AI and Real Estate Market Anomaly Detection

Key Applications of AI in Anomaly Detection

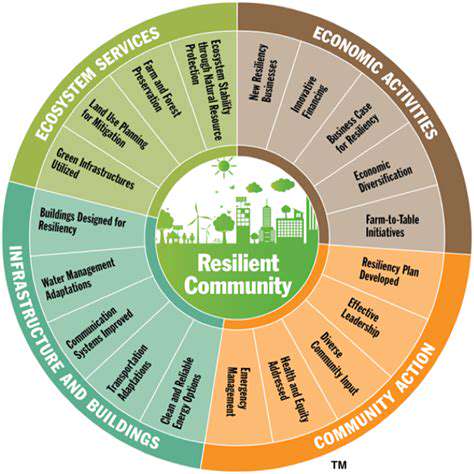

AI's potential in real estate anomaly detection extends far beyond simple price fluctuations. We can use it to identify unusual patterns in property sales volumes, discover geographical clusters of unusual price changes, and even pinpoint potential fraudulent activities. Sophisticated algorithms can learn to recognize subtle shifts in buyer behavior or seller motivations, providing valuable insight into emerging market forces.

Imagine a system that automatically flags a sudden surge in property listings in a specific neighborhood. This could be a sign of a market correction, a change in local policy, or even a larger economic trend impacting the area. AI can also identify anomalies in property valuations, potentially indicating inflated or depressed prices compared to comparable properties. These insights can help investors and real estate professionals make more informed decisions.

Data Sources and Techniques for Anomaly Detection

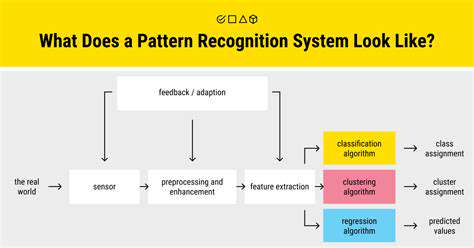

The effectiveness of AI-driven anomaly detection hinges on the quality and quantity of data used to train the algorithms. This includes historical sales data, property characteristics (size, location, features), market trends, demographic information, economic indicators, and even social media sentiment related to real estate. Gathering and integrating these diverse data sources is a crucial step. Various machine learning techniques, such as clustering algorithms, statistical methods, and neural networks, are used to identify anomalies. Each technique has its strengths and weaknesses, and the best approach depends on the specific data and the desired outcome.

Careful consideration of data quality is essential. Inaccurate or incomplete data can lead to flawed anomaly detection. Furthermore, the models need to be regularly updated to account for evolving market conditions and new data points. Constant monitoring and refinement are vital to maintaining the accuracy and relevance of the anomaly detection system.

The Future of AI-Powered Anomaly Detection in Real Estate

The future of AI-driven anomaly detection in real estate is promising. As technology continues to advance, these systems will become more sophisticated, capable of handling increasingly complex data sets and identifying even more subtle anomalies. This will lead to more precise predictions about market trends, empowering stakeholders to adapt their strategies and capitalize on emerging opportunities.

Furthermore, the integration of AI with other technologies, such as virtual reality and augmented reality, could create immersive experiences for potential buyers and investors, enabling them to better understand and appreciate properties in a new light. This innovative approach can provide a more personalized and efficient real estate experience, ultimately transforming the way we interact with and understand the market.

Virtual test drives are revolutionizing the automotive industry, offering a convenient and engaging way for potential buyers to experience a vehicle's features and performance from the comfort of their own homes. This technology allows individuals to explore various models, virtually sit behind the wheel, and even navigate different terrains, all without leaving the house. This innovative approach saves time and effort, making the car-buying process more accessible and efficient.