AI for Property Tax Optimization

Introduction to Property Tax Optimization with AI

Understanding the Fundamentals of Property Taxes

Property taxes are a significant expense for homeowners, and understanding the fundamentals is crucial for optimizing your tax burden. These taxes are levied by local governments and used to fund essential services like schools, roads, and public safety. Properly understanding how these taxes are calculated and what factors influence them can save you money and ensure you're paying only what's necessary. Knowing the assessed value of your property, the applicable tax rate, and any exemptions or deductions available is essential.

Different jurisdictions have varying methods of calculating property tax, and it's important to research the specific procedures in your area. This includes understanding how your property's value is assessed, what factors affect the assessed value, and how your local government determines the tax rate.

Exploring Tax Assessment and Valuation

Property tax assessment is the process of determining the fair market value of a property for tax purposes. This valuation is critical, as it directly impacts the amount of taxes you owe. Factors like the property's location, size, condition, and amenities all contribute to the assessed value. Understanding these factors and how they influence the valuation process is essential for effectively navigating the property tax system.

Often, property values are assessed periodically, and changes in market conditions can significantly impact these assessments. Staying informed about these assessments and the processes involved can help you anticipate potential tax increases or decreases.

Identifying Potential Tax Deductions and Exemptions

Many homeowners are unaware of the potential tax deductions and exemptions available to them. These can significantly reduce your overall tax liability. Researching and understanding these deductions and exemptions is crucial to optimizing your property tax payments. For instance, certain deductions might be available for homeowners who have made significant improvements to their property. Exemptions, like those for senior citizens or disabled individuals, can also provide substantial relief.

Furthermore, you should investigate any state or local programs that offer property tax relief. These programs can vary significantly depending on your location and circumstances, so it's essential to research them to see if they apply to you.

Strategies for Optimizing Your Property Tax Payments

Optimizing your property tax payments involves a multifaceted approach. Proactively managing your property's value through well-maintained upkeep can potentially result in a lower assessed value. Furthermore, understanding the local property tax laws, regulations, and processes is key. Keeping abreast of any changes in tax laws or rates in your area is essential to ensure you're always paying the most optimal amount. This proactive approach can save you money and ensure you're paying only what's necessary.

Consulting with a qualified tax professional can offer valuable insights and personalized strategies for optimizing your property taxes. Their expertise in navigating the complexities of property tax laws can be invaluable in identifying and claiming all applicable deductions and exemptions. This professional guidance can be crucial in minimizing your tax burden.

Predictive Modeling for Future Value Projections

Predictive Modeling Techniques

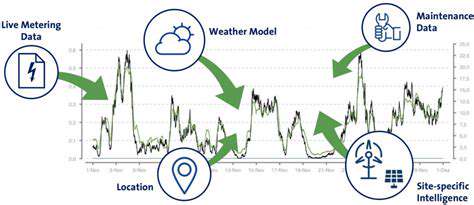

Predictive modeling, a crucial component of data science, involves developing algorithms to forecast future outcomes based on historical data. These models learn patterns and relationships within the data to make accurate predictions, which can be leveraged for various applications, including financial forecasting, customer behavior analysis, and risk assessment. Understanding the different techniques, such as regression, classification, and clustering, is essential for selecting the right approach for a particular problem.

Different predictive modeling techniques employ various algorithms to achieve accurate predictions. For example, linear regression models relationships between variables, while decision trees create a tree-like structure to classify data based on different conditions. Selecting the appropriate technique depends on the nature of the data and the specific question being addressed. Understanding the strengths and limitations of each technique is paramount for successful model development. Choosing the right technique is crucial for obtaining meaningful and reliable results.

Data Preparation and Feature Engineering

A critical aspect of predictive modeling is data preparation. This step involves cleaning, transforming, and preparing the data for model training. Cleaning involves handling missing values, outliers, and inconsistencies in the data. Transforming the data often includes scaling or normalizing features, which can significantly improve model performance. Data preparation is essential for building accurate and reliable predictive models.

Feature engineering is another vital step in data preparation. It involves creating new features from existing ones or transforming existing features to improve model performance. This process can often uncover hidden patterns and relationships within the data, leading to more accurate predictions. Feature engineering is a crucial process that can significantly enhance the accuracy and reliability of predictive models. This is because well-crafted features can lead to a more accurate reflection of the underlying relationships in the data.

Model Evaluation and Selection

Evaluating the performance of a predictive model is crucial for determining its suitability for a specific task. Metrics like accuracy, precision, recall, F1-score, and root mean squared error (RMSE) are commonly used to assess the model's predictive power. Careful consideration of these metrics is essential for selecting a model that best fits the specific needs of the application.

Choosing the best model among multiple options is a critical step. Considering factors like model complexity, interpretability, and computational cost is essential. Comparing different models using appropriate evaluation metrics ensures that the selected model is not only accurate but also efficient and easy to understand. Selecting the right model is crucial for achieving optimal results.

Applications of Predictive Modeling

Predictive modeling finds applications in diverse fields, including finance, healthcare, and marketing. In finance, it can be used to forecast stock prices, assess credit risk, and manage investment portfolios. In healthcare, it can be used to predict patient outcomes, identify high-risk individuals, and personalize treatment plans. In marketing, it can be used to segment customers, predict customer churn, and personalize marketing campaigns.

These applications highlight the wide-ranging potential of predictive modeling. The ability to forecast future trends and outcomes has significant implications for decision-making in various sectors. Predictive modeling can significantly impact a wide range of industries, leading to improved efficiency and effectiveness.

Future Trends in Predictive Modeling

The field of predictive modeling is constantly evolving, with new techniques and technologies emerging regularly. The increasing availability of big data and the advancement of machine learning algorithms are driving innovation in this area. Deep learning models, in particular, are showing great promise for tackling complex problems with intricate data patterns.

The integration of predictive modeling with other emerging technologies, such as the Internet of Things (IoT) and cloud computing, will further expand the scope and impact of these techniques. The future of predictive modeling is bright, with significant potential for improvement across various sectors. Continuous advancements in algorithms and data availability will likely lead to more accurate and reliable predictions in the years to come.

Automated Valuation and Assessment Processes

Automated Valuation Models

Automated valuation models (AVMs) are crucial components of automated valuation and assessment (AV&A) processes. These models leverage sophisticated algorithms and vast datasets to estimate property values. By analyzing numerous factors like location, size, age, and market trends, AVMs can produce valuations quickly and efficiently, minimizing the time and resources required for traditional appraisal methods. This efficiency translates to significant cost savings for tax assessors, allowing them to focus on other critical tasks.

Different types of AVMs exist, each employing various methodologies. Some AVMs rely on statistical regression models, while others utilize machine learning techniques to predict values based on complex relationships within the data. The accuracy of these models is continuously improving with advancements in data science and the availability of larger, more comprehensive datasets, leading to more accurate and reliable assessments.

Data Collection and Processing for AV&A

Accurate and comprehensive data is the bedrock of any successful AV&A system. This involves collecting various data points, including property characteristics (size, age, features), comparable sales data, market trends, and economic indicators. The quality and quantity of this data directly impact the reliability and accuracy of the resulting valuations. Effective data processing techniques are essential to ensure data integrity, eliminate inconsistencies, and prepare the data for use in the valuation models.

Ensuring data accuracy and consistency is paramount. Errors in data entry or inconsistencies in data format can significantly impact the reliability of the AVMs. Robust data quality checks and validation procedures are necessary to maintain the integrity of the data used for assessment.

Assessment Efficiency and Reduced Costs

AV&A systems automate the valuation process, leading to significant improvements in assessment efficiency. The ability to process a large volume of properties quickly and accurately frees up assessor resources, allowing them to focus on more complex tasks, such as reviewing valuations, managing appeals, and ensuring fairness and equity in the assessment process. The reduced reliance on manual processes translates into substantial cost savings for governments.

Improved Valuation Accuracy and Fairness

AVMs can potentially enhance the accuracy of property valuations compared to traditional methods. By considering a broader range of data points and utilizing advanced algorithms, AVMs can identify subtle correlations and patterns that might be missed by human appraisers. This increased accuracy can contribute to fairer and more equitable property tax assessments, reducing the likelihood of disputes and appeals.

While AVMs offer significant potential for accuracy improvements, ongoing monitoring and adjustments are essential. Regular review and refinement of the models, incorporating feedback from field reviews and appeals, are crucial to ensure the models remain effective and accurate over time.

Integration with Existing Systems and Workflow

For successful implementation, AV&A systems must seamlessly integrate with existing government systems and workflows. This integration ensures that the automated valuation data flows smoothly into the existing assessment databases, property records, and tax calculation processes. This integration also facilitates the efficient handling of appeals and other related processes.

Careful planning and execution of the integration process are critical to avoid disruptions to the existing workflow. Proper training and support for staff using the new system are also essential elements for a smooth and successful transition.

Read more about AI for Property Tax Optimization

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing