AI Powered Valuation: A Powerful Tool for Property Management

Improved Decision-Making for Property Owners and Managers

Streamlining Valuation Processes

AI-powered valuation tools are revolutionizing the way property owners and managers approach property assessments. These sophisticated systems analyze vast datasets, including comparable sales, market trends, and property characteristics, to generate highly accurate and detailed valuations in a fraction of the time it takes traditional methods. This efficiency not only saves valuable time and resources but also allows for more informed decisions, whether it's setting rental rates, determining investment potential, or negotiating property sales.

The automation inherent in these tools minimizes the potential for human error often associated with manual valuations. By eliminating subjective judgments and relying on objective data analysis, AI ensures a more consistent and transparent process, leading to greater trust and confidence in the valuation results. This improved accuracy also helps avoid costly miscalculations in financial projections and investment strategies.

Enhanced Market Insight and Forecasting

AI algorithms excel at identifying patterns and trends within complex real estate markets. By constantly learning and adapting to evolving market conditions, these systems can provide accurate predictions of future property values, enabling proactive decision-making. Property owners and managers can leverage this foresight to anticipate market fluctuations, adjust strategies accordingly, and capitalize on emerging opportunities. This advanced market intelligence is crucial for staying ahead of the curve in a dynamic real estate environment.

Understanding market fluctuations is vital for accurate forecasting. AI systems track factors like interest rates, economic indicators, and local zoning changes, all of which significantly impact property values. This comprehensive analysis allows for more accurate projections, equipping decision-makers with the information necessary to make well-informed choices and potentially mitigate risks.

Improved Investment Strategies

The ability to analyze vast datasets and predict market trends empowers investors to make more data-driven decisions. AI-powered valuation tools provide insights into investment potential, allowing for a more strategic approach to portfolio management. By identifying high-growth areas, assessing risk factors, and evaluating potential returns, investors can optimize their portfolios and potentially achieve higher returns while minimizing risk. This enhanced ability to predict market performance is a significant advantage for real estate investment strategies.

Optimizing Rental Rates and Revenue

AI-driven valuation models can help optimize rental rates by providing real-time data on comparable properties in the area. This allows for more accurate pricing strategies, leading to higher occupancy rates and increased revenue. Property managers can use this data to refine their pricing models and tailor their strategies to specific market segments, maximizing potential income. By analyzing market trends and tenant preferences, AI-powered systems can contribute significantly to maximizing rental income and streamlining the overall management process.

Streamlining the Valuation Process

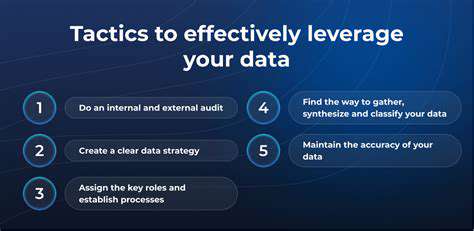

Understanding the Traditional Valuation Process

Traditional valuation methods often rely on extensive research, historical data analysis, and expert opinions. This process can be time-consuming and resource-intensive, especially for complex assets or rapidly evolving markets. Gathering the necessary data points, verifying their accuracy, and synthesizing them into a comprehensive valuation report can take weeks or even months, hindering the speed and efficiency of critical business decisions.

Challenges of Manual Valuation

Manual valuation processes are susceptible to human error, which can lead to inaccurate or inconsistent results. Subjectivity in the interpretation of data, inconsistencies in methodology, and the potential for bias can all affect the reliability of the final valuation. This inherent risk can have significant financial implications, particularly in situations demanding precise and objective evaluations.

Furthermore, the sheer volume of data needed for comprehensive analysis often overwhelms traditional valuation methods. Manual data collection and processing are prone to errors and can take an excessive amount of time, potentially delaying crucial decisions or creating bottlenecks in the workflow.

The Rise of AI in Valuation

Artificial intelligence (AI) is rapidly transforming the valuation process, offering a more efficient, accurate, and objective approach. AI-powered tools leverage machine learning algorithms to analyze vast datasets, identify patterns, and generate valuations with greater speed and precision than traditional methods.

Benefits of AI-Driven Valuation

AI-driven valuation systems provide several key advantages. They automate data collection and analysis, minimizing the risk of human error and significantly reducing the time required for valuations. This increased efficiency allows businesses to make quicker decisions, adapt to market changes more effectively, and gain a competitive edge.

Furthermore, AI's ability to analyze complex data sets and identify hidden patterns can reveal insights that traditional methods might miss. This deeper understanding of market dynamics leads to more accurate and reliable valuations, reducing the risk of financial miscalculations.

Accuracy and Objectivity in AI Valuation

AI algorithms are trained on vast amounts of historical data, enabling them to identify complex relationships and correlations that might not be apparent to human analysts. This data-driven approach minimizes subjective interpretations and biases, resulting in more objective and accurate valuations. The consistent application of algorithms ensures that valuations are consistently applied across different assets and situations.

Future of AI Valuation in Business

The future of AI in valuation is promising. As AI technology continues to advance, we can anticipate even more sophisticated and accurate valuation models. This will further enhance the efficiency and reliability of the valuation process, enabling businesses to make more informed decisions and achieve optimal financial outcomes. Integration with other business intelligence systems will undoubtedly create a more dynamic and responsive approach to understanding asset value.

Read more about AI Powered Valuation: A Powerful Tool for Property Management

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

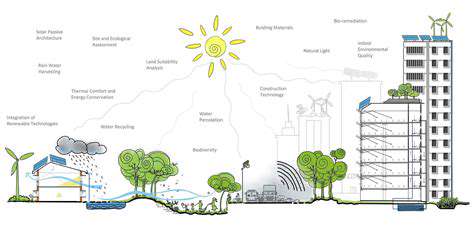

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

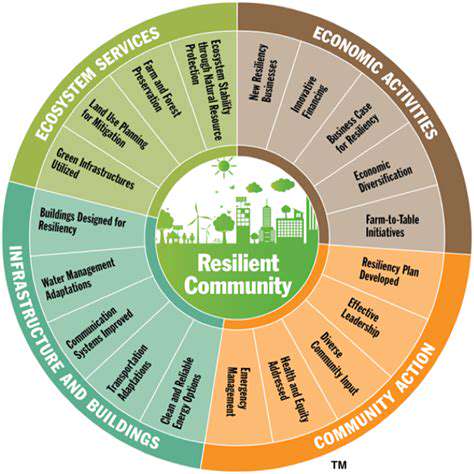

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing