Flood Risk Management in Property Investment

Analyzing Property-Specific Flood Risks

Understanding Floodplain Delineations

Floodplain maps developed by government agencies serve as critical tools for identifying areas vulnerable to flooding. These detailed maps illustrate potential floodwater extents during various scenarios, combining historical data with topographic analysis. Property investors should prioritize reviewing these delineations as they directly impact insurance costs and long-term asset value. The mapping process integrates multiple factors including terrain elevation, watershed characteristics, and documented flood history to create comprehensive risk profiles.

Beyond basic zone identification, savvy investors examine finer details like base flood elevation levels and floodway boundaries. This granular analysis reveals subtle risk variations between adjacent properties that might share the same flood zone designation but have materially different exposure levels.

Evaluating Historical Flood Data

Historical flood records offer more than just past event documentation - they reveal hydrological patterns that inform future risk probabilities. Agencies like FEMA maintain databases containing flood magnitudes, durations, and recurrence intervals that span decades. Pattern recognition in this data can uncover emerging trends that static flood maps might not yet reflect, particularly in areas experiencing rapid environmental changes.

Investors should cross-reference official records with local sources like newspaper archives and municipal maintenance logs. These often contain valuable anecdotes about infrastructure performance during extreme events that don't appear in standardized databases.

Assessing Elevation and Topography

The interplay between a property's elevation and surrounding topography creates microclimates of flood risk. While general elevation matters, the property's position relative to natural drainage pathways proves equally critical. A parcel just inches higher than its neighbors might avoid inundation while adjacent properties flood.

Modern LIDAR mapping technologies now enable centimeter-level elevation analysis, allowing investors to identify subtle terrain features that influence water movement. This precision helps detect natural basins or imperceptible slopes that could channel water toward (or away from) a property during heavy rainfall.

Analyzing Drainage Systems and Infrastructure

Municipal drainage systems represent both flood mitigation assets and potential failure points. Investors should evaluate not just system presence but its design capacity relative to projected rainfall intensities. Aging infrastructure in rapidly developing areas often becomes overwhelmed as increased impervious surfaces alter historical runoff patterns.

Critical infrastructure assessment includes examining maintenance records, identifying known choke points, and understanding planned upgrades. Properties downstream of scheduled drainage improvements might present undervalued opportunities, while those reliant on neglected systems could carry hidden risks.

Considering Climate Change Impacts

Contemporary flood risk analysis must account for shifting precipitation patterns and sea level rise. Traditional 100-year flood models based on historical data increasingly underestimate current risks in many regions. Forward-looking investors analyze climate projection models alongside conventional flood maps.

Particular attention should focus on areas where development patterns intersect with changing environmental conditions. Coastal properties might face compound risks from both intensified storms and incremental sea level rise, while inland areas could experience unprecedented rainfall intensities.

Evaluating Insurance Premiums and Flood Coverage

Flood insurance costs provide a market-driven assessment of risk that complements technical analyses. Premium differentials between seemingly similar properties often reveal subtle risk factors that standard assessments might miss. Savvy investors treat insurance markets as information systems, analyzing rate trends for early warnings about emerging risks.

Beyond basic coverage, investors should understand policy details like grandfathering provisions and community rating system discounts that can significantly impact long-term carrying costs. Policy exclusions for certain flood types (e.g., groundwater seepage) also warrant careful review.

Incorporating Flood Mitigation Strategies

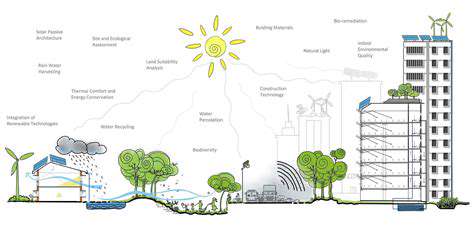

Proactive flood mitigation can transform risk profiles and create value. Modern approaches extend beyond basic elevation to include permeable paving, rain gardens, and smart water detention systems. The most effective strategies combine structural solutions with natural features that work with local hydrology rather than against it.

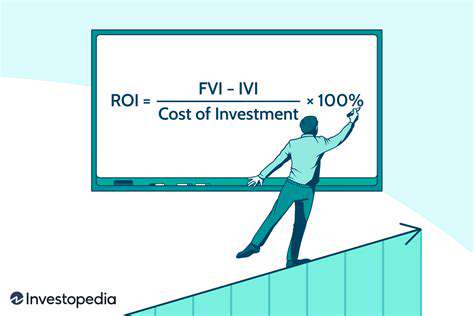

Investors should evaluate mitigation ROI through both risk reduction and potential premium savings lenses. Some jurisdictions offer tax incentives for flood-resilient improvements, creating additional financial benefits beyond basic risk management.

Legal and Regulatory Compliance in Flood-Prone Areas

Understanding the Scope of Legal Compliance

Flood-related regulations form a complex web of federal, state, and local requirements that evolve alongside climate science and disaster experience. Compliance isn't static but requires continuous monitoring of regulatory updates and judicial interpretations that might redefine permitted uses or disclosure obligations. The most sophisticated property owners establish dedicated compliance tracking systems rather than relying on periodic audits.

Jurisdictional overlaps frequently occur, particularly in coastal areas subject to both floodplain and coastal zone regulations. Investors must navigate these layered requirements while anticipating how future policy shifts might affect property utilization and value.

Navigating Regulatory Landscapes

Effective regulatory navigation demands understanding both the letter of the law and its practical enforcement patterns. Some jurisdictions rigorously enforce technical requirements while others prioritize broader policy goals. Seasoned developers maintain relationships with multiple regulatory agencies to better anticipate enforcement priorities and interpretation nuances.

Special attention should focus on variance processes and appeals procedures, which often provide pathways for reasonable accommodations when strict compliance proves impractical. These administrative mechanisms frequently offer more flexibility than investors realize.

Implementing Effective Compliance Programs

Best-in-class compliance programs integrate legal requirements into operational decision-making rather than treating them as afterthoughts. Forward-looking organizations embed compliance checkpoints throughout project lifecycles, from initial due diligence through ongoing property management. Digital compliance tracking systems now enable real-time monitoring of regulatory changes across multiple jurisdictions.

Training programs should extend beyond basic rule familiarization to cultivate compliance-thinking at all organizational levels. Case-based learning proves particularly effective for helping teams recognize how abstract regulations apply to concrete situations.

Maintaining Ongoing Compliance

Sustained compliance requires institutionalizing knowledge management as regulations and staff both change over time. Centralized compliance databases that document decision rationales and precedents prevent knowledge loss during personnel transitions. Regular lessons learned reviews after regulatory interactions help organizations continuously improve their approaches.

Participation in industry associations and policy working groups provides early awareness of pending regulatory changes while offering opportunities to shape emerging standards. This proactive engagement often yields compliance advantages that reactive approaches cannot match.

Read more about Flood Risk Management in Property Investment

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing