed what was once a paperwork-intensive ordeal into a surprisingly smooth experience. Today's buyers can complete much of the process from their smartphones - viewing properties through high-definition virtual tours, submitting offers with digital signatures, and tracking progress through transparent dashboards. This convenience particularly benefits working professionals and international buyers who previously faced logistical hurdles.

Improving Transparency and Efficiency

Digital ledgers now provide immutable records of property histories, while smart contracts automate escrow processes with built-in compliance checks. These innovations don't just speed up transactions - they create audit trails that benefit all parties. Title companies report significant reductions in claims as these systems eliminate traditional pain points in the transfer process.

Enhanced Security and Risk Mitigation

Contemporary platforms employ military-grade encryption alongside multi-factor authentication, creating environments where sensitive financial data remains protected throughout complex transactions. Fraud detection systems now analyze patterns across thousands of data points, flagging suspicious activity with remarkable accuracy.

The Future of Real Estate Transactions

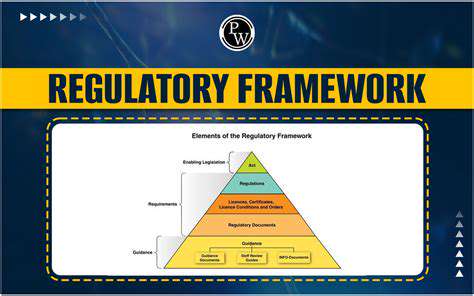

Tomorrow's transactions may incorporate biometric verification and AI-powered compliance checks that adapt to local regulations in real time. We might see the emergence of transaction concierges - intelligent systems that guide users through each step while anticipating their needs based on behavioral patterns.

Investment Opportunities and Challenges in PropTech

Investment Opportunities in PropTech

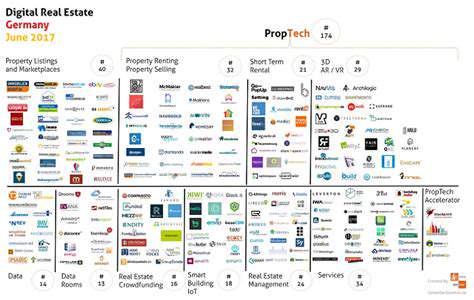

The burgeoning sector offers diverse entry points for capital - from enterprise software streamlining large portfolios to consumer apps revolutionizing how people find homes. Particularly promising are solutions that bridge physical and digital experiences, creating seamless interactions between properties and their occupants.

Challenges Facing PropTech Investments

While opportunities abound, investors must navigate a rapidly evolving landscape where today's cutting-edge solution may become tomorrow's obsolete technology. The most successful investors often partner with industry veterans who can separate genuine innovations from passing fads.

Long-Term Trends and Considerations

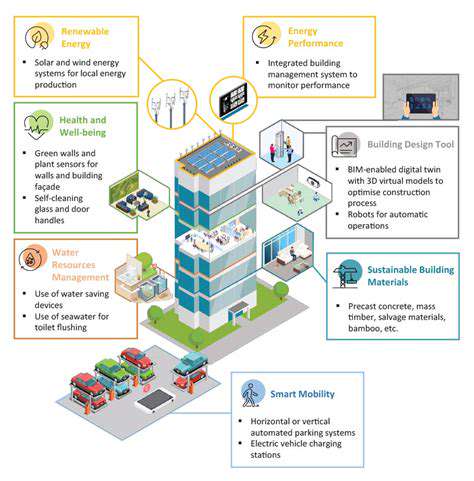

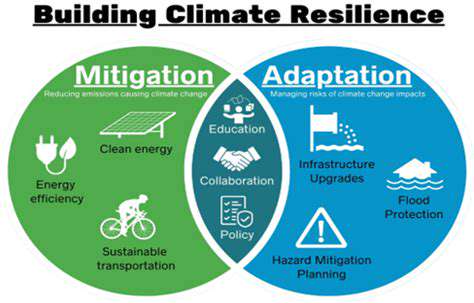

Sustainability-focused technologies appear particularly well-positioned as environmental concerns reshape development priorities. Solutions that reduce energy consumption or improve building efficiency may offer both financial returns and positive environmental impact - a powerful combination for modern investors.

The Future of Real Estate: Seamless Integration of Technology

Enhanced Customer Experiences

The next generation of real estate services will likely feel more like personalized concierge than traditional transactions. Imagine systems that learn your preferences over time, suggesting properties you'll love before you even search for them.

Automation and Efficiency

Routine tasks will increasingly handle themselves, freeing professionals to focus on creative problem-solving and relationship-building. This shift may redefine success in the industry, valuing strategic thinking over administrative prowess.

Data-Driven Decision Making

Advanced analytics will empower all market participants with insights once available only to institutional players. This democratization of information could make markets more efficient while reducing information asymmetries.

Smart Homes and Integrated Systems

Future properties may anticipate occupant needs through ambient computing - adjusting environments automatically while providing intuitive control through natural interfaces.

Sustainable and Eco-Friendly Practices

Green technologies will likely become standard rather than premium features as the industry responds to climate challenges. Properties that demonstrate genuine sustainability may command lasting value premiums.

Read more about Real Estate Innovation: The Rise of PropTech and Smart Buildings

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing