AI and Real Estate Market Bubble Indicators

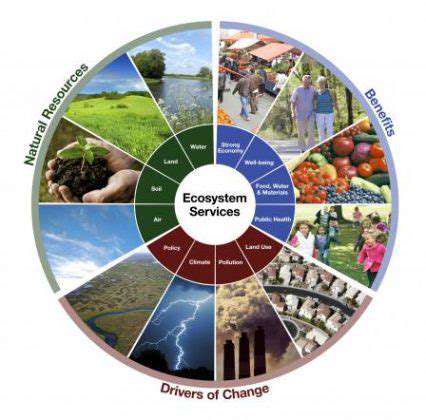

Regional variations matter profoundly - coastal markets react differently to interest rate changes than manufacturing hubs. Some models now incorporate climate risk factors and remote work trends that traditional analyses overlooked. The most forward-thinking analysts track emerging variables like generational housing preferences and infrastructure investment timelines.

Model Evaluation and Refinement

Effective models undergo continuous stress-testing against historical crises (2008, dot-com bubble) and hypothetical scenarios. Analysts measure false positive rates and refine thresholds to balance sensitivity with practicality. Backtesting against previous cycles helps identify which indicators provided the clearest early warnings versus lagging indicators that merely confirmed existing trends.

Model maintenance requires regular data pipeline audits and algorithm adjustments to account for structural market changes. The shift to remote work, for instance, necessitated complete recalibration of urban vs. suburban valuation models. Successful teams maintain version control systems to track model evolution and document rationale for each adjustment.

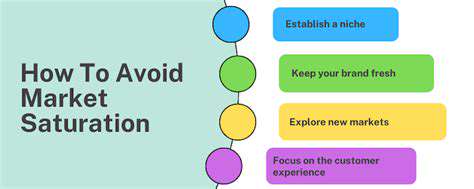

Identifying Market Saturation and Overvaluation Indicators

Identifying Saturation Points

Market saturation manifests when new developments sit vacant while existing inventory lingers, and price reductions become commonplace. Seasoned analysts spot subtle signs like extended marketing periods and increasing seller concessions before official statistics reflect the slowdown. They track absorption rates - the time needed to sell current inventory at existing sales pace - which often foreshadows turning points.

Micro-market analysis proves crucial, as saturation rarely occurs uniformly across regions. Certain neighborhoods or property types (luxury condos, suburban office parks) typically lead the downturn while others remain stable. This granular perspective helps investors reallocate resources before broad market declines.

Assessing Competitive Landscape

In crowded markets, developers begin offering unusual incentives - free upgrades, buy-down mortgages, or rental guarantees. When competing projects launch simultaneously after lengthy approval processes, this often creates temporary oversupply. Savvy analysts track permitting timelines and construction starts to anticipate these gluts.

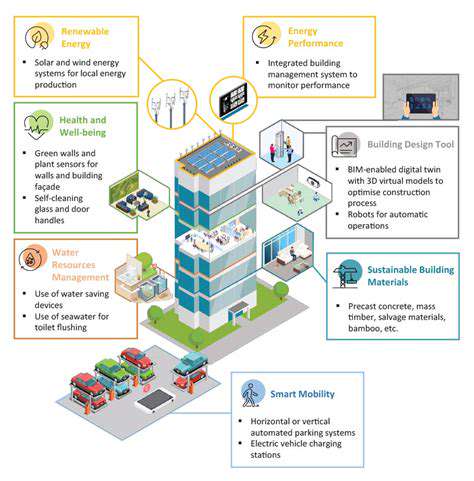

Differentiation becomes critical in saturated markets. Properties with unique amenities (EV charging, co-working spaces) or superior locations maintain value better than generic offerings. Forward-thinking developers now incorporate flexibility (convertible office/residential spaces) to adapt to shifting demand.

Analyzing Consumer Behavior and Trends

Search query data reveals early demand shifts before transactions occur. Declining searches for starter homes coupled with rising rent vs. buy queries often precede market softening. Social media sentiment analysis now supplements traditional surveys, providing real-time pulse checks on buyer psychology.

Generational preferences create waves - millennials' urban preferences gave way to pandemic-era suburban shifts, while Gen Z's digital nomadism impacts certain markets disproportionately. Tracking these evolving priorities helps anticipate saturation points in specific property categories.

Evaluating Sales Data and Market Share

Seasonally-adjusted months of inventory provides clearer saturation signals than raw sales figures. When inventory exceeds 6-7 months' supply in normally tight markets, price adjustments typically follow. Analysts watch for growing disparities between listing prices and final sale prices as early indicators of weakening demand.

Institutional buyer activity often foreshadows market turns. When REITs and hedge funds slow acquisitions or shift asset allocations, this frequently precedes broader pullbacks. Tracking these sophisticated players' moves provides valuable market intelligence.

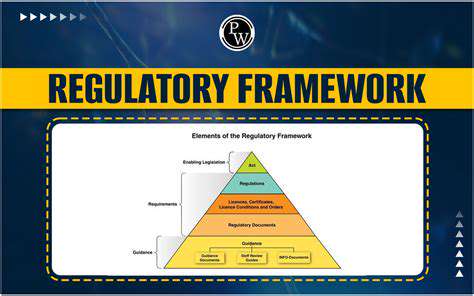

The Role of AI in Regulatory Oversight and Policymaking

AI-Powered Monitoring of Regulatory Compliance

Modern compliance systems now cross-reference property records across multiple databases, flagging discrepancies in square footage, ownership history, or valuation claims. Natural language processing scans contracts and disclosures for non-standard clauses that might indicate predatory terms. These systems learn from each investigation, continuously improving detection capabilities.

Blockchain experiments now enable tamper-proof transaction records, while computer vision verifies property conditions match listing descriptions. This multi-layered approach creates audit trails that deter fraud while expediting legitimate transactions.

Predictive Modeling for Policy Decisions

Advanced simulations now model policy impacts at neighborhood levels, revealing unintended consequences before implementation. Zoning change proposals can be stress-tested against demographic projections and infrastructure capacities, helping avoid affordable housing shortages or transportation bottlenecks.

Some municipalities now run parallel policy experiments - applying different regulations to statistically similar neighborhoods and measuring outcomes. This empirical approach moves beyond theoretical debates to data-driven policymaking.

Enhanced Transparency and Accountability

Public-facing dashboards now display real-time market metrics with drill-down capabilities, allowing stakeholders to verify data sources and methodologies. Open API architectures enable third-party validation of government analyses, while blockchain-based voting systems increase community participation in development decisions.

Automated disclosure systems ensure all parties receive identical information simultaneously, reducing information asymmetry that previously advantaged institutional players. This levels the playing field for individual buyers and sellers.

Improved Efficiency in Regulatory Processes

Machine learning now pre-screens permit applications for completeness, reducing processing delays. Computer vision automates building code compliance checks in plan reviews, while natural language processing extracts key terms from contracts for instant regulatory assessment.

Chatbots handle routine inquiries, freeing staff for complex cases. These efficiencies have reduced approval timelines in pilot cities by 40-60%, accelerating housing supply without compromising oversight.