AI Driven Due Diligence for Property Investment

Data Collection Strategies

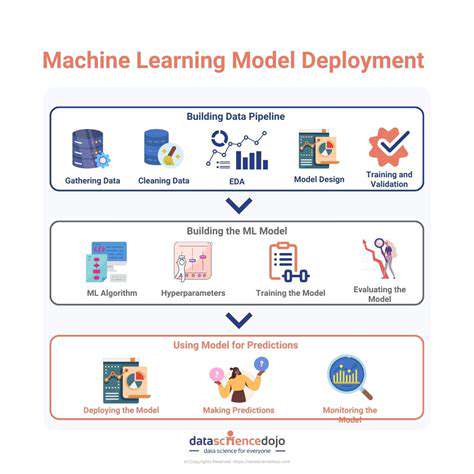

AI-powered data aggregation systems utilize sophisticated algorithms to identify, collect, and process data from diverse sources. These systems can automatically extract relevant information from unstructured data like text documents, social media posts, and sensor readings, significantly expanding the scope of data collection beyond traditional methods. The ability to seamlessly integrate with various data sources is crucial for comprehensive analysis and reporting. Furthermore, these systems can be programmed to prioritize specific data points based on predefined criteria, ensuring that the most valuable information is readily accessible.

Data quality is paramount in AI-powered data aggregation. Robust validation and filtering mechanisms are essential to ensure accuracy and reliability. These mechanisms can identify inconsistencies, errors, and biases in the data, helping to maintain the integrity of the aggregated information. The systems are designed to handle large volumes of data, ensuring that data is not lost or distorted during the collection and processing stages. Furthermore, these systems often include features for data cleansing and transformation, which further enhances the quality and usability of the collected data.

Analysis and Insights Generation

Once the data is aggregated, AI-powered systems can perform sophisticated analyses to extract meaningful insights. These analyses can range from simple trend identification to complex predictive modeling. This allows businesses to make data-driven decisions, anticipate future trends, and optimize various operations. The ability to identify patterns and correlations in data that might otherwise go unnoticed is a key advantage of AI-powered systems.

AI algorithms can also be used to create comprehensive reports and visualizations. These reports can be tailored to specific needs and provide actionable insights. For example, an AI-powered system could generate reports highlighting key performance indicators (KPIs) for a particular department or project. These dynamic reports can be updated in real-time, allowing users to track progress and make adjustments as needed. This capability enables more agile decision-making, resulting in improved efficiency and productivity.

Predictive modeling capabilities are another crucial aspect of AI-powered data aggregation. By analyzing historical data and identifying patterns, these systems can predict future outcomes, enabling businesses to proactively address potential challenges. For instance, a system might predict potential customer churn based on past behavior, allowing for targeted interventions to retain valuable customers.

Moreover, the ability to automate data analysis tasks significantly reduces the time and resources needed for data-driven decision-making. This automation frees up human analysts to focus on more strategic tasks and higher-level insights, ultimately leading to greater efficiency and productivity.

Predictive Modeling for Enhanced Market Insight

Understanding the Predictive Power of AI

Predictive modeling, powered by artificial intelligence (AI), is revolutionizing market analysis. By leveraging vast datasets and sophisticated algorithms, AI can identify patterns and trends that are often invisible to human analysts. This enhanced visibility allows for more accurate forecasting of future market behavior, enabling informed decision-making and a deeper understanding of market dynamics. This predictive capability is particularly valuable in the real estate sector, where market fluctuations can significantly impact investment strategies.

AI algorithms learn from historical data, identifying relationships and correlations between various factors. This learning process allows the AI to predict potential future outcomes, offering valuable insights into market trends, pricing fluctuations, and potential investment opportunities. The accuracy of these predictions can be substantially higher than traditional methods, leading to more effective and profitable investments.

Data Preparation and Feature Engineering

A crucial aspect of successful predictive modeling is the quality and preparation of the data used to train the AI models. Data cleaning, transformation, and feature engineering are essential steps to ensure the model's accuracy and reliability. This involves identifying and handling missing data, transforming variables into suitable formats, and creating new features that capture relevant market characteristics. Robust data preparation is fundamental for achieving reliable predictive outcomes.

Model Selection and Training

Choosing the appropriate AI model for a specific predictive task is critical. Different models excel in different situations. From linear regression to more complex algorithms like support vector machines or neural networks, the selection depends on the nature of the data and the desired outcome. The training process involves feeding the selected model with the prepared data, allowing it to learn the relationships between input variables and the target variable. Careful model selection and effective training are essential to harness the predictive power of AI.

Evaluating Model Performance

Assessing the accuracy and reliability of a predictive model is paramount. Evaluation metrics like Mean Squared Error (MSE), Root Mean Squared Error (RMSE), and R-squared are used to quantify the model's performance. These metrics provide insights into the model's ability to accurately predict future outcomes. Regular monitoring and evaluation are crucial to ensure the model remains relevant and effective as market conditions evolve.

Integrating AI into Due Diligence Processes

AI-driven predictive modeling can be seamlessly integrated into property due diligence processes. By incorporating the insights from predictive models, property analysts can identify potential risks, evaluate investment opportunities, and make more data-driven decisions. For example, AI can forecast property values, assess market trends, and predict potential rental income. This integration streamlines the due diligence process, leading to more efficient and accurate assessments.

Real-World Applications in Property Investment

Predictive modeling is already transforming property investment decisions across the globe. Investors can leverage these insights to identify undervalued properties, assess rental income potential, and predict future market fluctuations. By understanding the future market outlook, investors can make more informed decisions and optimize their investment portfolios. AI-powered predictive modeling is critical for navigating the complexities of the real estate market and achieving superior returns.

The traditional linear model, a cornerstone of many scientific and economic analyses, posits a direct, predictable relationship between variables. This straightforward approach assumes that changes in one variable directly and proportionally influence another, creating a clear, linear path from cause to effect. Understanding this foundational principle is crucial for grasping the model's strengths and limitations.

Automated Risk Assessment and Mitigation Strategies

Defining Automated Risk Assessment

Automated risk assessment, a cornerstone of modern AI-driven due diligence, involves the use of sophisticated algorithms and machine learning models to identify, analyze, and prioritize potential risks associated with various business ventures. This process transcends traditional methods by leveraging vast datasets and complex calculations to quickly evaluate a wide range of factors, from financial stability to regulatory compliance. It goes beyond simply identifying risks, providing a quantified assessment of their potential impact and likelihood, which is crucial for informed decision-making.

This approach significantly streamlines the due diligence process, enabling companies to make quicker and more informed decisions regarding investments, partnerships, and acquisitions. The speed and accuracy of automated risk assessment are particularly valuable in today's fast-paced business environment, allowing for proactive risk management and more efficient allocation of resources.

Key Components of Automated Risk Mitigation

Effective risk mitigation strategies involve more than just identifying potential problems; they require proactive measures to minimize or eliminate those risks. Automated systems can play a pivotal role in this process by identifying and implementing appropriate mitigation strategies tailored to the specific risk profile. This includes recommending corrective actions, developing contingency plans, and even implementing automated controls to prevent future occurrences. The ability to dynamically adjust these mitigation strategies as the risk landscape evolves is a critical advantage of AI-driven solutions.

Leveraging AI for Enhanced Accuracy and Speed

AI's ability to process vast amounts of data with unprecedented speed and accuracy significantly enhances the effectiveness of risk assessment. Machine learning algorithms can analyze historical data, identify patterns, and predict future outcomes with remarkable precision. This allows for a more comprehensive and nuanced understanding of potential risks, leading to more accurate estimations of their likelihood and impact. The result is a more robust and reliable risk assessment process, contributing significantly to the overall success of the investment or business partnership.

Furthermore, automated systems can sift through massive datasets far more quickly than human analysts, drastically reducing the time required for risk assessments. This speed is invaluable in today's competitive market, allowing companies to make informed decisions in a timely manner, and capture opportunities that might otherwise be missed.

Integrating Risk Assessment into the Due Diligence Process

Integrating automated risk assessment tools into the due diligence process provides a more comprehensive and efficient approach. Instead of being an isolated step, risk assessment becomes an integral part of the overall evaluation. This seamless integration allows for a continuous flow of information, facilitating more informed decision-making at every stage of the process. The continuous monitoring and updating of risk profiles also enhance the accuracy of the evaluation over time.

The Future of Automated Risk Mitigation

The future of risk assessment and mitigation will be increasingly driven by the advancement of AI and machine learning technologies. Emerging capabilities, such as natural language processing and predictive modeling, will allow for even more sophisticated analyses of complex risk factors. This includes the ability to analyze unstructured data, such as news articles and social media posts, to identify emerging risks and trends. These advancements will make automated risk assessments even more powerful and proactive, enabling businesses to identify and mitigate potential problems before they arise.

This evolution will lead to a more agile and anticipatory approach to risk management, equipping companies with the tools to navigate a dynamic and unpredictable business environment.

The Future of AI in Property Investment: Opportunities and Challenges

AI-Powered Property Valuation

AI algorithms are revolutionizing property valuation by analyzing vast datasets of comparable properties, market trends, and economic indicators. This allows for significantly more accurate and efficient valuations compared to traditional methods, which often rely on subjective appraisals. This automated process can save considerable time and resources for investors, particularly in rapidly evolving markets. Furthermore, AI can identify subtle patterns in data that might be missed by human analysts, leading to more sophisticated and insightful assessments of property value.

These advanced valuation models can also factor in a wider range of variables, such as neighborhood amenities, school quality, and proximity to public transportation. This comprehensive approach to valuation is crucial for making informed investment decisions in the current complex real estate landscape.

Predictive Analytics for Investment Strategy

AI-driven predictive analytics can forecast future market trends in the property investment sector. By analyzing historical data, current market conditions, and economic projections, AI systems can identify promising investment opportunities and potential risks. This capability enables investors to make data-driven decisions, minimizing the element of guesswork and enhancing their chances of success.

Automated Property Management

AI-powered tools are streamlining property management tasks, such as tenant screening, lease agreements, and maintenance requests. This automation frees up valuable time for property managers to focus on higher-level strategic initiatives, improving efficiency and potentially reducing operational costs.

Furthermore, AI-powered chatbots can handle routine inquiries and issues, providing faster and more consistent support to tenants. This leads to improved tenant satisfaction and potentially reduces the volume of calls and emails handled by human staff.

Enhanced Due Diligence and Risk Assessment

AI can significantly enhance due diligence processes by automating the analysis of vast amounts of property-related data. This includes verifying legal documents, assessing property condition, and identifying potential risks associated with a given investment. This significantly reduces the time and effort required for comprehensive due diligence, allowing investors to evaluate more properties more quickly and efficiently.

By identifying potential problems early on, AI can help investors mitigate risks and make more informed decisions, ultimately leading to higher success rates and reduced losses.

Personalized Investment Recommendations

AI can tailor investment recommendations to individual investors' specific needs and risk tolerances. By analyzing investor profiles and market conditions, AI systems can suggest optimal investment strategies, property types, and locations. This personalized approach ensures that investment decisions align with individual financial goals and risk appetite.

Improved Fraud Detection and Security

AI algorithms can detect fraudulent activities related to property investments. By analyzing transaction patterns, identifying unusual activity, and flagging potential red flags, AI can significantly reduce the risk of fraud and financial losses. This enhanced security measure protects investors and maintains the integrity of the real estate market.

This proactive approach to fraud prevention safeguards investment capital and ensures the sustainability of the entire property investment ecosystem. The ability of AI to identify anomalies and patterns that might be missed by human analysts is a major advantage in this area.

Read more about AI Driven Due Diligence for Property Investment

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing