AI for Property Tax Assessment Efficiency

Improving Equity and Transparency in Property Tax Assessments

Promoting Inclusive Practices

Enhancing equity and transparency requires a proactive approach to fostering inclusive practices within organizations. This involves actively seeking diverse perspectives and creating environments where all individuals feel valued and respected. Implementing inclusive hiring practices is crucial for ensuring a representative workforce, which in turn helps organizations better understand and serve the needs of diverse customer bases and communities.

Furthermore, promoting training and development opportunities for all employees, regardless of background or position, is essential to ensure everyone has the tools and skills necessary to succeed. This can be achieved through tailored programs that address individual needs and provide opportunities for growth and advancement, fostering a culture of continuous learning and development.

Ensuring Open Communication

Transparency in communication is paramount to building trust and fostering a culture of accountability. Clear and consistent communication channels must be established to ensure that information flows freely and accurately throughout the organization. This includes providing regular updates on key performance indicators, progress on projects, and any relevant changes that could impact employees or stakeholders.

Open dialogue and feedback mechanisms are also vital. Creating opportunities for employees to voice their concerns, provide constructive criticism, and share their ideas helps foster a collaborative environment and promotes the identification of potential issues or areas for improvement.

Implementing Fair Decision-Making Processes

Establishing transparent and fair decision-making processes is crucial to ensuring equity and accountability. These processes should be clearly defined and documented, outlining the steps involved and the criteria used for evaluation. This ensures all stakeholders understand the procedures and reduces the potential for bias or discrimination.

Providing clear and objective criteria for evaluating candidates for promotions, awards, or other opportunities is critical. Using metrics and data to support these decisions strengthens the fairness and transparency of the process, reducing the potential for subjective judgments and allowing for a more objective assessment of each candidate.

Utilizing Data and Metrics for Evaluation

Employing data-driven approaches to evaluate the effectiveness of equity and transparency initiatives is essential for continuous improvement. Collecting data on key metrics such as representation across different demographics, employee satisfaction, and complaint resolution rates allows for a comprehensive understanding of the impact of these initiatives. These metrics provide a clear picture of the progress made and identify areas where adjustments or further interventions may be needed.

Regularly reviewing and analyzing this data is critical for identifying trends and patterns that may indicate areas where interventions are required. Tracking these metrics over time allows for a more accurate assessment of the effectiveness of implemented strategies and facilitates the development of targeted solutions to address any identified gaps or disparities.

Future Trends and Considerations for AI Implementation

Predictive Modeling for Enhanced Accuracy

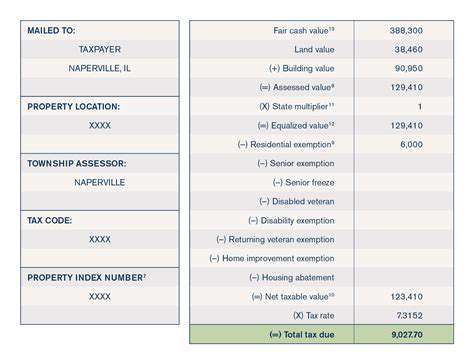

AI-powered predictive modeling will be crucial for improving the accuracy and efficiency of property tax assessments. By analyzing vast datasets of property characteristics, market trends, and comparable sales, AI algorithms can identify patterns and predict future market values with greater precision than traditional methods. This predictive capability will allow for more accurate assessments, reducing the potential for undervalued or overvalued properties and ultimately leading to a fairer and more equitable tax system.

Automated Data Processing and Analysis

AI can automate the often tedious and time-consuming process of data processing and analysis. This includes tasks such as extracting data from various sources, cleaning and preparing the data for analysis, and identifying anomalies or inconsistencies. By automating these processes, assessors can save significant time and resources, allowing them to focus on more complex tasks and ensuring consistent application of assessment methodologies across the entire portfolio of properties.

Improved Valuation of Complex Properties

AI algorithms excel at handling complex data sets, making them particularly well-suited for valuing properties with unique features, like historical structures, or properties in rapidly developing areas. These complex valuations often require significant expertise and time for traditional methods. AI can provide a more objective and comprehensive analysis, ensuring that these properties are assessed accurately and fairly in relation to the current market value.

Real-time Adjustments to Market Fluctuations

Real estate markets are dynamic and constantly evolving. AI systems can be designed to monitor market fluctuations in real-time and adjust assessment models accordingly. This ensures that property values are constantly updated to reflect current market conditions, preventing outdated assessments that could lead to inaccurate tax calculations.

Enhanced Transparency and Explainability

Transparency in the assessment process is crucial for building public trust. While AI can deliver accurate results, the process of arriving at those results needs to be understandable and justifiable. Future AI models will need to be designed with explainability in mind, providing clear explanations of how valuations are derived and what factors are considered in the process. This will foster greater trust and confidence in the fairness of the property tax assessment system.

Integration with Existing Systems

Successful AI implementation requires seamless integration with existing property tax management systems. This integration will allow for a smooth transition and ensure that AI-powered tools can be utilized effectively within the current workflow. It's essential to consider data compatibility and ensure that AI algorithms can access and process data from various sources and databases currently in use.

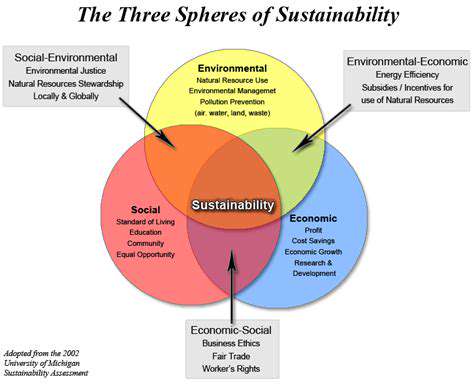

Ethical Considerations and Bias Mitigation

As AI systems become more integrated into property tax assessments, it's critical to address potential biases and ethical concerns. AI models are trained on data, and if that data reflects existing societal biases, the AI system could perpetuate those biases in its assessments. Careful consideration must be given to the data used to train the models and to implement mechanisms to mitigate bias and ensure fairness and equity in the assessment process.

Read more about AI for Property Tax Assessment Efficiency

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

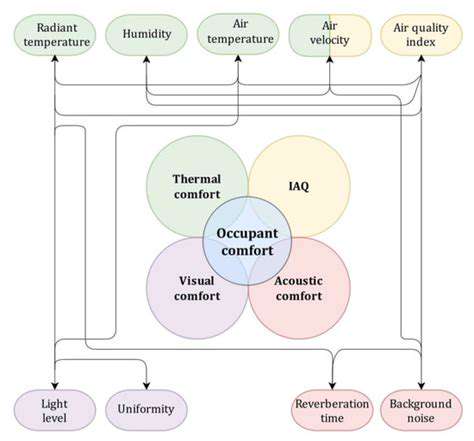

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing