Green Mortgages and Sustainable Property Financing

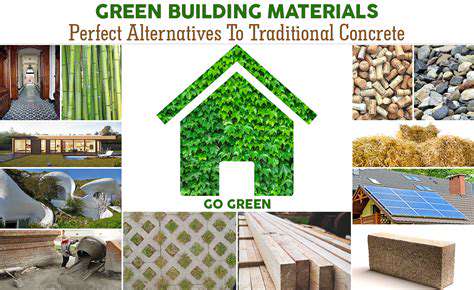

The demand for environmentally conscious financial products is rapidly increasing, and green mortgages are emerging as a significant component of this shift. These mortgages often come with incentives for borrowers who make sustainable improvements to their properties, such as installing solar panels or upgrading insulation. This not only benefits the environment but also can lead to long-term savings on energy bills for homeowners, making the investment attractive from both an ecological and financial perspective.

The growing awareness of climate change and its impacts on property values is driving the adoption of green mortgages. Lenders are recognizing the importance of sustainability and are increasingly developing products that encourage environmentally responsible building practices and resource conservation. This trend is likely to continue as regulatory pressure and consumer demand for sustainable options increase.

Sustainable Property Financing: Beyond Mortgages

Sustainable property financing isn't limited to traditional mortgages. It encompasses a wide range of financial instruments designed to support the development and operation of environmentally friendly properties. These include green bonds, which are debt securities issued to fund projects with environmental benefits, and impact investments, which seek to generate both financial returns and positive social or environmental impact.

Innovative financing models are crucial for accelerating the transition to a more sustainable built environment. By providing capital for sustainable projects, these instruments help attract private investment, foster innovation, and ultimately contribute to a more eco-friendly future for property development and management.

The Role of Government Incentives in Promoting Sustainable Financing

Government incentives play a critical role in encouraging the adoption of sustainable property financing. Tax breaks, subsidies, and grants for energy-efficient improvements can make these projects more financially attractive for homeowners and developers. Such policies can significantly influence market trends and accelerate the transition toward environmentally responsible practices.

By strategically implementing these incentives, governments can foster a more sustainable built environment and address pressing environmental concerns. These programs can also stimulate economic growth by creating jobs in green industries and promoting innovation in sustainable technologies.

Impact of Technology on Sustainable Financing

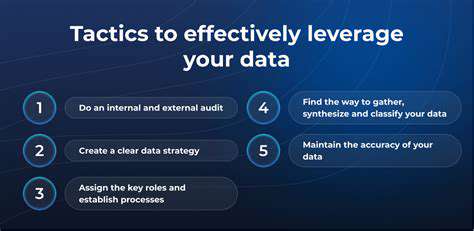

Technological advancements are transforming the way sustainable property financing operates. Data analytics and digital platforms are enabling lenders to assess the environmental performance of properties more accurately and efficiently. This data-driven approach can facilitate the development of more sophisticated and tailored financing solutions for environmentally conscious projects.

Addressing Environmental Risks in Property Valuation

Accurate assessment of environmental risks associated with properties is crucial for responsible financing. Factors like proximity to environmentally sensitive areas, potential for flooding, and the presence of contaminated sites need to be considered in the valuation process. This approach ensures that financing decisions are made with a comprehensive understanding of the environmental risks involved and promotes responsible investment in sustainable properties.

Integrating environmental considerations into property valuations is becoming increasingly important for both lenders and borrowers. This approach minimizes financial risks and promotes the development of sustainable and resilient communities.

The Future of Green Building Standards

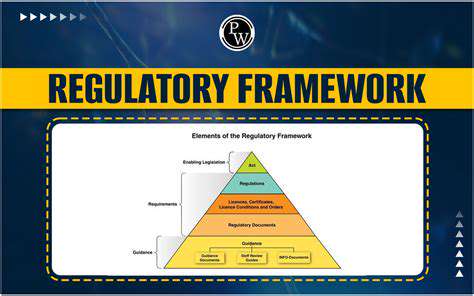

The future of sustainable property financing is inextricably linked to the evolution of green building standards. Stringent and widely adopted standards can provide a clear framework for evaluating and promoting environmentally responsible practices. This can help to ensure that financing is directed towards projects that truly meet sustainability goals.

The ongoing development and refinement of green building standards will play a key role in shaping the future of sustainable property financing. These standards will provide a common language and benchmark for evaluating the environmental performance of buildings, ultimately driving the market towards more sustainable and resilient development.