Real Estate Climate Risk Frameworks: Implementation

Blending Climate Risk Factors into Property Valuation and Investment Choices

Grasping the Importance of Climate Threats

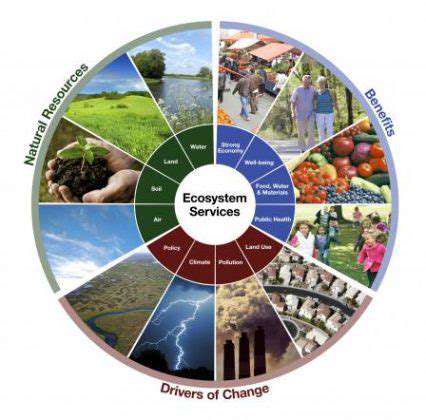

The reality of climate change has arrived - its effects are visible worldwide, and organizations are waking up to the necessity of factoring climate risk into their financial assessments. Comprehending the possible monetary consequences of climate-related incidents is vital for enduring viability and adaptability. This involves evaluating both the probability and potential intensity of severe weather occurrences, coastal flooding, and shifting rainfall distributions.

Embedding climate risk into appraisal techniques extends further than basic problem recognition. It demands an active strategy for pinpointing weaknesses, estimating possible damages, and embedding this knowledge into decision protocols. Such forward-thinking methods empower firms to make wiser investment choices, reduce hazards, and ultimately improve financial outcomes while supporting ecological sustainability.

Approaches for Evaluating Climate-Related Financial Effects

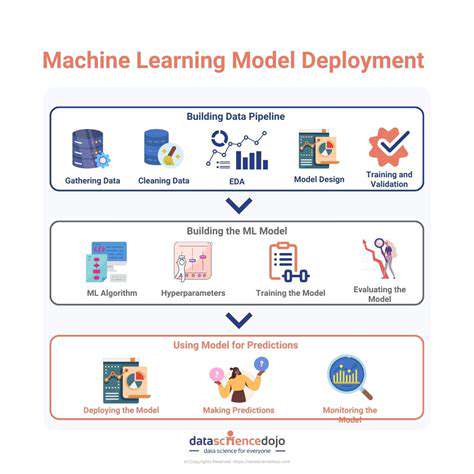

Multiple techniques are developing to properly gauge financial consequences tied to climate issues. These span from elementary scenario examinations, considering possible results under varying climate projections, to advanced climate threat simulations employing intricate datasets to forecast monetary losses connected to particular environmental incidents. Precise and thorough evaluation remains fundamental for successful hazard control.

These techniques permit organizations to grasp the potential fiscal impact of diverse climate situations and strategize appropriately. This incorporates predicting possible harm to tangible properties, interruptions to supplier networks, and alterations in customer needs stemming from environmental occurrences. The particular approaches utilized will differ based on sector and business characteristics.

Addressing Both Immediate and Systemic Climate Risks

Climate risk evaluation needs to cover both concrete hazards like extreme weather and coastal inundation, alongside systemic risks including regulatory modifications, technological breakthroughs, and evolving customer tendencies. These dual classifications frequently interconnect and overlap. An all-encompassing strategy is necessary to account for the complete range of potential consequences.

Physical dangers directly impact properties and activities, whereas systemic risks can influence market worth and future earnings potential. Identifying and handling both risk varieties is crucial for establishing a sturdy appraisal structure that considers the entire scope of climate-connected unpredictability.

Constructing Resilient Valuation Frameworks

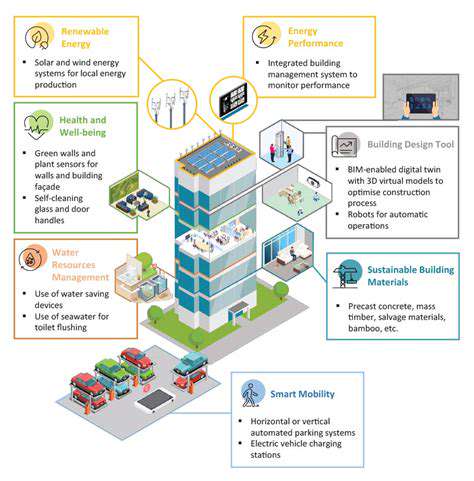

Building appraisal models that deliberately include climate threats requires complete awareness of an enterprise's susceptibility to environmental impacts. This means recognizing essential assets and functions, judging their fragility to climate-related dangers, and measuring possible deficits. Meticulous examination of past information and forthcoming climate predictions proves indispensable for correct modeling.

The Significance of Openness and Information Sharing

Enhanced clarity and revelation concerning climate vulnerabilities are growing more crucial for financiers and interested parties. Businesses that actively embed climate considerations into their appraisals showcase dedication to lasting viability and strength. This pledge can establish credibility and draw investors who progressively concentrate on environmental, social, and governance aspects. More straightforward reporting assists investors in making educated choices and promotes a greener economic framework.

Unambiguous explanation of climate dangers and prevention methods nurtures trust and assurance, allowing more knowledgeable discussions between stakeholders, investors, and the broader public.

Read more about Real Estate Climate Risk Frameworks: Implementation

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing