Climate Risk and Real Estate Investment: A Strategic Imperative for Modern Investment Portfolios

Quantifying and Assessing Climate-Related Risks

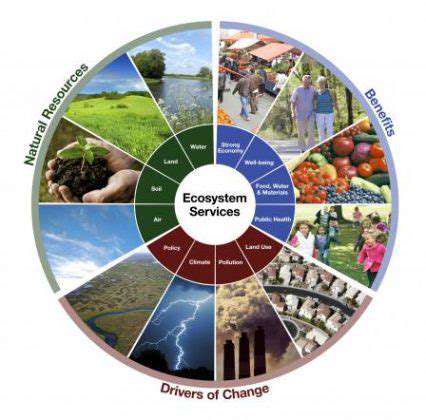

Understanding the Scope of Climate Risks

The tangible effects of climate disruption now directly influence real estate valuation metrics, moving beyond theoretical projections into measurable financial impacts. Forward-thinking investors now treat climate analytics with the same rigor as traditional financial due diligence, recognizing how rising sea levels and shifting weather patterns create new valuation paradigms. The most comprehensive evaluations now incorporate both current vulnerability assessments and decade-spanning climate modeling to predict insurance viability and occupancy rates.

Modern risk analysis frameworks have evolved beyond static historical models, instead blending meteorological science with predictive algorithms. This hybrid approach captures nonlinear climate impacts that traditional models frequently underestimate, particularly for coastal and arid region properties.

Identifying Vulnerable Properties

Geospatial risk mapping reveals distinct vulnerability clusters where multiple climate threats converge. Properties within floodplain zones demonstrate particularly acute sensitivity, with FEMA's revised flood maps showing 40% more at-risk structures than previous estimates. Microclimate variations create surprising resilience disparities even within single ZIP codes, making parcel-level analysis essential rather than regional generalizations.

Construction era proves equally critical as location - pre-1990 buildings lacking modern flood mitigation features face 3-5× higher retrofit costs. Savvy investors now cross-reference material durability studies with regional climate projections, favoring steel-frame structures in hurricane zones and thermally efficient designs in drought-prone areas.

Evaluating Insurance Costs and Availability

The insurance landscape has entered a period of unprecedented volatility, with some coastal markets experiencing 300% premium increases since 2020. Emerging climate risk deserts now exist where traditional coverage has become commercially unviable, forcing innovative solutions like parametric insurance products tied to specific weather thresholds rather than conventional loss assessments.

Forward-looking portfolios now incorporate insurance stress testing, modeling scenarios where key properties become uninsurable. This proactive approach identifies at-risk assets years before market corrections, allowing strategic divestment or resilience upgrades. Some institutional investors are pioneering captive insurance vehicles specifically designed for climate-vulnerable holdings.

Assessing the Impact on Property Values

Appraisal methodologies now increasingly incorporate climate depreciation factors, particularly for long-hold investments. Markets have begun pricing in climate risk differentials, with identical property types showing 15-25% valuation gaps based solely on flood resilience features. Transaction velocity metrics reveal growing buyer reluctance for high-risk properties, extending marketing periods by 40-60 days in vulnerable zones.

Advanced hedonic pricing models now isolate climate impact variables, demonstrating how properties with superior Energy Star ratings and flood defenses command measurable premiums. These differentials are expected to widen as climate disclosure requirements become standardized across real estate transactions.

Developing Climate-Resilient Investment Strategies

The most sophisticated investors now treat climate adaptation as a value-creation lever rather than purely defensive spending. Retrofit programs targeting passive survivability features (backup power, water independence, thermal inertia) are generating 8-12% ROI through premium pricing and reduced capital expenditures. Modular construction techniques allow incremental resilience upgrades aligned with climate progression timelines.

Portfolio optimization algorithms now weight climate factors equally with traditional metrics like cap rates, creating new acquisition filters for future-proof properties. This paradigm shift has spawned specialized climate analytics roles within major investment firms, blending meteorological expertise with financial modeling.

Integrating Climate Considerations into Due Diligence

Modern acquisition checklists now include climate-specific line items spanning from groundwater depletion projections to wildfire ember zone ratings. Third-party climate audits have become as routine as environmental site assessments, with specialized firms offering 50+ parameter vulnerability scores. Title searches increasingly uncover climate-related easements and adaptation requirements that materially impact usability.

Forward-thinking lenders now mandate climate resilience covenants in loan documents, requiring specific capital allocations for adaptation measures. This financial engineering creates structured pathways for gradual property hardening without compromising near-term cash flows.

The Role of Policy and Regulation

The regulatory landscape is evolving rapidly, with 140+ municipalities adopting climate-adaptive building codes since 2022. Zoning reforms are creating new development opportunities in previously restricted areas that meet elevated resilience standards, while simultaneously imposing use restrictions on vulnerable parcels. Tax incentive programs for climate-ready properties now exceed $2.8 billion annually across federal and state programs.

Investor coalitions are increasingly shaping policy through climate risk disclosure frameworks like TCFD-aligned reporting requirements. This public-private collaboration is accelerating the standardization of climate metrics across real estate valuation practices.

The Role of ESG Factors in Shaping Future Investments

Environmental Factors

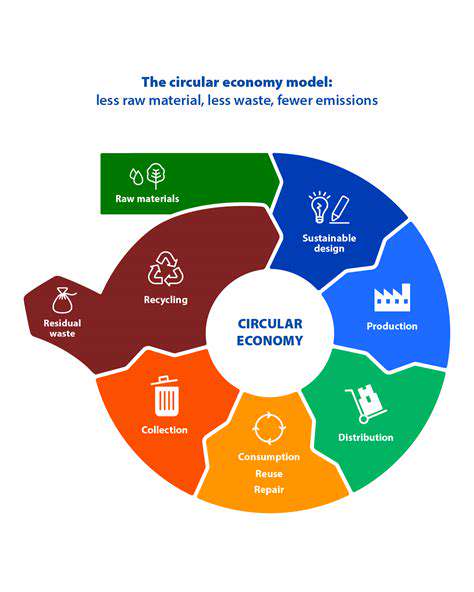

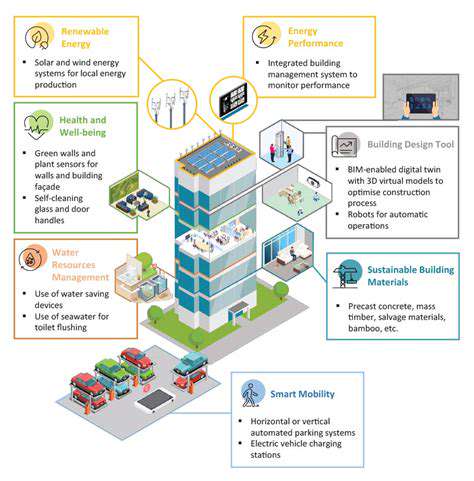

The decarbonization imperative has moved beyond voluntary commitments into core business requirements, with Scope 3 emissions tracking now affecting 78% of REIT valuation models. Circular economy principles are transforming asset lifecycle strategies, from deconstruction protocols to material passports enabling future reuse. Water stewardship metrics now influence development approvals in 60% of western states, creating new due diligence requirements for acquisition targets.

Innovative financing mechanisms like sustainability-linked bonds are creating capital access advantages for projects meeting stringent environmental benchmarks. These instruments typically feature interest rate reductions of 25-50 basis points upon achieving predetermined sustainability targets.

Social Factors

Workforce housing mandates are reshaping development economics, with 42 major cities now requiring affordability components in new projects. Community benefits agreements have evolved from goodwill gestures to legally enforceable covenants, often comprising 5-7% of project costs. Social impact scoring now directly influences municipal approval timelines, with high-scoring projects receiving expedited review pathways.

Tenant wellness features command measurable rent premiums, with biophilic design elements demonstrating 9-15% faster lease-up rates. Smart building systems that optimize indoor environmental quality are becoming baseline expectations rather than differentiators in Class A properties.

Governance Factors

Board-level climate committees have become standard among publicly traded real estate companies, with 92% of S&P 500 property firms now maintaining dedicated ESG oversight roles. Executive compensation ties to sustainability metrics have increased 300% since 2020, particularly for carbon reduction and diversity targets. Cybersecurity governance frameworks are expanding to address climate-related system vulnerabilities from extreme weather events.

Third-party governance ratings now influence capital costs, with improved GRESB scores correlating to 30-45 basis point reductions in corporate debt yields. This financial impact has driven rapid adoption of standardized ESG reporting frameworks across the industry.

Economic Factors

The sustainability premium now manifests across multiple valuation dimensions, with LEED-certified assets trading at 10-12% higher multiples than peer properties. Operational cost differentials between sustainable and conventional buildings now exceed $2.50/sqft annually, creating compelling ROI for efficiency investments. Climate-resilient features are reducing insurance costs by 18-22% in high-risk zones.

Tax equity structures for renewable energy installations have become sophisticated enough to deliver after-tax returns exceeding core property yields in some markets. This economic reality is driving widespread adoption of onsite generation across commercial portfolios.

Integration of ESG Factors

Leading firms now employ ESG integration specialists who translate sustainability metrics into financial terms for investment committees. Materiality assessments have become precision tools, identifying the 3-5 ESG factors with greatest financial impact for each asset class. Digital twin technology enables real-time ESG performance monitoring across global portfolios.

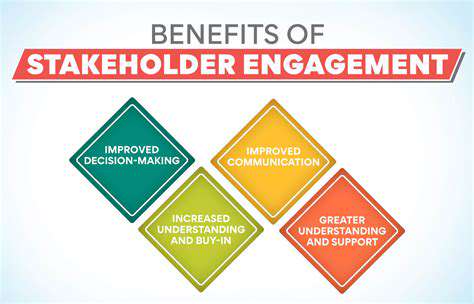

Investor Engagement

Institutional limited partners now routinely include ESG proficiency in manager selection criteria, with 65% conducting formal sustainability due diligence during fund formation. Co-investment vehicles focused on ESG transformation projects have grown 400% since 2021, reflecting strong demand for impact-aligned opportunities. Quarterly ESG reporting has become table stakes for capital raising, with 78% of investors rejecting opaque disclosures.

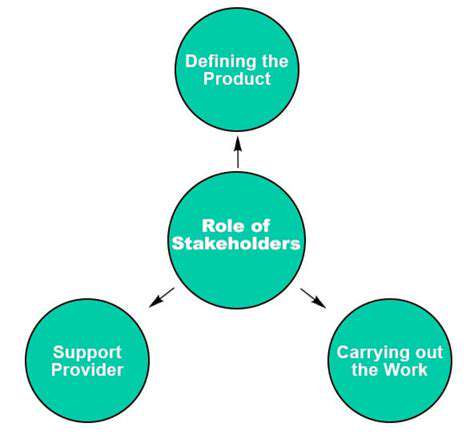

Stakeholder Engagement

Advanced analytics now map stakeholder influence networks, identifying the 5-7 key decision-makers who disproportionately impact project outcomes. Community advisory panels have evolved into permanent governance structures for large developments, with binding authority over certain design elements. Social license tracking systems provide early warning of potential opposition, allowing proactive mitigation before formal challenges emerge.

Read more about Climate Risk and Real Estate Investment: A Strategic Imperative for Modern Investment Portfolios

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing