Climate Risk and Real Estate Asset Valuation

The Impact on Property Insurance and Financing

Property Insurance Market Shifts

The increasing frequency and severity of climate-related events are significantly impacting the property insurance market. Insurers are facing rising claims costs, leading to higher premiums and, in some cases, a reluctance to offer coverage in high-risk areas. This dynamic is creating challenges for homeowners, renters, and businesses alike, as finding affordable insurance becomes more difficult, particularly in regions experiencing more intense weather patterns like hurricanes, wildfires, and floods. This shift in the insurance market is forcing a reevaluation of risk assessment methodologies and potentially leading to changes in building codes and construction practices.

Financing Challenges for Vulnerable Properties

Climate risk is also creating hurdles for financing real estate. Lenders are increasingly scrutinizing properties located in areas prone to climate-related disasters. This heightened scrutiny often leads to higher interest rates, stricter loan terms, or outright denial of financing for properties in vulnerable zones. This can be particularly problematic for homeowners attempting to purchase or refinance, as well as developers seeking to build in areas experiencing heightened environmental risks. The financial implications for both buyers and sellers are significant and underscore the need for accurate risk assessments and potentially tailored financing solutions for vulnerable properties.

Changes in Real Estate Investment Strategies

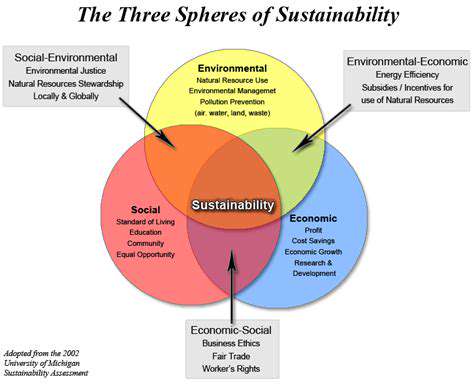

Investors are adapting their strategies to account for climate risk. This includes diversifying portfolios to include properties in less vulnerable areas, investing in climate-resilient infrastructure and construction methods, and incorporating climate-related risk assessments into their due diligence processes. The increasing awareness of climate change is prompting a shift toward more sustainable and resilient investments, and those who fail to adapt risk losing out on opportunities or experiencing significant financial losses.

The Role of Government Regulations

Government regulations and policies play a crucial role in mitigating climate risk to real estate. Regulations pertaining to building codes, land-use planning, and insurance requirements can help reduce vulnerability to climate impacts. However, the effectiveness of these regulations often varies based on factors like local political will, financial resources, and community engagement. Government interventions are essential to ensure the long-term stability and resilience of the real estate market in the face of climate change.

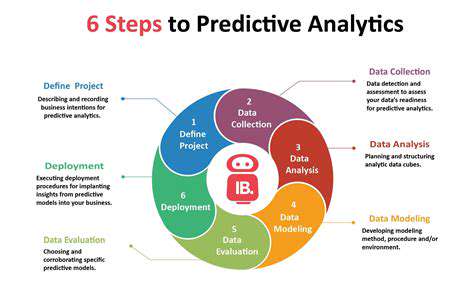

The Need for Enhanced Risk Assessment Tools

Accurate and comprehensive risk assessments are essential to understanding and managing climate risks to real estate. These assessments should go beyond traditional methodologies and incorporate detailed climate projections, hydrological models, and vulnerability analyses. The development and application of advanced risk assessment tools are crucial for informing insurance pricing, financing decisions, and real estate investment strategies. Improved data collection, modeling techniques, and predictive capabilities are necessary to effectively navigate the complexities of climate risk and ensure long-term sustainability of real estate assets.

Read more about Climate Risk and Real Estate Asset Valuation

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing